Good afternoon! KPMG Australia caught a senior partner using AI to complete an internal AI training exam, essentially cheating on a test about AI. KPMG is one of the Big Four accounting firms that audit major corporations and governments, so getting busted for copying answers isn’t exactly a great look. The partner had to retake the test and pay a $7,000 fine.

The awkward part is that KPMG has been telling clients AI will make auditing cheaper and more efficient. The firm says more than two dozen employees have been caught misusing AI on tests since July, while rival Deloitte recently refunded the Australian government over an AI-error-filled report suggesting the accounting world is still figuring out how to use the tech without letting it use them.

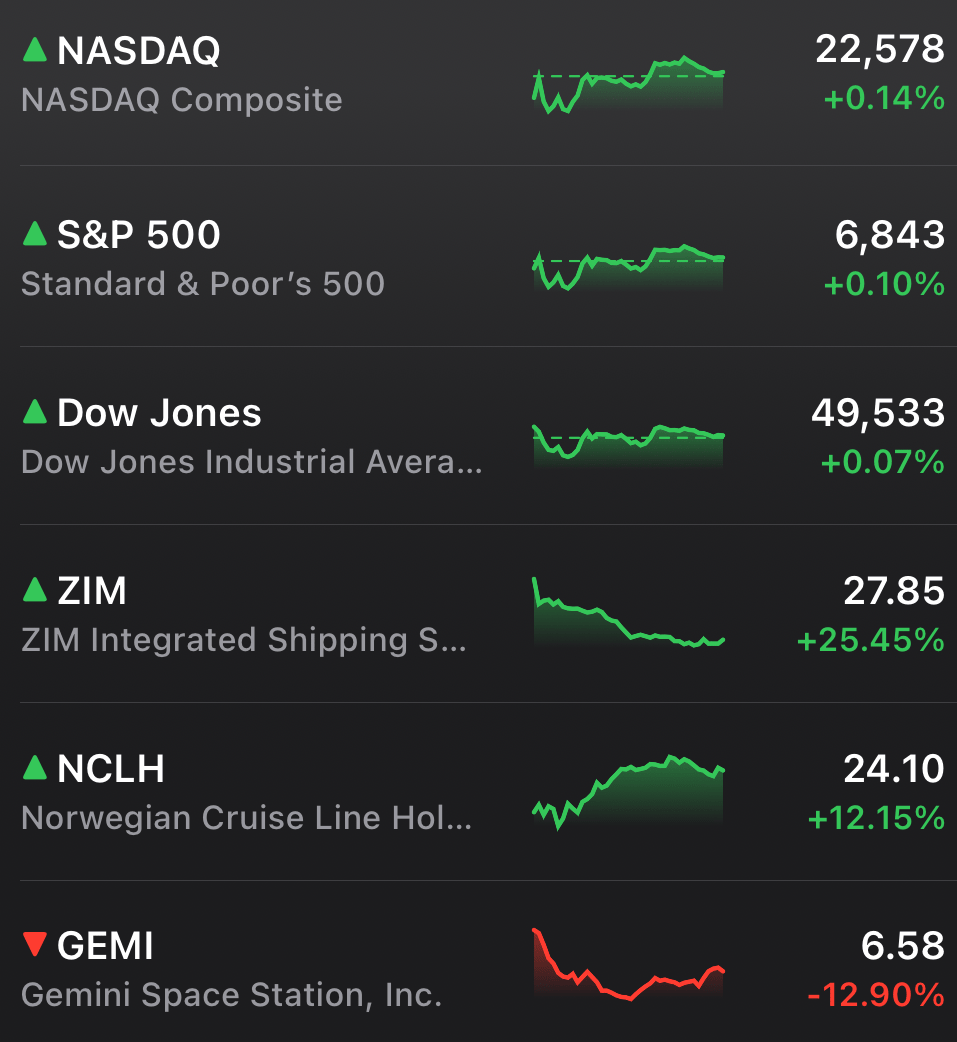

MARKETS

Stocks wiped out early losses in a choppy session, ending the day with barely any movement across major indexes. The S&P 500 finished slightly higher, the Nasdaq 100 dipped, and the Russell 2000 ended flat as buyers stepped in late.

Oil slipped after signs of progress in US-Iran talks, easing supply fears despite ongoing global shipping tensions. Even with headlines about chokepoints and sanctions, crude moved only modestly, suggesting traders see diplomacy outweighing disruption for now.

STOCKS

Winners & Losers

What’s up 📈

Masimo jumped 34.26% after Danaher moved toward a $9.9 billion acquisition of the medical device maker $MASI

Compass Pathways surged 31.15% on positive late-stage trial results for its psilocybin depression treatment $CMPS

ZIM Integrated Shipping Services soared 25.45% after rival Hapag-Lloyd agreed to acquire the company for $35 per share in cash $ZIM

Norwegian Cruise Line climbed 12.21% after Elliott Investment Management disclosed a stake of more than 10% $NCLH

Fiserv rose 6.84% following reports that activist investor Jana Partners built a position $FISV

Paramount Skydance gained 5.09% as deal talks resumed after Netflix granted a waiver to Warner Bros. Discovery $PSKY

Figma added 2.53% after partnering with Anthropic on a new “Code to Canvas” feature $FIG

AMC Entertainment ticked up 1.63% amid efforts to refinance $2.5 billion in debt $AMC

What’s down 📉

JFB Construction Holdings plunged 43.05% after announcing a $1.5 billion merger with drone maker Xtend $JFB

Gemini Space Station dropped 12.90% following the departure of three top executives in a major shakeup $GEMI

Atlassian fell 2.62% after reports it froze hiring during the software sector slump $TEAM

ServiceNow slipped 1.05% despite insider buying plans from the CEO and canceled executive stock sales $NOW

INVESTORS

Activist Elliott Takes Major Stake in Norwegian Cruise Line, Pressures Turnaround

One of Wall Street’s most feared activist investors just bought a ticket for the cruise industry. Elliott Investment Management has accumulated more than a 10% stake in Norwegian Cruise Line $NCLH and is pushing for sweeping changes to revive the struggling operator. The firm signaled it’s willing to escalate into a proxy fight if management doesn’t cooperate, essentially telling the company: fix performance or we’ll ask shareholders to do it for you.

Norwegian has badly trailed rivals like Royal Caribbean and Carnival despite a post-pandemic travel boom, with shares still hovering near Covid-era levels. Elliott believes operational tweaks, improved guest experience, and better strategy execution could dramatically narrow that gap, even suggesting the stock could eventually reach $56 per share.

Private islands, public problems

A key frustration is that Norwegian owns valuable assets it hasn’t fully exploited. Competitors have successfully used flashy private island destinations to lure high-spending travelers, while Norwegian’s own Bahamas island, Great Stirrup Cay, has seen slower development. Elliott also floated bringing in former Royal Caribbean executive Adam Goldstein as a potential board member, a move that would inject proven cruise industry leadership into the company.

The pressure campaign lands at a chaotic moment. Norwegian recently replaced its CEO with former Subway boss John Chidsey, who lacks cruise industry experience, a decision that rattled investors and sent the stock lower. Elliott argues the company has turned itself around before and could do so again with sharper execution.

Activists are back in style

Elliott’s move is part of a broader resurgence in shareholder activism across corporate America. Firms like Starboard Value and Jana Partners are simultaneously targeting companies such as Tripadvisor and Fiserv $FISV, demanding restructurings, asset sales, or sharper focus on core businesses. At Fiserv, Jana has reportedly been pushing management to boost performance after a steep stock decline tied to a disappointing strategic overhaul.

The surge in activism is fueled by a hotter dealmaking environment, making it easier for investors to pressure companies into selling divisions or themselves outright. Last year alone saw a record number of activist campaigns worldwide, many resulting in CEO departures or board shakeups.

For Norwegian, the message from Wall Street’s activist class is blunt: demand for cruises is strong, competitors are thriving, and underperformance is no longer excusable. Whether management can steer the ship back on course or ends up fighting its own shareholders will likely determine the company’s next chapter.

NEWS

Market Movements

📺 Warner Bros. reopens talks with Paramount: Warner Bros. Discovery $WBD will hear a new offer from Paramount $PSKY after Netflix $NFLX granted a 7 day waiver to resume negotiations. The board still backs the Netflix deal, but Paramount has signaled a higher bid, setting up a potential takeover battle.

🏗️ Investors worry Big Tech is overspending on AI: Fund managers increasingly fear hyperscalers are pouring too much money into AI infrastructure with uncertain returns. Any slowdown in capex could ripple through AI supply chain companies such as Applied Materials $AMAT.

🎮 Google AI tool sparks gaming stock selloff: Gaming companies sold off after Google $GOOGL launched Project Genie, which can generate playable worlds from prompts. Analysts say the tool’s current capabilities are limited, but markets are reacting to long term disruption risks.

🧑💻 ServiceNow CEO buys stock after selloff: ServiceNow $NOW executives are signaling confidence after the CEO disclosed plans to purchase $3 million in shares and leaders halted prearranged selling programs. The moves aim to reassure investors following weakness across enterprise software stocks.

🛠️ Construction firm merges with drone maker: JFB Construction $JFB surged after announcing a $1.5 billion merger with Israeli drone company Xtend backed by Eric Trump. The deal represents a major pivot from construction into defense technology.

🎥 AMC seeks refinancing for heavy debt load: AMC $AMC rose after reports it is working to refinance roughly $2.5 billion of debt, including high interest obligations due soon. Lower borrowing costs could ease financial pressure as the theater chain continues its recovery.

🪨 Trump pushes Pentagon to buy more coal: President Trump ordered the Defense Department to prioritize coal power contracts in an effort to support the struggling industry. Experts say even full adoption would have only a limited impact on overall US coal demand.

₿ Bitcoin struggles below $70K: Bitcoin $BTC remains stuck in the mid $60,000 range and is down sharply this month, putting it on track for its worst first quarter in years. Analysts say a break below $60K or above $74K could determine the next major move.

🛒 Walmart earnings face high expectations: Walmart $WMT heads into earnings with a high bar after becoming a crowded safety trade and trading above Wall Street’s average price target. Elevated expectations mean even solid results could disappoint investors.

🎮 Sony may delay PlayStation 6 due to AI chip demand: Sony $SONY is reportedly considering pushing the PS6 release to 2028 or 2029 as AI data center demand squeezes memory supply. The shortage is also affecting other gaming hardware makers and prices.

🚕 Tesla robotaxis record multiple crashes in Austin: Tesla $TSLA’s robotaxi fleet has logged 14 crashes since launching in June 2025 across roughly 800,000 miles of paid rides. The incident rate is higher than the US average for human drivers, raising safety questions as autonomy expands.

STOCK

Gemini stock tumbles after top executives exit in major leadership shakeup

Gemini Space Station $GEMI plunged after the crypto firm announced the sudden departure of three senior leaders, including its COO, CFO, and chief legal officer. The exits take effect immediately and include the resignation of COO Marshall Beard from the board, signaling a significant restructuring at the top.

Investors reacted swiftly, sending shares sharply lower and deepening the stock’s losses for the year.

Founders step in as leadership reshuffles

The company said it does not plan to replace the COO role for now. Many of Beard’s responsibilities, including revenue-related duties, will be absorbed by cofounder Cameron Winklevoss alongside his existing leadership role.

Interim appointments have been made to stabilize operations. Chief accounting officer Danijela Stojanovic will serve as temporary CFO, while Kate Freedman steps in as interim general counsel.

Cuts and closures add to uncertainty

The leadership overhaul follows aggressive cost-cutting measures earlier this month, including a 25% workforce reduction and the shutdown of operations in the United Kingdom, European Union, and Australia. These moves reflect broader pressure across the crypto industry as trading activity and valuations remain subdued.

Despite the turmoil, Gemini expects full-year revenue to increase modestly compared with the prior year. However, the company also anticipates a substantial adjusted loss, highlighting the difficult path to profitability.

Coming just months after its IPO, the shakeup raises questions about strategy, governance, and the firm’s ability to navigate a challenging crypto market. For investors, the sudden changes suggest a company still searching for stability in a volatile sector.

CALENDAR

On The Horizon

Tomorrow

Markets will digest a delayed update on housing starts and building permits along with the minutes from January’s Fed meeting, which could reveal how policymakers are thinking about inflation, growth, and future rate moves.

A packed earnings slate follows, with reports from companies spanning tech, travel, energy, defense, payments, restaurants, and consumer brands including Analog Devices, Booking.com, Carvana, Occidental Petroleum, DoorDash, Moody’s, eBay, Garmin, Global Payments, Figma, Cheesecake Factory, Wingstop, and several international heavyweights.

Away from corporate results, Meta CEO Mark Zuckerberg is set to testify in a closely watched trial examining whether social media harms teenage mental health. The stakes are enormous for the company because stricter rules limiting youth access to platforms like Facebook and Instagram could dent a lucrative revenue stream. Research from Harvard estimates that under-18 users generated roughly $11 billion in advertising income for social media firms last year, highlighting just how much is on the line.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com