Good afternoon! Meta hit pause on its international rollout of Ray-Ban Display smart glasses as demand in the US quickly outpaced supply. The company said it is prioritizing domestic orders after receiving overwhelming interest in the AI-powered specs.

The move looks less like a setback and more like a stress test passed. The $799 glasses have earned solid reviews, helped boost EssilorLuxottica’s sales, and signaled that smart glasses might finally be breaking out of their flop era.

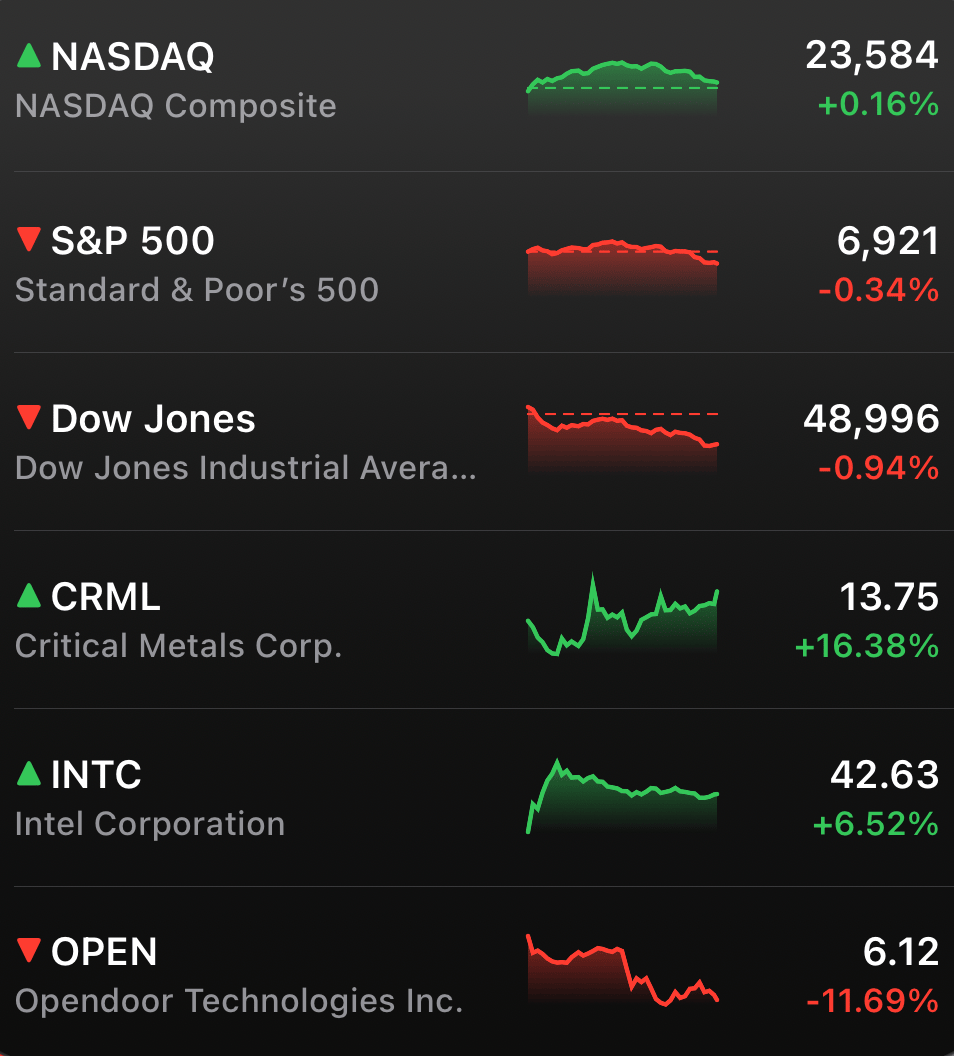

MARKETS

Indexes pulled the ol’ switcheroo. The S&P 500 and Dow backed off after flirting with fresh highs, while the Nasdaq squeezed out gains as investors leaned back into tech optimism.

The data was mixed enough to keep everyone guessing. ADP showed December private payrolls rebounding, but JOLTS revealed job openings slid to their lowest level since September, setting the stage for Friday’s jobs report to shape expectations around Fed easing in 2026.

STOCKS

Winners & Losers

What’s up 📈

Ventyx Biosciences jumped 36.62% on reports that Eli Lilly is in talks to acquire the company for roughly $1B $VTYX

Critical Metals surged 16.38% as renewed US interest in Greenland boosted rare earth plays $CRML

United States Antimony Corp. climbed 12.30% on the same Greenland-driven critical minerals narrative $UAMY

Compass rose 9.42% after a key antitrust waiting period expired for its acquisition of Anywhere Real Estate $COMP

Intel advanced 6.44% to a new 52-week high as CES visibility, Mobileye deal optics, and foundry chatter lifted sentiment $INTC

Eli Lilly gained 4.14% amid takeover talks with Ventyx, extending strength across biotech $LLY

MP Materials added 4.48% as rare earth supply chain risks moved back into focus $MP

Amgen rose 3.47%, extending its rally after acquiring Dark Blue Therapeutics $AMGN

What’s down 📉

Opendoor Technologies plunged 11.90% after President Trump said he wants to ban institutional investors from buying single-family homes $OPEN

First Solar fell 10.29% after a Jefferies downgrade citing weak booking visibility $FSLR

AST SpaceMobile sank 12.06% after being cut to Underperform, with analysts flagging competition from Starlink and limited retail traction $ASTS

Western Digital dropped 8.89% and Seagate Technology slid 6.71%, giving back part of Tuesday’s AI-storage-fueled rally $WDC $STX

Invitation Homes slid 6.01% and Blackstone fell 5.58% on fears of restrictions targeting institutional homebuyers $INVH $BX

Northrop Grumman sank 5.62%, Lockheed Martin fell 4.87%, and General Dynamics dropped 4.18% after Trump said defense firms should halt dividends and buybacks until demands are met $NOC $LMT $GD

IMAX dipped 5.38% despite posting record 2025 ticket revenue $IMAX

Deckers Outdoor fell 4.10% following analyst downgrades weighing on Ugg and Hoka momentum $DECK

IPO

Discord IPO Signals Return of Mega Tech Listings

Wall Street might finally be dusting off its IPO calendar.

Chat platform Discord has confidentially filed for an IPO and is working with Goldman Sachs and JPMorgan, according to reports. Founded in 2015, Discord now counts more than 200 million monthly active users, making it one of the largest social platforms still sitting on the private-market sidelines. The company was last valued around $15 billion in a 2021 funding round, shortly after it turned down a $12 billion acquisition offer from Microsoft.

The IPO watchlist gets interesting again

Discord’s move is reopening the conversation around long-awaited tech listings, especially as AI-driven capital needs push companies toward public markets. OpenAI is widely viewed as the biggest wildcard, with private valuations reportedly north of $500 billion and long-term infrastructure commitments that make public capital increasingly attractive. Anthropic, the maker of Claude, is also in focus after a late-2025 funding round valued it as high as $350 billion, positioning it as the enterprise-focused counterweight to OpenAI.

Then there’s SpaceX, which could be the crown jewel of the next IPO cycle. Elon Musk has said a 2026 listing is “accurate,” and recent secondary transactions have valued the company near $800 billion, with some upside estimates reaching $1.5 trillion. If SpaceX goes public, it would likely become the largest IPO in history.

Why this isn’t an IPO flood yet

Despite the buzz, this is still more thaw than flood. Venture capital fundraising fell sharply in 2025, and many startups that raised massive private rounds over the past few years don’t urgently need public cash. At the same time, public markets have become far less forgiving, demanding clearer paths to profitability and tighter disclosure, which keeps many companies private longer.

That’s what makes Discord’s filing notable. In a market starved for exits, even a single high-profile IPO can help reset expectations, return capital to investors, and reopen the pipeline just as AI, space, and crypto companies gear up for another capital-intensive growth phase.

NEWS

Market Movements

🪨 Greenland sparks rare-earth rally: Rare earth stocks surged after the White House confirmed the US is actively exploring options to acquire Greenland, reigniting speculation around strategic mineral supply chains.

🧠 Stack Overflow survives AI: While its public Q&A forum has collapsed under pressure from generative AI, Stack Overflow’s enterprise AI tools and data licensing business are quietly driving revenue growth.

🍗 Jollibee takes global growth to Wall Street: Jollibee announced plans to spin off and list its international business in the US, highlighting how overseas expansion is now powering the company’s growth.

⚛️ D-Wave accelerates gate-model push: D-Wave Quantum $QBTS agreed to acquire Quantum Circuits for $550M, deepening its bet on gate-model quantum computing as competition intensifies.

🎮 GameStop ties CEO pay to profits: GameStop $GME unveiled a compensation plan that pays CEO Ryan Cohen only if the company delivers real profitability and long-term shareholder returns.

🎬 Paramount loses again: Warner Bros. Discovery $WBD rejected Paramount’s takeover bid for the sixth time, reinforcing Netflix $NFLX as the board’s preferred partner.

🐶 Dogecoin rallies without Wall Street: Dogecoin $DOGE surged despite zero ETF inflows, underscoring how the move remains retail-driven rather than institutional.

🧱 Lego adds computers to bricks: Lego unveiled its new “Smart Brick,” embedding microcomputers and sensors into classic blocks, with the first rollout tied to Star Wars sets featuring motion triggered lights and sounds.

🚀 Intel rallies on CES buzz: Intel $INTC surged after a mix of CES chip announcements, optimism around its Mobileye $MBLY deal, and renewed foundry speculation helped reset sentiment despite no single breakout catalyst.

🧪 A new quantum contender files: Infleqtion and Churchill Capital Corp X $CCCX cleared a key hurdle toward going public after filing an S-4 for their SPAC merger, positioning Infleqtion as a differentiated quantum play using neutral atom technology instead of the superconducting or trapped-ion systems used by rivals like IonQ $IONQ, Rigetti $RGTI, and D-Wave $QBTS.

🏠 Trump rattles housing stocks: Shares of Blackstone $BX, Invitation Homes $INVH, and major homebuilders fell after President Trump floated banning Wall Street firms from buying single-family homes.

CRYPTO

Crypto Stocks Catch a Break as MSCI Backs Off Index Changes and Ethereum Staking Grows

Crypto markets caught a quiet but important break this week, with two developments easing pressure on digital-asset-linked stocks and reinforcing longer-term conviction around ethereum.

MSCI Blinks on Crypto Index Rule

Strategy $MSTR jumped after MSCI said it will allow digital asset treasury companies to remain in its global indexes, reversing a proposal that would have excluded firms whose crypto holdings exceed 50% of assets. Had the change gone through, passive funds tracking MSCI benchmarks would have been forced sellers, creating a meaningful technical overhang for Strategy and its peers.

MSCI emphasized the decision is not permanent and said it will continue studying how to distinguish operating companies from investment vehicles. Still, for now, the risk of forced index-driven selling is off the table, giving crypto treasury stocks some breathing room.

Ethereum Staking Flips One-Way

At the same time, ethereum $ETH is flashing a separate signal of growing conviction. The queue to exit ETH staking has dropped to zero days, while the line to enter has stretched beyond 25 days, with roughly 1.46 million ETH waiting to be locked up.

Analysts see the imbalance as a sign that deleveraging pressure has cleared and longer-term holders are stepping in. Institutional demand is playing a bigger role this cycle, with asset managers, ETFs, and corporate treasuries increasingly opting to earn yield through staking rather than holding idle tokens.

Institutions Tighten Supply

BitMine Immersion Technologies $BMNR, the largest ethereum treasury firm, began staking part of its holdings in December, while ETF providers like Grayscale have started distributing staking rewards to shareholders. As more ETH gets locked up and fewer validators rush for the exits, circulating supply tightens.

The broader takeaway is subtle but important. While price action remains volatile, the underlying structure of ethereum ownership is shifting toward longer-duration holders, a setup that historically supports a more constructive medium-term outlook.

CALENDAR

On The Horizon

Tomorrow

The data parade keeps marching on tomorrow with the weekly check-in on initial jobless claims. We’ll also get a grab bag of macro updates, including the US trade deficit, consumer credit trends, and a final look at productivity and labor costs from Q3.

Earnings stay relatively light, but a few familiar names step up to the mic. Reports are due from RPM International, Acuity Brands, Tilray Brands, and WD-40, offering a quick pulse check across industrials, lighting, cannabis, and whatever magic is still inside that blue-and-yellow can.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com