Good afternoon! Federal prosecutors say a gambling ring of college players, alumni, pro bettors, and even a former NBA player manipulated 25+ games to cash in on sportsbook winnings. It allegedly started in 2022 with point shaving, then spread to 39 NCAA players across 17+ Division I teams, with bribes of $10K–$30K per game.

The NCAA says investigations into most of the named teams are already underway, and it’s pushing to ban prop bets on college games to stop this from happening again.

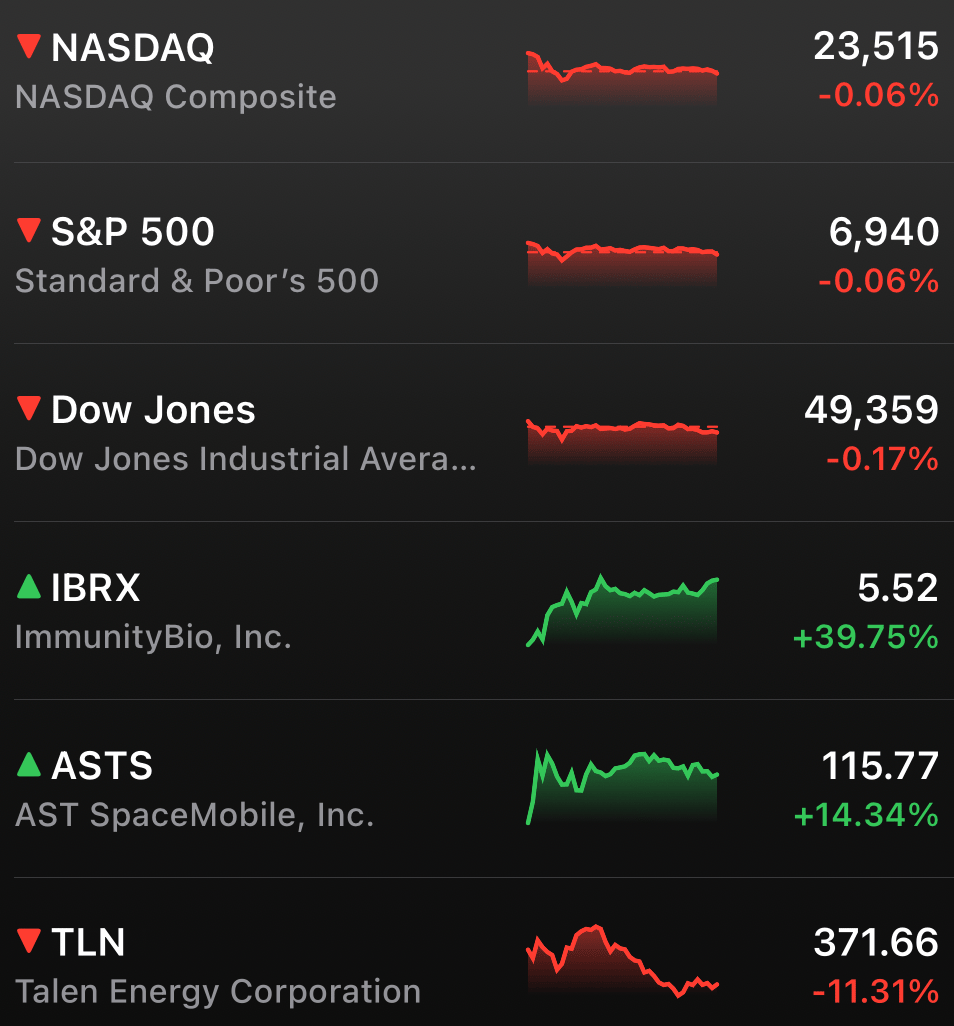

MARKETS

Stocks tried to shake off the jitters, but the S&P 500 and Nasdaq still slipped into the weekend with small losses and a red week on the scoreboard. The one exception: small caps, with the Russell 2000 beating the S&P for the 11th straight session, its longest flex over large caps since 2008.

Meanwhile, the Fed soap opera kept markets jumpy. Treasury yields climbed as Trump cooled the Kevin Hassett-to-Fed-Chair chatter, lowering odds that a known dove would take the wheel, while chip stocks kept running like they did not get the memo.

STOCKS

Winners & Losers

What’s up 📈

ImmunityBio exploded 39.75% after upbeat guidance for its bladder cancer drug Anktiva sparked fresh retail hype. $IBRX

Riot Platforms jumped 16.05% after announcing land acquisition + its first data center lease with AMD at its Rockdale site. $RIOT

AST SpaceMobile rallied 14.34% after being named an eligible vendor for the Pentagon’s SHIELD program (Golden Dome-related). $ASTS

Novo Nordisk rose 9.12% after UK regulators approved a higher Wegovy dose, while early demand for its weight-loss pill is reportedly strong. $NVO

Bloom Energy climbed 7.42% as Trump hinted Big Tech may help fund new power plants, pushing “AI power buildout” names higher. $BE

Micron gained 7.78% after a board member bought ~$7.8M of shares, a pretty loud confidence signal. $MU

GE Vernova rose 6.12% on the same “Big Tech pays for power” narrative. $GEV

Rocket Lab popped 5.98% after Morgan Stanley upgraded it to Overweight. $RKLB

Quanta Services advanced 4.27% as grid/infrastructure names caught a tailwind from the power buildout theme. $PWR

PNC Financial Services added 3.79% after a strong Q4 with record revenue. $PNC

Worthington Steel rose 3.38% after announcing a $2.4B deal to buy Germany’s Kloeckner & Co. $WS

What’s down 📉

Talen Energy sank 11.30% as the market worried Trump’s electricity-price push could mean tougher terms for power generators. $TLN

Constellation Energy fell 9.80% on the same fear: more supply, more competition, less pricing power. $CEG

DraftKings dropped 8.01% after reports prediction markets are stealing share from traditional NFL betting. $DKNG

Amcor slid 7.29% after completing a 1-for-5 reverse stock split. $AMCR

Vistra fell 7.54% as investors repriced the power trade under new political pressure. $VST

Flutter Entertainment lost 6.28% on prediction market betting competition concerns. $FLUT

QXO fell 4.84% after announcing a $750M common stock offering. $QXO

Mosaic slid 4.46% after preliminary Q4 volumes missed expectations amid weaker fertilizer demand. $MOS

Regions Financial slipped 2.63% after missing fourth-quarter revenue expectations. $RF

AI

Sandisk, Western Digital, and Seagate Are the New AI Winners

The biggest winners of 2025 did not rotate out in 2026. They hit “run it back.”

Hard drive and storage names like Sandisk $SNDK ( ▼ 2.56% ) , Western Digital $WDC ( ▼ 3.44% ) , and Seagate $STX ( ▼ 6.94% ) ripped last year as investors realized something simple: AI is not just a chip story, it is a data story, and data has to live somewhere.

The AI trade found its next bottleneck

Storage stocks have been straight-up ridiculous: Sandisk, Western Digital, and Seagate surged 388%, 219%, and 189%in 2025 as the AI infrastructure boom pulled in every piece of the stack.

And 2026 is already picking up where 2025 left off, with Sandisk up 74.24% YTD while the S&P 500 is up just 1.38%.

Why memory is quietly running the show

AI training and inference do not just burn GPUs, they burn memory and storage. The demand surge is colliding with slower supply growth, which is why investors keep bidding up anything tied to NAND, HDDs, and flash.

As one AI exec put it: if you keep stacking GPUs without enough fast memory behind them, you are basically buying supercars and forgetting to build roads.

Someone with real chip credibility just made a big bet: This cycle is usually brutal and cyclical, but bulls think the momentum lasts through 2026 because AI spending is still accelerating.

And one insider-style signal turned heads: Mark Liu, former senior exec at TSMC and now on Micron’s board, bought 23,200 shares of Micron $MU worth $7.8M, basically saying “I still think this has more upside” even after Micron’s monster run.

The sneaky loser: consumer tech

Not everyone’s winning. For companies like Apple $AAPL ( ▲ 0.2% ) and Dell $DELL ( ▲ 3.69% ) , rising memory prices are turning into a real margin headache.

Memory is now roughly 20% of a laptop’s hardware cost, up from 10% to 18% earlier in 2025, which forces the classic ugly choice: eat the cost and get margin-compressed, or pass it on and pray customers don’t notice.

Bottom line: storage is becoming the “unsexy backbone” of AI, and markets are finally paying it like it matters.

NEWS

Market Movements

🛰️ AST SpaceMobile Golden Dome Contract Boosts Stock: AST SpaceMobile $ASTS jumped after it said it’s a “prime contract awardee” for the Defense Department’s SHIELD program tied to the Golden Dome missile defense strategy. The IDIQ setup pre-qualifies ASTS to compete for future orders across R&D, engineering, prototyping, and operations. The news strengthens the “government + defense” pillar of the ASTS bull case.

🥈 Silver Rally Warning Spurs Options Hedges and Bearish Bets: Several strategists warned silver’s surge is starting to look fragile and downside risk is rising. One recommended selling $SLV calls to finance protective puts, while others cited signs like physical tightness easing and forwards flipping back to contango. Another manager said he’s effectively short via put options and framed it as a small, speculative bet.

🤖 Google Leads Apple in Personalized AI Assistant Race: Google $GOOGL appears to be moving faster on personalized AI by connecting Gemini across its apps with “Personal Intelligence.” Apple $AAPL is leaning on Gemini for the next Siri, but key personalized features may take longer to roll out. Google’s advantage is services depth, while Apple’s advantage is owning the iPhone default.

🏭 EPA Says xAI Used Gas Turbines Illegally at Colossus Data Center: The EPA ruled xAI violated rules by running portable gas turbines without required air permits at its Colossus 1 site in Memphis. xAI relied on a loophole tied to “portable” generators, but regulators said federal rules still applied. The issue matters because xAI is also using similar generators for Colossus 2 near Alabama.

🎬 Netflix-Warner Bros. Deal Opposition Shifts to Europe: Groups opposing Netflix’s $NFLX bid for Warner Bros. Discovery $WBD are now lobbying European regulators after limited traction in the US. Paramount Skydance $PSKY leadership and theater-linked groups have been pushing back, especially on concerns around theatrical distribution. Netflix tried to calm fears, saying it would keep a 45-day theatrical window strategy.

🧩 Claude Code Fuels AI-Driven Selloff in Software Stocks: Software stocks keep sliding as investors price in AI agents replacing parts of traditional SaaS workflows. A SemiAnalysis piece argued Claude Code is a “ChatGPT moment repeated” and that software differentiation like UI and workflow speed could become less valuable. The implication is more valuation compression as agents shift value toward data and APIs.

📢 OpenAI Launches Ads for Free Tier and ChatGPT Go With Privacy Limits: OpenAI said ads will roll out to the free tier and the $8/month ChatGPT Go plan, but they will be clearly labeled and separate from answers. The company said it won’t sell conversation data to advertisers and answers won’t be influenced by ads. Users can turn off personalization, and ads won’t show for minors or sensitive topics.

ENERGY

Trump Wants Big Tech to Pay for New Power Plants

GE Vernova $GEV jumped 6.12% Friday after investors realized the AI boom is about to come with a new price tag: electricity, and lots of it. The Trump administration is reportedly pushing a plan that would force hyperscalers to help fund new power generation so households are not stuck subsidizing the data center buildout.

AI needs power, so write the check

The basic idea is pretty blunt: if Big Tech wants to build AI data centers at warp speed, Big Tech has to help build the power plants too. That could mean hyperscalers bidding into long-term contracts that finance new generation, especially in PJM (the 13-state grid covering Northern Virginia and Ohio, aka Data Center World HQ).

GE Vernova = the “sell shovels” trade

Jefferies called $GEV the “clearest winner” because Vernova sells the natural gas turbines that get installed when new plants are approved and built. If PJM needs more capacity, that likely means more gas plants, more turbine orders, and more pricing power for the turbine suppliers.

Utilities are getting smoked for a reason

More supply kills scarcity, and scarcity is what was making certain power names look unstoppable. That’s why Vistra $VST, Constellation $CEG, and Talen Energy $TLN dropped hard, because a serious push to expand generation undercuts the entire “tight grid = permanently high prices” thesis.

Bottom line: this is a policy shift that rewards the builders, not the toll collectors, and $GEV is one of the cleanest ways to trade it.

CALENDAR

On The Horizon

Tomorrow

Enjoy the long weekend: U.S. markets are closed next Monday for Martin Luther King Jr. Day, and we’re off too.

But the calendar still goes hard next week.

Tuesday is earnings-only (Netflix, Interactive Brokers, U.S. Bancorp, DR Horton, United, etc.),

Wednesday brings delayed construction spending and pending home sales plus prints from Johnson & Johnson, Charles Schwab, Halliburton, Kinder Morgan, and Travelers.

Thursday is the heavyweight day with delayed PCE, a revised Q3 GDP read, and a monster earnings slate led by Procter & Gamble, GE, Intel, Abbott, Capital One, and Freeport-McMoRan.

Friday wraps it with consumer sentiment + flash PMI data, plus results from SLB, Hyundai, and Booz Allen.

Also on deck: the Supreme Court hears arguments in the Lisa Cook case on Wednesday, and Davos kicks off Monday with the World Economic Forum. Keep your popcorn ready for Trump’s special address on Wednesday, because that one’s basically guaranteed to move headlines.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com