Good afternoon! The US trade deficit shrank fast in October, falling nearly 40% from the prior month to its lowest level since 2009. Exports jumped while imports slipped, giving Q4 GDP a quiet tailwind economists didn’t see coming.

But don’t call it a trend yet. The move was driven by gold exports, tariff-driven swings in drug imports, and rising AI-related equipment purchases, with more trade uncertainty looming as the Supreme Court weighs the legality of Trump-era tariffs.

MARKETS

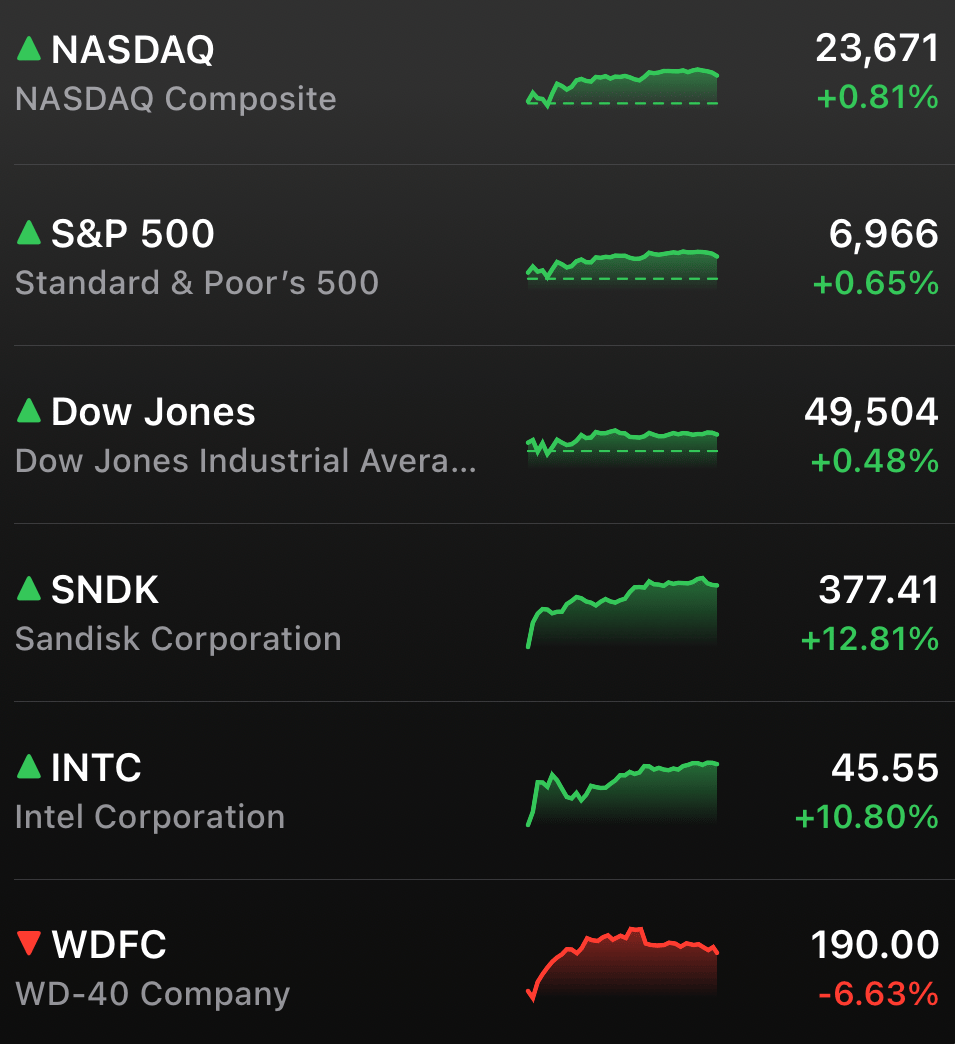

Markets kicked off the year like they’ve got momentum on their side. The S&P 500, Dow, and Russell 2000 all finished the week at fresh record highs, while bond markets quietly set up a friendlier backdrop for banks as short-term yields fell faster than long-term ones.

Friday’s jobs report threaded the needle. Hiring came in lighter than expected, but unemployment dropped, calming fears of an economic slowdown without forcing the Fed’s hand. Traders now see almost no chance of a January rate move, leaving stocks free to focus on earnings and whatever comes next.

STOCKS

Winners & Losers

What’s up 📈

CG Oncology surged 29.26% after pulling forward publication of Phase 3 bladder cancer data to the first half of this year $CGON

LoanDepot jumped 18.85% after President Trump ordered a $200B mortgage bond purchase aimed at lowering rates $LDI

UWM Holdings climbed 13.69% on the same mortgage bond push boosting lender sentiment $UWMC

Opendoor Technologies popped 13.14% as lower mortgage rate expectations reignited housing demand optimism $OPEN

Sandisk spiked 12.87% following a wave of Wall Street price target hikes $SNDK

Intel rallied 10.70% after Trump praised CEO Lip-Bu Tan and highlighted government investment $INTC

Vistra gained 10.50% after announcing an AI-related power deal with Meta $VST

Rocket Companies rose 9.60% as mortgage lenders broadly caught a bid $RKT

Lennar advanced 8.85% on improving housing affordability expectations $LEN

Lam Research climbed 8.66% after Goldman Sachs raised its price target amid chip equipment strength $LRCX

What’s down 📉

WD-40 slid 6.63% to a 52-week low after missing Q1 earnings expectations $WDFC

Rio Tinto fell 5.04% on reports of early-stage merger talks with Glencore that rattled investors $RIO

Under Armour dropped 5.78% as tariff-sensitive retail names sold off after the Supreme Court declined to rule on Trump-era tariffs $UA

Deckers Outdoor retreated 3.37% amid the same tariff overhang $DECK

Mattel slipped 3.11% as trade uncertainty weighed on consumer goods stocks $MAT

General Motors declined 2.70% after flagging more than $7B in Q4 charges tied to EV cutbacks and China exposure $GM

ENERGY / AI

Meta Locks In Nuclear Power to Fuel Its Prometheus AI Supercluster

AI’s biggest constraint isn’t chips anymore. It’s electricity.

Meta is going nuclear to solve that problem, signing long-term power agreements tied to its Prometheus AI supercluster in Ohio. The company is partnering with Vistra, Oklo, and TerraPower to secure massive amounts of always-on energy for the next decade and beyond. Investors liked the signal, and nuclear-linked stocks moved fast.

The Power Problem Nobody Can Ignore

Prometheus is expected to come online in 2026, and Meta already knows today’s grid won’t cut it tomorrow. These deals are projected to add about 6.6 gigawatts of power by 2035, a scale that puts AI infrastructure in the same league as small states.

Vistra will extend and boost output from existing nuclear plants, while Oklo and TerraPower represent next-gen reactors that could directly power Meta’s data centers later this decade.

AI’s New Arms Race Is About Megawatts

The shift is telling. Hyperscalers are realizing that compute scales fast, but power does not. Nuclear offers carbon-free baseload energy, long-term price stability, and insulation from grid volatility, all things wind and solar struggle to guarantee at AI scale.

Meta isn’t alone. Google, Amazon, and Microsoft are all circling nuclear partnerships, quietly turning a once sleepy energy corner into strategic AI infrastructure.

Think Long Term, Not Next Quarter

Critics point out nuclear projects take years to deliver and won’t ease near-term grid strain. Meta seems fine with that. This is a 2030s problem being solved now.

By locking in nuclear supply early, Meta is betting that future AI dominance won’t be decided by models alone, but by who controls the power to run them. The market reaction suggests investors are starting to see it the same way.

NEWS

Market Movements

🧠 Apple CEO succession talk is narrowing around hardware chief John Ternus: Internal chatter has Ternus increasingly viewed as the top in-house candidate to eventually succeed Tim Cook. Cook isn’t leaving imminently, but reports suggest Apple is accelerating planning as he looks to scale back day-to-day demands. Prediction markets have also swung heavily toward Ternus.

🩺 OpenAI rolls out ChatGPT Health as AI becomes a second opinion in medicine: OpenAI launched a health-focused experience inside ChatGPT that lets users connect records and wearable data for more personalized guidance. The company says tens of millions of health questions hit ChatGPT daily, showing how mainstream the behavior is. Doctors are already using AI too, from admin tasks to risk prediction and diagnostic support.

🏠 Trump’s $200B mortgage bond plan sparks a housing stock surge: Trump said he wants massive mortgage bond purchases to push mortgage rates lower, and the market instantly priced in “housing thaw.” Rocket $RKT, UWM $UWMC, LoanDepot $LDI, and Opendoor $OPEN jumped hard, with homebuilders catching a bid too. The real question is impact: economists are split on whether it moves rates a little or enough to matter.

🚗 GM takes a $6B hit as EV optimism meets reality: General Motors $GM disclosed a massive Q4 charge tied to an EV strategy reset as demand cooled and incentives faded. The company also flagged an additional China-related charge, underscoring pressure beyond North America. The broader message: the EV transition is still happening, just slower and pricier than the marketing decks promised.

✈️ Southwest gets a rare double-upgrade as Wall Street sees a 2026 earnings rebound: JPMorgan flipped from bearish to bullish on Southwest $LUV and raised its target dramatically. The bank argues Southwest has a real path to much stronger 2026 earnings, resetting how the market should value the stock. Investors are also watching new revenue levers like assigned seating and premium tiers.

🏭 Intel spikes after Trump publicly cheers CEO Lip-Bu Tan: Intel $INTC jumped after Trump praised leadership and highlighted government backing, showing how political alignment is now part of the thesis. Investors are still focused on one key swing factor: can Intel’s foundry business land more external customers. Washington support may help, but execution still decides the outcome.

💊 Amazon Pharmacy expands GLP-1 access with Novo’s new Wegovy pill delivery: Amazon $AMZN will offer home delivery for Novo Nordisk’s oral Wegovy, making weight-loss treatment easier to access without injections. Novo is pushing harder into retail and telehealth channels as competition heats up with Eli Lilly $LLY. The pill’s edge is convenience and price, especially for patients priced out of injectables.

⚖️ Tariff stocks whip around after the Supreme Court delays clarity: Markets briefly stumbled when the court declined to issue a ruling on tariffs, catching traders positioned for relief. Tariff-sensitive names swung fast as “soon” turned into “unknown timeline.” The move showed how much tariff optimism is already baked into prices.

🪙 Bitcoin chops sideways as JPMorgan sees early signs ETF selling is stabilizing: Bitcoin $BTC has stayed rangebound even with heavy multi-day ETF outflows. JPMorgan says flow patterns suggest the worst of the de-risking may be done, hinting at stabilization rather than panic. Other analysts still want a clean breakout level before calling the next leg.

💾 Sandisk keeps ripping as Wall Street reframes storage as an AI bottleneck trade: Sandisk $SNDK jumped again after firms raised price targets and doubled down on AI-driven storage demand. Training and inference are turning “boring storage” into a pick-and-shovel infrastructure story. Momentum is doing the rest.

ECONOMY

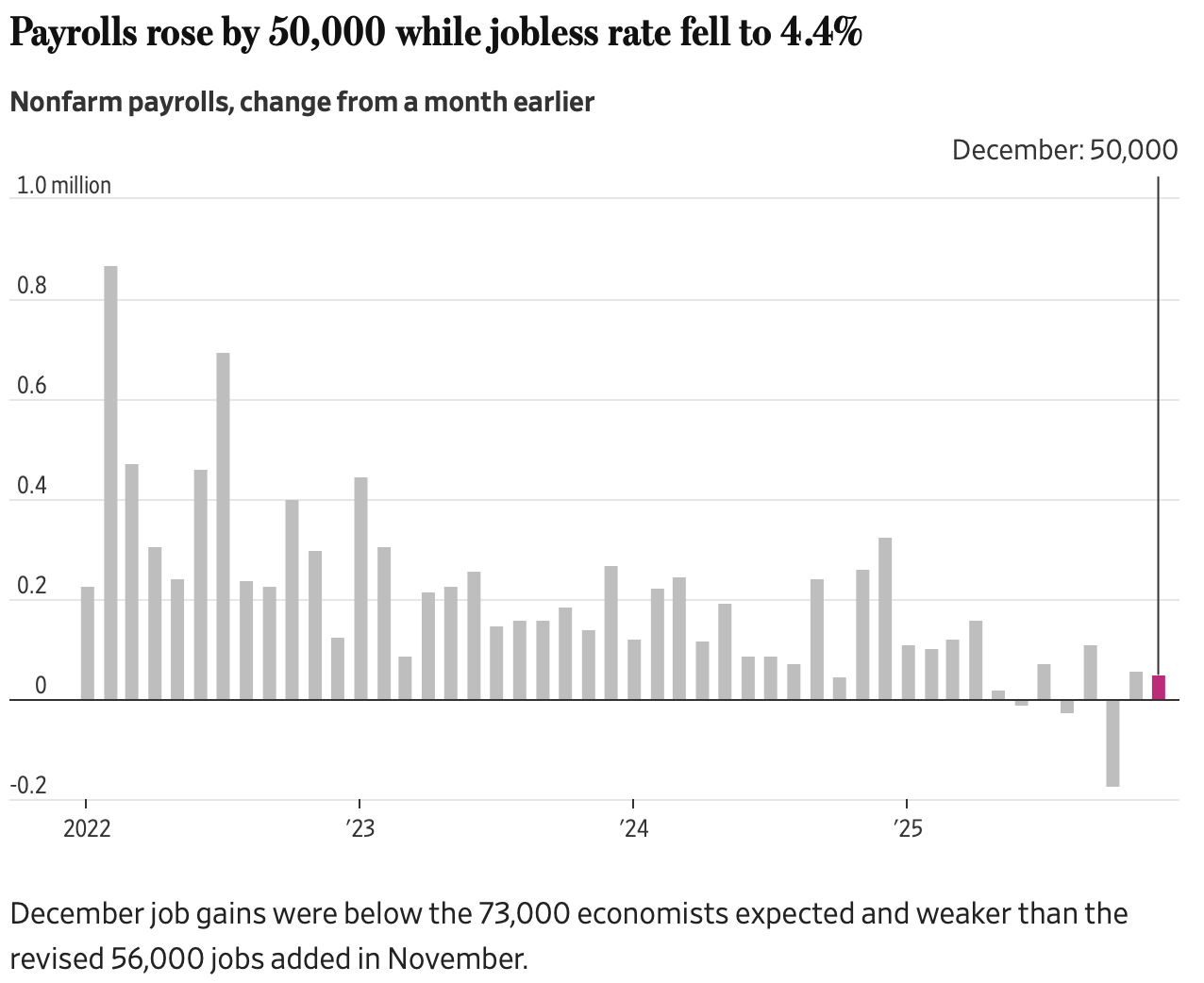

Jobs Miss the Forecast, Unemployment Falls Anyway

December’s jobs report delivered a classic case of economic whiplash.

Payroll growth came in soft, with employers adding just 50,000 jobs versus expectations closer to 70,000. At the same time, the unemployment rate unexpectedly slid to 4.4%, beating forecasts and giving the headline number a healthier glow than the hiring data underneath.

Fewer Jobs, Better Optics

Most of the hiring that did happen was clustered in services. Restaurants and bars led the way, followed by healthcare and social assistance, while retail shed jobs and government payrolls barely moved.

It’s a pattern that’s becoming familiar. The unemployment rate keeps drifting lower, but job creation itself looks increasingly narrow and uneven.

The Quiet Stall Beneath the Surface

Zoom out, and 2025 tells a much weaker story. The U.S. added just 584,000 jobs for the entire year, the slowest pace outside a recession in more than two decades. Nearly all of that growth happened early in the year, before hiring momentum faded amid tariff uncertainty and slowing demand.

Healthcare and social assistance more than carried the total, masking job losses across manufacturing, transportation, and other blue-collar sectors. Manufacturing’s share of total employment has now slipped below 8%, a record low.

Markets Hear “Steady,” Not “Strong”

Investors took the report as reassurance, not a warning. The falling unemployment rate eased pressure on the Federal Reserve to cut rates quickly, and markets leaned further into the idea that policy will stay on hold in January.

The takeaway is less about strength and more about stasis. The labor market isn’t breaking, but it isn’t reaccelerating either. Hiring and separations are nearly balanced, job switching is slowing, and wage pressure is cooling. For now, that’s just stable enough for the Fed to wait and just weak enough to keep rate-cut chatter alive later this year.

CALENDAR

On The Horizon

Tomorrow

Next week is basically a macro obstacle course. The big moment comes Tuesday with December CPI, the last inflation check before the Fed’s January 28 decision, while a parade of Fed speakers throughout the week will try to shape expectations now that the labor market looks less overheated.

There’s more under the hood too. PPI, retail sales, the Beige Book, jobless claims, and industrial production all drop in quick succession, giving markets plenty to chew on. Earnings season also kicks off, led by the big banks, turning the week into a full-blown test of both inflation nerves and corporate confidence.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com