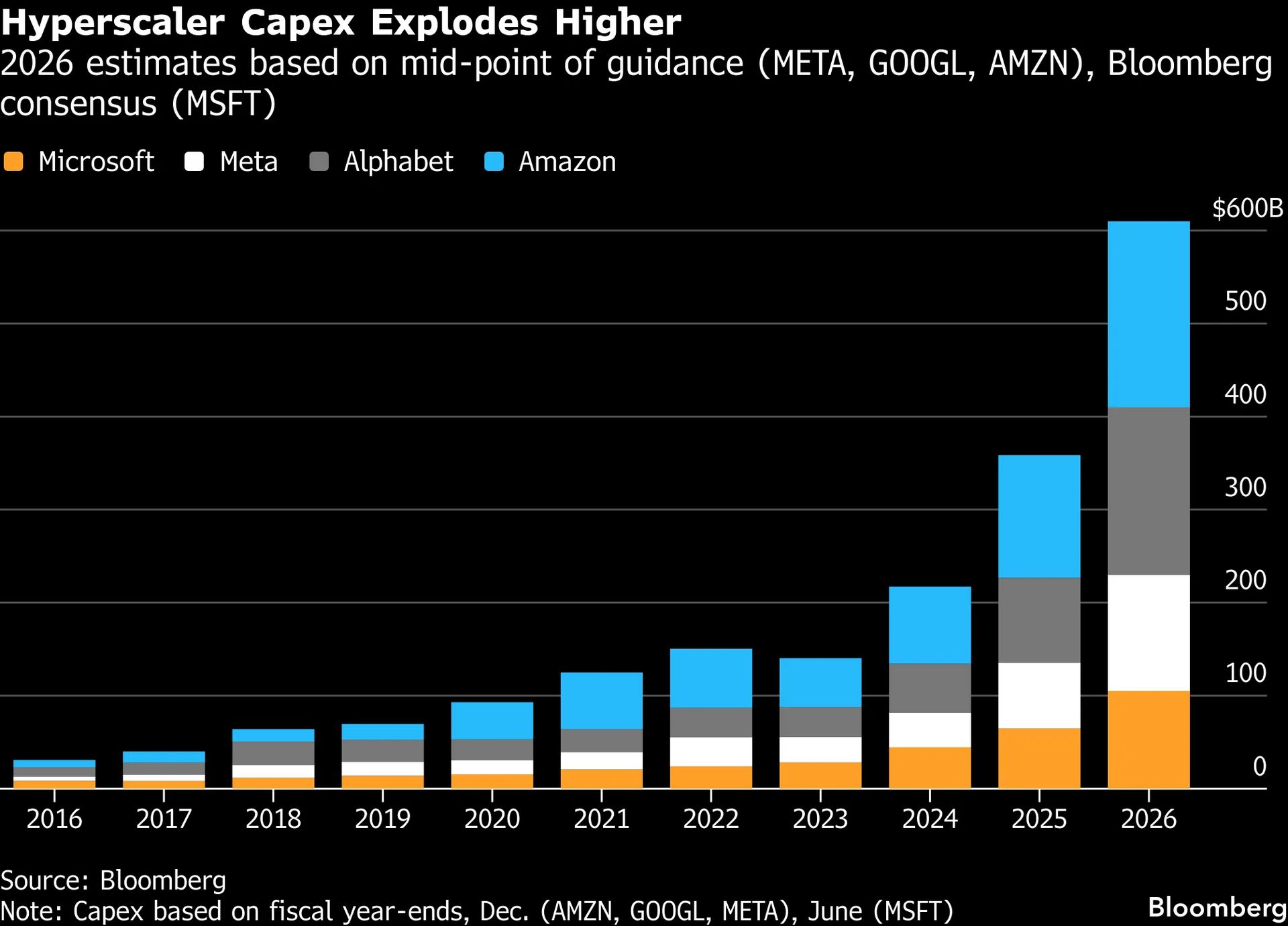

The biggest names in tech are opening the spending floodgates again. Analysts expect Meta $META ( ▼ 0.86% ) , Microsoft $MSFT ( ▲ 0.42% ) , Amazon $AMZN ( ▼ 0.42% ) , and Alphabet $GOOGL ( ▼ 1.48% ) to boost combined capital expenditures by about 50% in 2026, pushing the total past $600 billion. That follows already record breaking spending in 2025.

Most of that money is flowing into AI infrastructure, but each company is putting its own spin on where the dollars go.

Alphabet and Meta Are Building AI Empires

Alphabet $GOOGL is going big, with capex expected to jump from $91.4 billion in 2025 to as much as $185 billion in 2026. Most of that is aimed at technical infrastructure, including servers, data centers, and networking gear to power AI model development, cloud demand, and advertising improvements.

Meta $META is also ramping hard. After spending $72 billion in 2025, it expects to invest between $115 billion and $135 billion in 2026. The focus is squarely on data centers, servers, and network infrastructure to train advanced AI models. The company also highlighted long term bets on custom silicon and energy to support its AI ambitions.

Amazon and Microsoft Are Feeding the Cloud and AI Boom

Amazon $AMZN plans to spend around $200 billion in 2026, up from $131.8 billion in 2025. While some of that supports traditional cloud workloads, most is tied to AI demand inside AWS. The company is also investing in fulfillment efficiency, robotics, and even expanding its Whole Foods footprint.

Microsoft $MSFT is projected to spend about $116 billion in 2026, up from $83 billion in 2025. Roughly two thirds of recent spending has gone toward shorter lived assets like GPUs and CPUs to meet soaring Azure and AI demand. Microsoft is also using that capacity to power its own AI products like Copilot across multiple services.

Tesla and Apple Take Different Paths

Tesla $TSLA ( ▲ 1.83% ) , while smaller in absolute dollars, is planning to more than double its capex to over $20 billion in 2026. That money will go toward new factories, battery production, vehicle programs like Cybercab and Semi, and AI compute infrastructure for projects such as Optimus and robotaxis.

Apple $AAPL ( ▼ 0.31% ) stands out as more conservative. Its capex is expected to rise only modestly to about $13.3 billion. Spending is spread across tooling, facilities, retail stores, and data centers, with Apple continuing to rely on a mix of in house and third party capacity rather than massive AI data center builds.

Even with different strategies, one theme is clear. AI is driving one of the largest infrastructure buildouts the tech industry has ever seen, and the spending race is far from over.