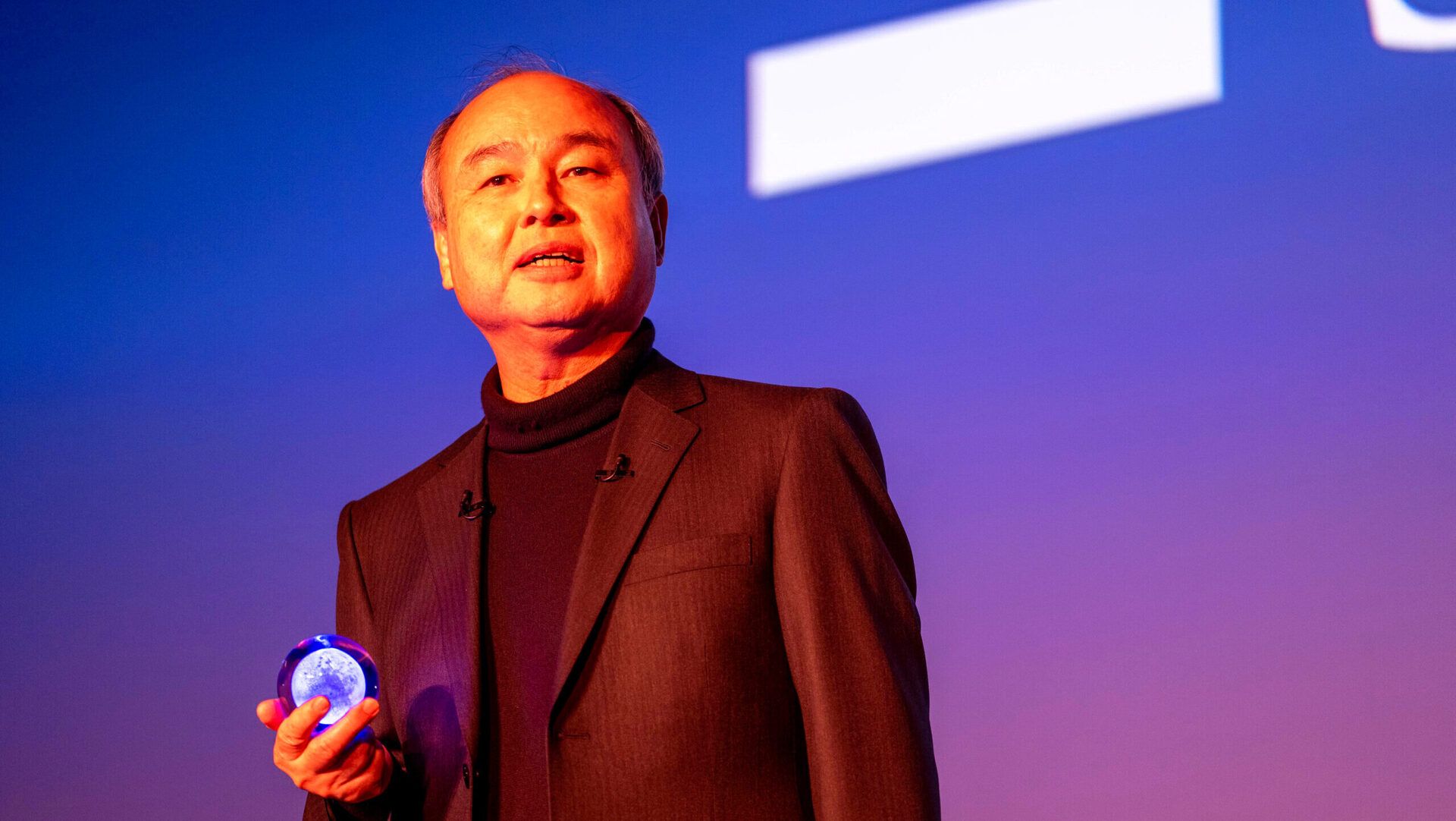

SoftBank $SFTBY ( ▼ 1.42% ) founder Masayoshi Son says he didn’t want to sell a single share of Nvidia $NVDA ( ▲ 3.08% ), but the firm’s October exit from its $5.8 billion stake was driven purely by its need for cash. Speaking at the FII Priority Asia forum, Son said he made the sale “crying,” adding: “I wish to have unlimited money. I respect Jensen. I respect Nvidia so much.” The CFO previously said the move had “nothing to do” with Nvidia’s performance.

SoftBank shares have been hammered since then, down 39 percent from their late-October peak, as investors grow uneasy about the firm’s exposure to OpenAI. The company owes OpenAI $22.5 billion by year-end to increase its stake, part of its broader push into AI infrastructure and Project Stargate data centers.

Son fired back at critics who argue the AI boom is becoming a bubble, calling skeptics “not smart enough.” He said he expects AI to be far smarter than humans within a decade and believes superintelligent systems and physical AI robots could replace “at least 10 percent” of global GDP. If the world invests $10 trillion to reach that point, he claimed the returns would pay back in just six months.