Good afternoon! The weight loss wars just hit a new milestone. Novo Nordisk has started rolling out the first GLP-1 pill approved for weight loss in the US, giving patients a needle-free alternative to injectable drugs like Wegovy shots. Monthly pricing lands between $149 and $299 depending on dose, undercutting most injectables.

The pill was cleared by regulators last month and is already showing up at CVS, Costco, and select telehealth platforms. Novo says supply should be steady this time, avoiding the shortages that plagued its injections, while rival Eli Lilly races to bring its own oral GLP-1 to market.

MARKETS

Stocks kept pressing higher, with the S&P 500 closing at a fresh record as traders leaned back into risk. The Nasdaq 100 and Russell 2000 led the way, while semiconductors ripped after CES buzz and upbeat comments from Nvidia’s Jensen Huang reignited the AI trade. Energy flipped from leader to laggard after yesterday’s run.

Outside equities, the action was just as telling. Venezuelan bonds surged as investors priced in a possible reset after years of default, while copper punched through $13,000 per ton and kept its hot streak alive. Treasurys were mostly unchanged, but between metals, AI stocks, and emerging-market debt, risk appetite was clearly back in the driver’s seat.

STOCKS

Winners & Losers

What’s up 📈

Alumis exploded 95.55% after strong late-stage psoriasis drug data.

After Nvidia lit a fire at CES, Sandisk jumped 27.56%, Western Digital rose 16.77%, Seagate gained 13.98%, and Micron added 10.00% as investors piled back into AI-driven storage demand. $SNDK $WDC $STX $MU

Moderna climbed 10.91% after Bank of America raised its price target. $ALMS $MRNA

Aeva Technologies soared 34.38% after being tapped for Nvidia’s autonomous platform, while Nebius jumped 7.95% on early access to Nvidia’s Vera Rubin racks. Accenture climbed 4.54% after announcing an AI acquisition. $AEVA $NBIS $ACN

OneStream popped 28.39% on a $6.4B buyout, Veeva Systems gained 7.47% after announcing a $2B buyback, and Vistra rose 4.05% on its power-generation acquisition tied to AI demand. $OS $VEEV $VST

Shake Shack rose 7.61% on an upgrade tied to World Cup traffic

Uber gained 5.93% after unveiling a robotaxi at CES,

JetBlue climbed 5.42% on bullish options activity. $SHAK $UBER $JBLU

Space stayed hot: Rocket Lab added 10.10% to hit a new all-time high, with AST SpaceMobile and EchoStar also moving higher. $RKLB $ASTS $SATS

What’s down 📉

SoFi Technologies slid 7.84% after Bank of America resumed coverage with an Underperform rating. $SOFI

American International Group dropped 7.48% following news that its CEO will step down later this year. $AIG

Roblox fell 6.43% after reports of widespread outages and a lowered price target. $RBLX

Modine Manufacturing declined 7.44% on similar concerns around data center cooling demand. $MOD

Adidas slipped 4.13% after warnings that competition from Nike could pressure growth. $ADDYY

Tesla dipped 4.13% as Nvidia’s open autonomous tech raised competitive concerns. $TSLA

TransUnion fell 4.86% after FHFA comments questioned credit bureau pricing models. $TRU

Equifax dropped 3.85% on the same regulatory concerns. $EFX

AI

Nvidia CES Keynote Lifts AI Storage Stocks While Cooling Names Slide

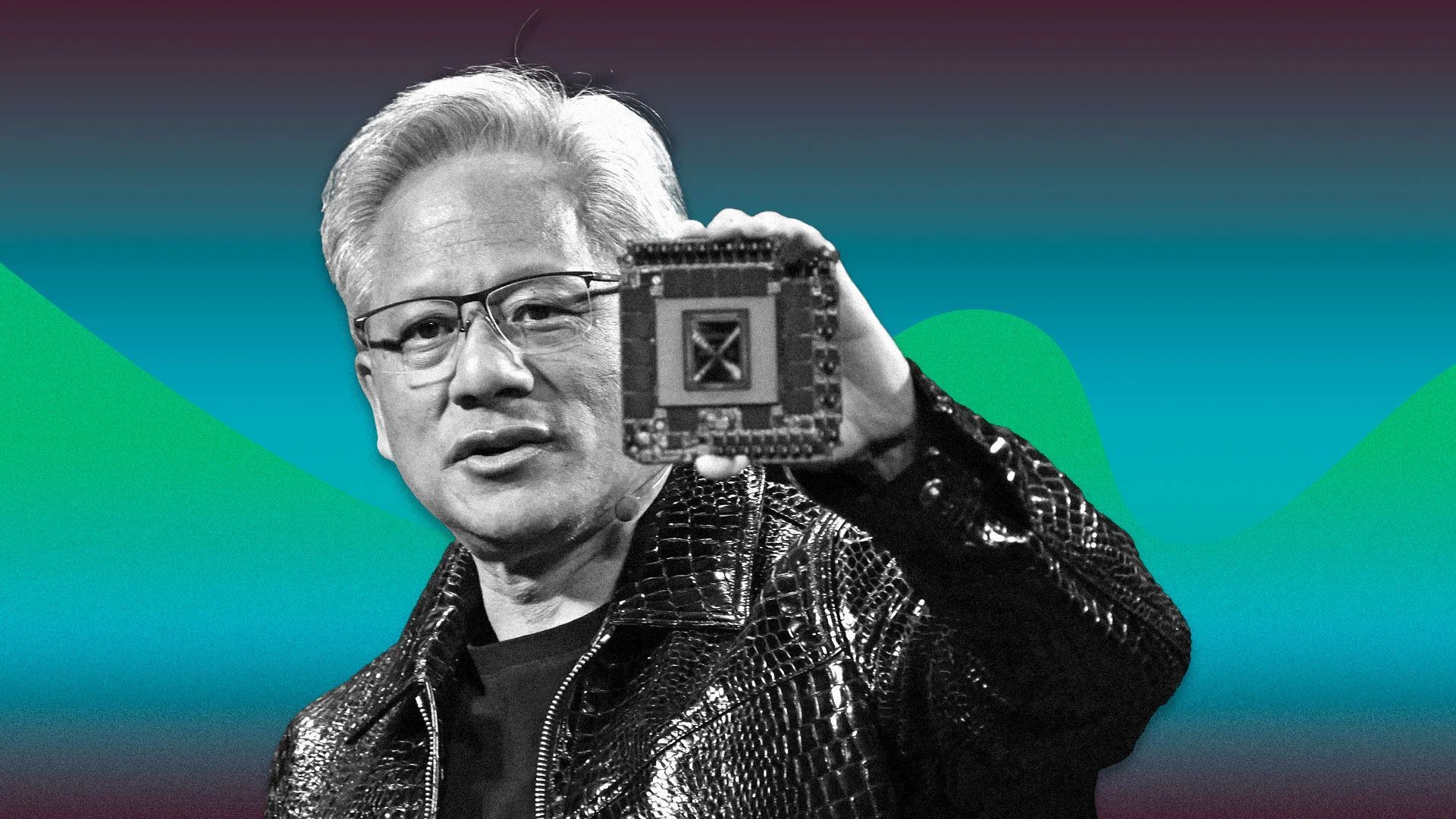

When Nvidia $NVDA CEO Jensen Huang speaks for 90 minutes, markets listen closely. His CES keynote reassured investors on Nvidia’s roadmap and immediately reshuffled winners and losers across the AI supply chain.

Rubin timeline gets the green light

Huang confirmed Nvidia’s next-generation Vera Rubin GPUs are already in full production, easing lingering concerns after last year’s Blackwell rollout. That helped steady $NVDA and pushed partners to highlight early access plans, including Nebius $NBIS, CoreWeave $CRWV, and Super Micro Computer $SMCI, all tying future growth to the Rubin cycle.

The takeaway for investors was straightforward. The timeline is intact, and the next leg of AI infrastructure spending is still coming.

Cooling stocks feel the heat

Not everyone benefited. Huang said upcoming Rubin AI racks can be cooled with much hotter water, removing the need for traditional chillers. That sent data center cooling and HVAC stocks lower, including Johnson Controls $JCI, Trane Technologies $TT, and Carrier $CARR, as investors reassessed demand for water-cooling infrastructure.

The selloff did not end the data center trade, but it did force a reset on which parts of the stack actually scale with Nvidia’s newest systems.

Storage stocks take center stage

On the flip side, data storage and memory names surged after Huang called AI storage a “completely unserved market.” Sandisk $SNDK jumped more than 25%, while Western Digital $WDC, Micron $MU, and Seagate Technology $STX all posted double-digit gains.

Analysts added fuel to the move, forecasting sharp increases in both DRAM and NAND pricing in early 2026 as AI-driven demand tightens supply.

Bottom line: Nvidia didn’t just talk AI at CES. It redirected capital across the market. Storage and memory stocks ripped higher, cooling names sold off, and partners rushed to prove they are plugged into the Vera Rubin cycle.

NEWS

Market Movements

🚀 Rocket Lab Hits Another Record: Rocket Lab closed at a fresh all-time high as options activity stayed elevated. The stock has become a core retail favorite despite profits still being a work in progress.

🧊 D-Wave Claims Qubit Breakthrough: D-Wave says it cracked a major bottleneck in gate-based quantum computing by packing more qubits together without overheating them. The approach cuts wiring and heat using stacked chips and multiplexing, which could help push the company beyond its annealing niche.

🚗 Nvidia Turns Autonomy Into a Product: Nvidia used CES to show how self-driving is becoming something automakers can buy, not build from scratch. Mercedes-Benz plans to ship vehicles using Nvidia’s new autonomy stack later this year, narrowing Tesla’s long-held integration edge.

₿ Bitcoin Rallies on ETF Inflows: Bitcoin is extending its early-2026 climb as spot ETF demand snaps back after months of caution. The biggest inflows since October suggest institutions are re-entering, though traders say this still looks like stabilization, not a breakout.

🕶️ Meta Pauses Smart Glasses Expansion: Meta is delaying international rollout of its Ray-Ban smart glasses due to tight supply and overwhelming demand. Waitlists now stretch well into 2026, forcing the company to prioritize US buyers first.

🎮 Roblox Slips After Outages, Cautious Call: Roblox fell after overnight outages disrupted gameplay and an analyst flagged slowing engagement. The combo raised fresh questions about how durable recent growth really is.

🟣 XRP Jumps on ETF Support: XRP surged to its highest level since November as trading volume spiked and ETF inflows stayed strong. Analysts caution the rally depends on whether liquidity holds.

🧬 Moderna Pops After Target Hike: Moderna climbed after Bank of America raised its price target, pointing to pipeline improvements and cost cuts. Pressure remains as the company works to diversify beyond COVID revenue.

✈️ JetBlue Rallies on Options Frenzy: JetBlue surged as bullish call buying exploded above normal levels. Traders appear to be betting on further upside tied to oil relief expectations.

🤖 AI Leaderboard Startup Hits Unicorn Status: LMArena raised $150 million at a $1.7 billion valuation, turning its AI model rankings into an industry scoreboard. Investors are betting benchmarks matter more as AI competition intensifies.

AUTONOMY

Uber Unveils Robotaxi With Lucid and Startup Nuro at CES

Uber $UBER shares jumped nearly 6% after the company revealed a production-intent robotaxi built with Lucid $LCID and autonomous startup Nuro at CES in Las Vegas. The vehicle is already being tested on public roads, with a commercial launch planned later this year starting in the San Francisco Bay Area.

Built on Nvidia’s autonomy stack

The Lucid Gravity–based robotaxi runs on Nvidia $NVDA Drive AGX Thor, plugging Uber directly into Nvidia’s broader push to make autonomy modular and off the shelf. Instead of building everything internally, Uber is leaning on Lucid for the vehicle platform, Nuro for autonomy software, and Nvidia for compute and safety infrastructure.

That setup lets Uber move faster while avoiding the massive capital burden of full vertical integration.

Uber is not waiting to be disrupted

For years, investors worried that robotaxis would eventually eat into Uber’s core business. This announcement makes Uber’s stance clear. It does not plan to sit back and watch that happen.

By embedding itself directly into the autonomous stack, Uber can stay central to ride demand, routing, payments, and customer relationships even as vehicles lose human drivers. If robotaxis scale, Uber wants to be the marketplace that controls access to riders rather than the company replaced by the technology.

Why Wall Street liked it

The news reinforces Uber’s asset-light strategy and positions the company as an autonomy platform rather than a fleet owner. It also underscores Nvidia’s growing influence across the autonomous ecosystem, as more companies converge on its hardware and software stack.

For investors, the takeaway is simple. If robotaxis are coming, Uber intends to be one of the biggest beneficiaries, not one of the casualties.

CALENDAR

On The Horizon

Tomorrow

The week is easing in quietly, but the data dump is right around the corner. Tomorrow kicks off a string of labor market updates with the JOLTS report, where job openings are expected to hover around 7.7 million, roughly matching the number of people looking for work. We will also get fresh private payroll figures from ADP, adding another read on how tight the job market really is.

Beyond jobs, investors will check the pulse of the services economy with December’s ISM Services report. Earnings season also starts warming up, with early results on deck from Albertsons, Cal-Maine Foods, Constellation Brands, and Jefferies.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com