Good afternoon! If the dollar were a tech stock, traders would be calling it “in a downtrend.” The dollar has slipped against other major currencies this year and is down sharply over the past 12 months, a sign that global investors are getting a little less confident in the US outlook. Even with the slide, policymakers don’t seem especially alarmed.

Behind the move is a cocktail of geopolitical tension, shifting rate expectations, and long-term debt concerns, all dulling the dollar’s classic safe-haven shine while gold and the Swiss franc pick up steam. A softer dollar can help US exporters and inflate overseas profits for multinational companies, but it also makes imports pricier and can nudge borrowing costs higher, leaving markets weighing the trade-offs.

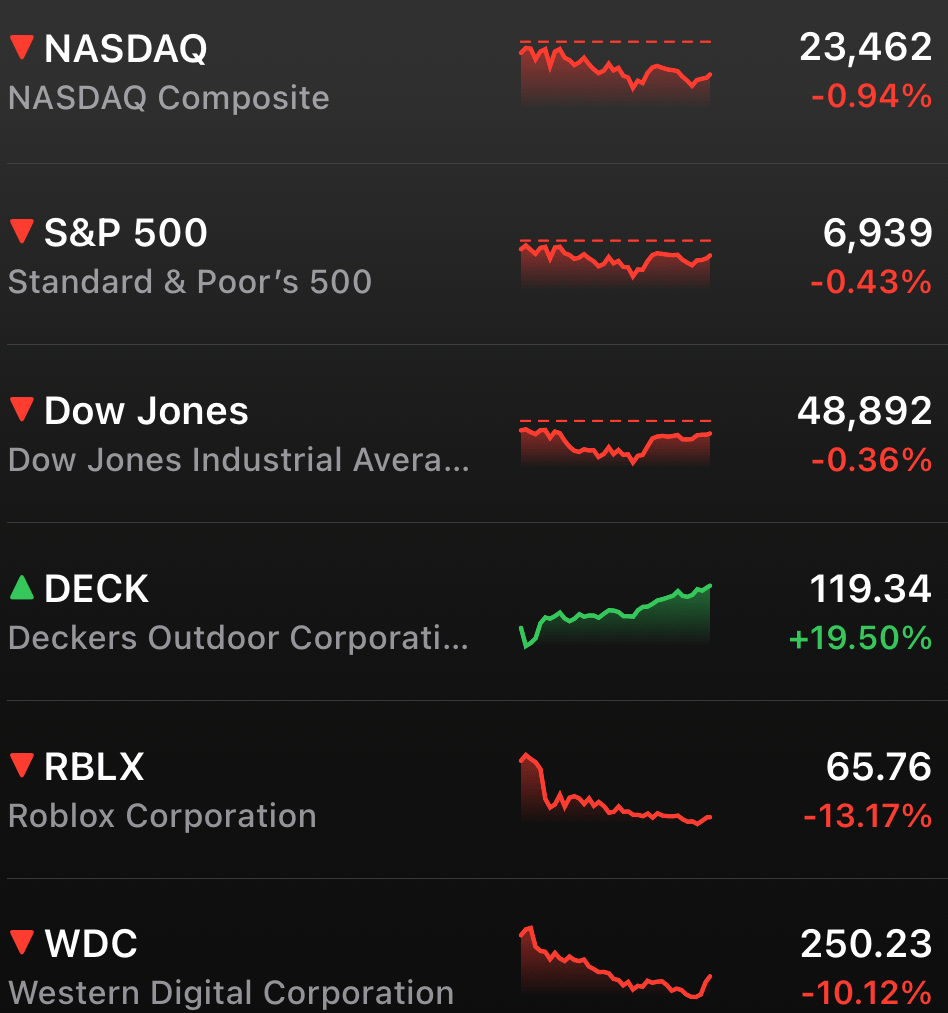

MARKETS

Tech kept pressing the market’s bruise, dragging the S&P 500 down for a third straight day as the Nasdaq 100 and Russell 2000 also slipped. Even with the pullback, January still clocked in as the S&P’s best month since October.

Gold and silver got slammed while the dollar ripped higher after Trump picked Kevin Warsh for Fed chair, spooking markets with a hawkish vibe. Crypto stayed on the back foot too, with Bitcoin and Ethereum extending their rough streaks as shutdown fears lingered.

STOCKS

Winners & Losers

What’s up 📈

Tesla rallied 3.38% as investors warmed up to the idea of a potential tie-up with SpaceX $TSLA

GameStop gained 4.89% after CEO Ryan Cohen said the company is hunting for a “big” acquisition $GME

Singapore-based payment software firm TechCreate continued its wild run, skyrocketing 101.20% in what appears to be a short squeeze $TCGL

Deckers Outdoor surged 19.40% on record revenue driven by strong demand for Hoka and Ugg products $DECK

Verizon jumped 11.83% after issuing upbeat profit and free cash flow forecasts and posting its best quarterly wireless subscriber growth in six years $VZ

What’s down 📉

Gaming stocks slid after Google unveiled an AI tool capable of generating playable, copyrighted-style worlds, pressuring Roblox, Nintendo, Take Two Interactive, and Unity Software $RBLX $NTDOY $TTWO $U

Western Digital fell 10.09% despite beating on sales and earnings $WDC

Aircraft-related names including Bombardier, American Airlines, and

Delta Air Lines slipped after renewed tariff threats on Canadian-made planes $BDRBF $AAL $DAL

SoFi Technologies dropped 6.36% even after reporting an earnings beat, as investors took profits $SOFI

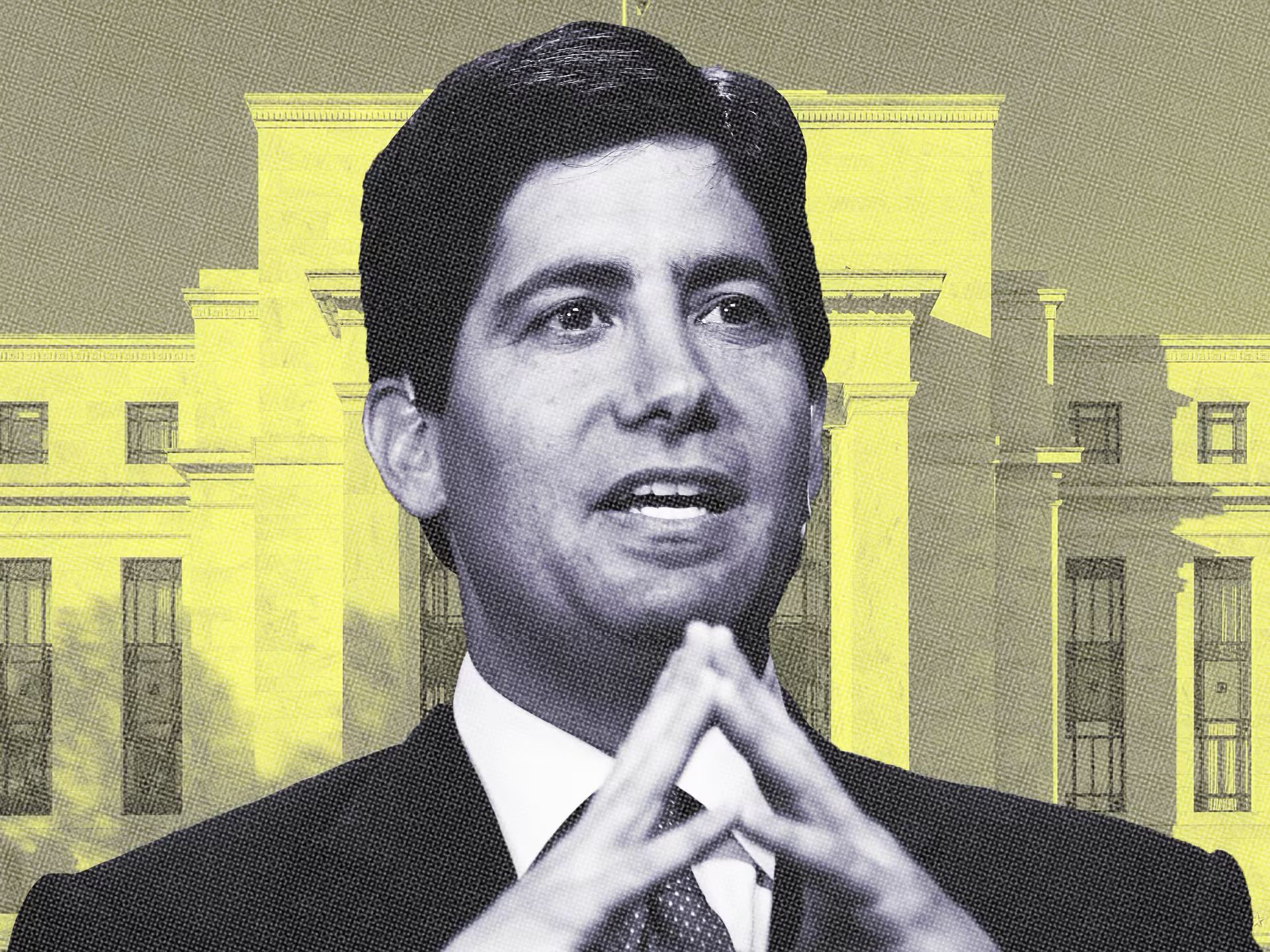

FEDERAL RESERVE

Trump Nominates Kevin Warsh to Lead the Federal Reserve

President Donald Trump has officially tapped Kevin Warsh to become the next chair of the Federal Reserve, ending months of speculation over who would replace Jerome Powell. If confirmed by the Senate, Warsh would take over in mid-May, stepping into one of the most powerful economic roles in the world. Trump praised the pick enthusiastically, saying Warsh could go down as one of the greatest Fed chairs ever.

Markets reacted quickly, with investors weighing what Warsh’s leadership could mean for interest rates, inflation policy, and the Fed’s independence. His reputation for being tough on inflation gave the dollar a lift, while also raising questions about how he would handle political pressure from the White House.

From Wall Street to Constitution Avenue

Warsh’s résumé checks a lot of establishment boxes. He grew up in upstate New York, studied at Stanford University and Harvard Law School, and worked as a banker at Morgan Stanley before joining the Fed. In 2006, at just 35 years old, he became the youngest Fed governor in history.

He was previously in the running for the top job in 2017 but didn’t make the cut. This time around, his mix of policy experience and market credibility helped put him back on the short list.

Inflation hawk or rate-cut convert?

Earlier in his career, Warsh built a reputation as an inflation hawk and a defender of Fed independence. He once argued that any improper political pressure on the central bank should be met with a “strong and forceful rebuke.” That stance earned him credibility among policymakers who worry about keeping politics out of monetary decisions.

More recently, though, his tone has shifted. Warsh has shown more openness to rate cuts and has downplayed concerns that tariffs could drive prices higher. He has also been outspoken about the Fed’s massive balance sheet, calling it bloated and signaling support for shrinking it more aggressively.

The Fed drama isn’t over

Even with a nominee in place, confirmation may not be smooth. Some lawmakers have said they want ongoing investigations related to Powell resolved before moving forward with any Fed leadership changes. Meanwhile, Powell could remain on the Board of Governors even after his term as chair ends, keeping him in the picture longer than expected.

All of that means the political and institutional tug-of-war around the Fed is far from finished. Warsh’s nomination may settle the “who” for now, but the bigger story is whether the central bank can maintain its independence in an environment where monetary policy has become a front-line political issue.

NEWS

Market Movements

🧠 OpenAI IPO Reportedly Targeted for Q4 to Beat Rival AI Startups: OpenAI is reportedly prepping a Q4 IPO to become the first major AI startup to hit public markets, potentially ahead of Anthropic. Reports say it is already talking to banks and could pursue a massive private raise first, with big names circling the round. $AMZN $NVDA $MSFT

🛒 GameStop CEO Ryan Cohen Teases “Genius or Totally Foolish” Big Acquisition: GameStop $GME CEO Ryan Cohen told The Wall Street Journal he is hunting for a major consumer or retail acquisition that could either be brilliant or a disaster. The company’s meme rally cash pile and crypto custody moves are fueling speculation this is about building flexibility for a big swing, with Cohen also increasing his personal stake. $GME

🚀 TechCreate Stock Explodes Nearly 900% With Management Saying “No Idea”: TechCreate $TCGL surged 889% in one session, then kept ripping with another 100% premarket move, even as the company said it has no undisclosed material news to explain it. Volume was insane and the short interest setup looked like gasoline on a spark, turning a tiny float into a violent squeeze machine. $TCGL

👟 Deckers Q3 Blows Past Estimates as Hoka and Ugg Stay Full Price: Deckers $DECK posted record quarterly revenue of $1.96B and adjusted EPS of $3.33, both well ahead of expectations, helped by strong full price demand and a 59.8% gross margin. The company raised full year revenue guidance and said buybacks should exceed $1B for the fiscal year, which is exactly the combo momentum traders love. $DECK

🤖 Tesla’s Business Still Runs on Cars, Even If the Stock Trades on Robots: Tesla $TSLA posted its first annual revenue decline, with 2025 revenue down 3% to $94.8B and automotive revenue down 10% as EV demand softened. Energy revenue climbed to nearly $13B and Tesla is clearing factory space to build Optimus, but the core economics are still mostly cars while the “future story” is expensive. $TSLA

📱 Apple’s Best iPhone Quarter Shows AI Is Not the Upgrade Trigger Yet: Apple $AAPL delivered record iPhone revenue while CEO Tim Cook credited fundamentals like camera, display, performance, and design instead of AI. Data cited suggests most buyers upgrade because their phone is old, broken, or slowing down, not because of new features, which makes AI more of a Wall Street narrative than a checkout line driver right now. $AAPL

🛢️ Exxon Beats Q4 Estimates but Chemicals Turn Into a Red Flag: Exxon Mobil $XOM beat expectations on revenue and EPS and also topped production forecasts, but the stock dipped as investors zeroed in on weak chemical results. The chemical division posted a rare negative quarter versus consensus profit expectations, highlighting a real downturn in that part of the cycle even as the broader company hit the numbers. $XOM

💳 SoFi Beats Q4 on EPS and Revenue as the “All in One Finance App” Story Holds: SoFi $SOFI topped Q4 EPS and revenue estimates and guided Q1 adjusted net revenue around consensus, pushing shares up premarket. The results support the view that the company’s product suite is gaining traction beyond student loan roots, even after a choppy start to 2026. $SOFI

🛰️ Tesla Stock Pops on Reported SpaceX Merger Talk, Not on Earnings: Tesla $TSLA traded higher after reports that a merger with SpaceX is being considered, and the move was more enthusiastic than the market’s reaction to Tesla’s earnings beat. The takeaway is simple: investors are more excited by the idea of adding a high prestige growth asset than watching the core car business deal with weaker revenue and profits. $TSLA

🎮 Gaming Stocks Slide After Google AI Tool Generates Playable Worlds: Google $GOOGL Project Genie spooked the gaming ecosystem after users showed it could generate playable worlds from prompts and even mimic copyrighted style environments. The fallout hit both engines and platforms, with Unity $U, Roblox $RBLX, Take Two $TTWO, and Nintendo $NTDOY selling off as investors priced in new IP and business model risks. $GOOGL $U $RBLX $TTWO $NTDOY

🪙 Bitcoin Heads for Fourth Straight Monthly Drop as Liquidations Surge: Bitcoin $BTC fell 5.53% this month and is on pace for its longest monthly losing streak since 2018, with heavy liquidations and big ETF outflows in the last 24 hours. Commentary in your text points to a risk off backdrop, with some buyers stepping in near $84,000 while bigger passive demand is cited lower. $BTC

🧊 Altcoins Keep Bleeding as Red Monthly Candles Stack Up: Ethereum $ETH is down more than 8% over 30 days and is tracking for a fifth straight negative month, while XRP $XRP, Solana $SOL, and Dogecoin $DOGE are down 5% to 7% and heading for four straight red months. Market pricing in your text implies very low odds of a sharp rebound soon, with macro and rate cut expectations still doing the damage. $ETH $XRP $SOL $DOGE

COMMODITIES

Gold and Silver Post Worst One-Day Drop in Decades as Dollar Surges

Gold and silver just had the kind of day usually reserved for meme stocks and crypto blowups. Silver plunged more than 30% at one point Friday, marking its sharpest drop since 1980, while gold tumbled over 10% intraday in its worst single-session slide in decades. The violent reversal followed months of relentless gains that had pushed both metals to record highs.

The trigger wasn’t just profit-taking. Reports that President Donald Trump would nominate former Fed governor Kevin Warsh to lead the Federal Reserve jolted currency and rate expectations, sending the US dollar sharply higher and undercutting the “debasement trade” that had fueled metals’ rally.

From safe haven to forced selling

For months, investors had piled into gold and silver on fears about inflation, geopolitical tensions, and the long-term value of the dollar. That trade became increasingly crowded, with fast-money speculators and momentum chasers helping push prices nearly straight up.

When sentiment flipped, the exit got crowded fast. Metals that are normally seen as defensive suddenly behaved like high-beta risk assets, as traders rushed to lock in gains and cut exposure all at once.

Leverage turned a pullback into a plunge

Another key accelerant was the heavy use of leverage in exchange-traded products tied to metals futures. Funds offering amplified daily exposure to silver had grown popular during the rally, which works beautifully on the way up but forces mechanical selling on the way down.

As futures prices slid, those leveraged vehicles had to rebalance by dumping more contracts near the close, adding fuel to an already fast-moving fire. The result was a cascade effect that made an overdue correction look more like a liquidation event.

Hawkish vibes, stronger dollar

Warsh’s reputation as someone more focused on inflation than on aggressive rate cuts helped calm fears that the Fed would go soft on prices. That perception gave the dollar one of its strongest days in months, making dollar-denominated assets like gold and silver less attractive.

In short, the same macro narrative that helped drive metals to extremes suddenly reversed. A stronger dollar and renewed confidence in monetary discipline pulled the rug out from under a trade built on currency anxiety.

Even after the plunge, both metals remain well above levels from earlier in the year. But Friday was a blunt reminder that when a crowded macro trade meets leverage and a narrative shift, “safe haven” can turn into “sell first, ask questions later.”

CALENDAR

On The Horizon

Tomorrow

January went out like a season finale. Big swings, rate drama, and nonstop headlines kept traders glued to their screens. Now February walks in with a packed calendar and basically says, hope you’re well rested.

Next week revolves around jobs data, building toward Friday’s January jobs report, the one print that can flip rate-cut expectations in seconds. At the same time, global central banks are stepping up: the Reserve Bank of Australia decides Tuesday, followed by the European Central Bank and the Bank of England on Thursday.

Monday earnings: Palantir Technologies, Walt Disney, NXP Semiconductors, Tyson Foods, Teradyne

Tuesday earnings: Advanced Micro Devices, Merck, PepsiCo, Amgen, Pfizer, Eaton, Nintendo, Emerson Electric, TransDigm Group, Mondelez International, Chipotle Mexican Grill, Electronic Arts, PayPal, Corteva, Take-Two Interactive, Super Micro Computer, Foot Locker

Wednesday earnings: Alphabet, Eli Lilly, AbbVie, Novartis, Novo Nordisk, Uber, Qualcomm, UBS, Boston Scientific, Arm Holdings, CME Group, GSK, Snap

Thursday earnings: Amazon, Shell, Sony, ConocoPhillips, BNP Paribas, Bristol-Myers Squibb, KKR, Intercontinental Exchange, Barrick Mining, Cigna, Fortinet, Roblox, Ares Management, Rockwell Automation, ArcelorMittal, Estée Lauder, Reddit, Atlassian, Blue Owl Capital, Illumina, Affirm, Peloton

Friday earnings: Toyota, Under Armour, Philip Morris International, Société Générale, Ørsted, Centene, AutoNation

Between global rate calls, nonstop earnings, and a make-or-break jobs report, next week isn’t bringing calm. It’s bringing catalysts.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com