Nvidia $NVDA ( ▲ 3.08% ) and TSMC $TSM ( ▼ 0.77% ) ticked higher in premarket trading after Reuters reported that Nvidia has asked its key manufacturing partner to ramp production of its H200 AI chips, citing stronger-than-expected demand from China. The request comes just weeks after the U.S. signaled it would allow Nvidia to ship its top Hopper-generation processors to China, with a portion of proceeds flowing back to the U.S. government.

China demand is bigger than expected

According to the report, Chinese companies have already placed orders for more than 2 million H200 chips for 2026, roughly triple the ~700,000 units Nvidia currently has in inventory. At an estimated selling price of around $27,000 per chip, fulfilling that demand could translate into more than $54 billion in incremental revenue, assuming regulatory approvals move forward.

Reuters previously reported that Nvidia plans to begin shipping these GPUs to China before the Lunar New Year holiday, which starts February 17, 2026. Chinese firms, largely shut out of Nvidia’s most advanced chips for much of 2025, are reportedly eager to secure supply as soon as restrictions ease.

Supply, geopolitics, and execution risk

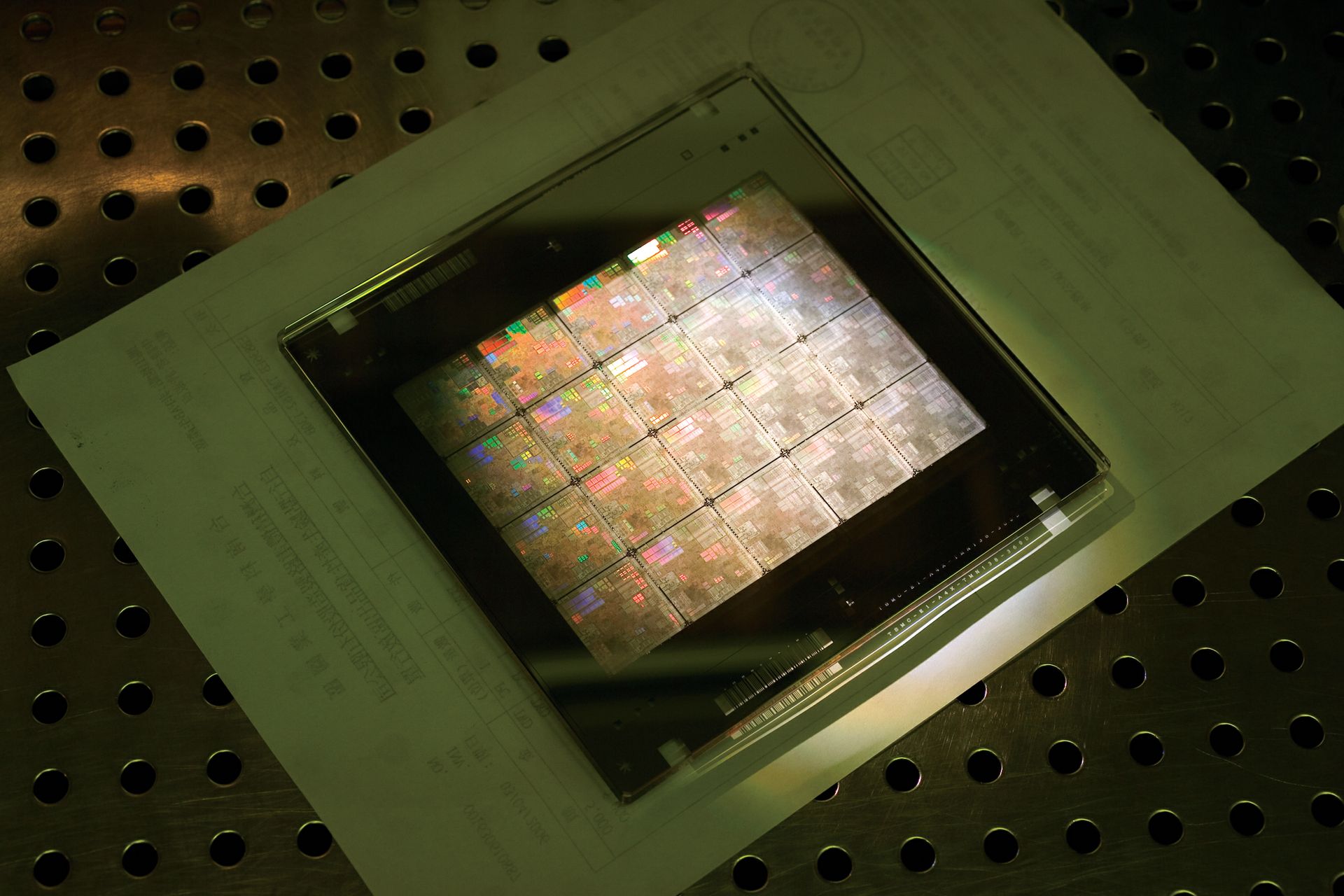

Whether Nvidia can fully capitalize on this demand will depend on two key factors: TSMC’s ability to scale production quickly and Chinese regulators approving purchases. Nvidia’s strong 2025 performance came despite limited access to China, making this potential reopening of the market a major swing factor for future growth.

During its Q3 earnings call, Nvidia CEO Jensen Huang said the company had proactively locked in supply, noting that Nvidia is “working with the largest company in the world” across its manufacturing partners. Huang’s close relationship with TSMC leadership has been well documented, including a recent visit to Taiwan where he met with CEO C.C. Wei and publicly praised the chipmaker as “the pride of the world.”

If production ramps smoothly, this could mark one of the most significant re-entries of U.S. AI hardware into the Chinese market yet and a meaningful new leg for Nvidia’s revenue story heading into 2026.