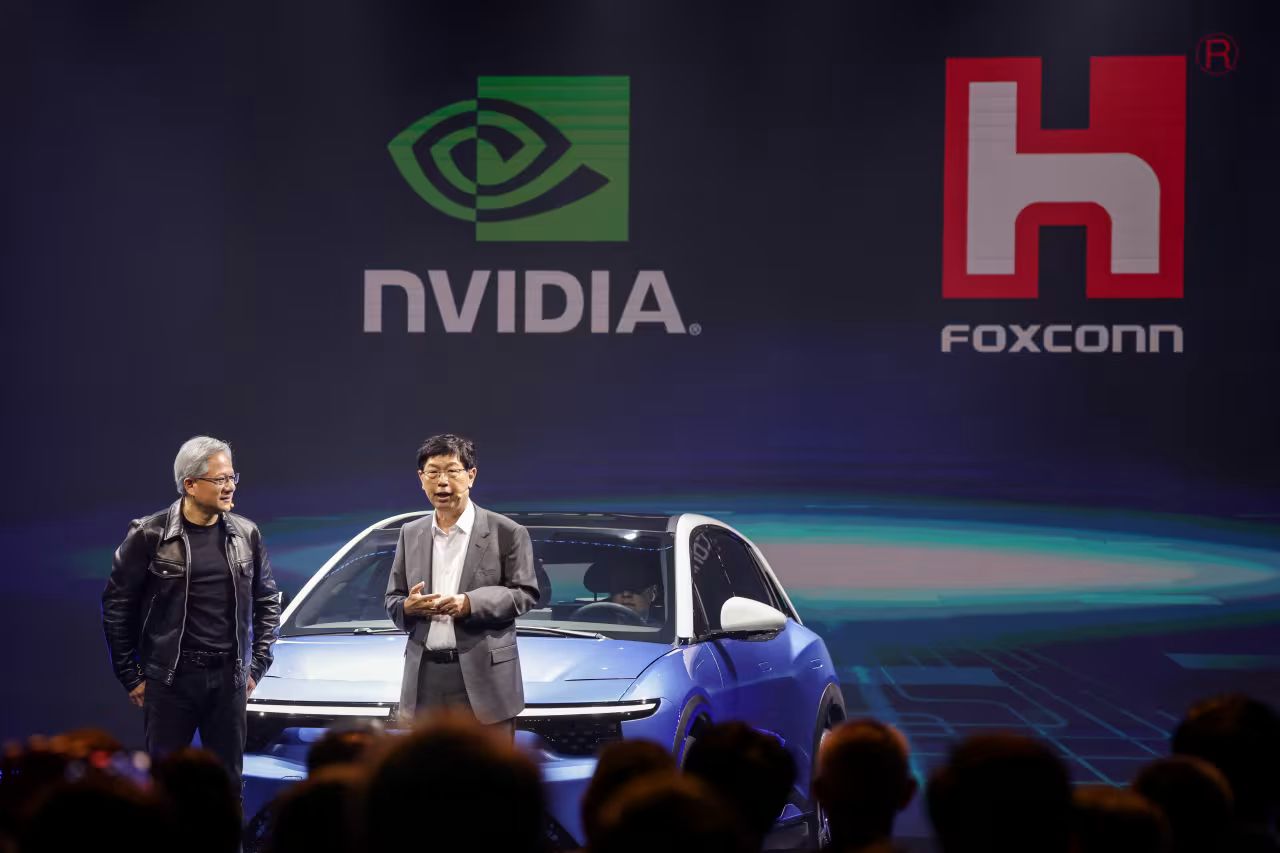

Nvidia $NVDA ( ▼ 1.33% ) is catching a bid after a brutal five-day slide, and the spark came from an unexpected place: Foxconn.

The manufacturing giant, formally known as Hon Hai Technology Group, reported January sales up 35.5% year over year and pointed directly to its cloud and networking division as the main growth driver. Translation: more data center gear, and specifically more AI infrastructure, is moving out the door.

AI Racks Are the Key Clue

Foxconn did not just post strong numbers. It explicitly said shipments of AI racks are continuing to increase and that this quarter’s seasonal performance should beat the typical range of the past five years.

That matters because AI racks are the physical backbone of large model training and inference clusters. These systems are typically packed with high-end GPUs, networking gear, memory, and power infrastructure. When rack shipments rise, it usually means hyperscalers and AI labs are still in aggressive buildout mode.

And guess who sits at the center of most of those racks? Nvidia.

Why This Helps Nvidia’s Narrative

After Nvidia’s recent pullback, investors were starting to worry about demand digestion or a pause in AI spending. Foxconn’s update pushes back against that fear.

If server manufacturers are seeing accelerating AI rack shipments, it suggests that orders for GPU-heavy systems are still flowing. That reinforces the idea that the AI data center buildout is not stalling, just moving through normal volatility.

This is not a direct read-through on one quarter of Nvidia revenue, but it is a strong signal that the broader AI hardware cycle still has momentum.

This Is Bigger Than One Supplier

We have seen this movie before. Earlier in the year, Micron surged after Foxconn reported better-than-expected quarterly sales, because memory is another core component inside AI servers.

When Foxconn talks, the entire AI supply chain tends to listen. It sits at a crucial junction between chip designers, component suppliers, and end customers building massive AI clusters.

So today’s Nvidia rebound is not just a technical bounce. It is the market reacting to fresh evidence that AI infrastructure demand, especially for dense GPU racks, is still very real.