Good afternoon! Nasdaq is flirting with an all-nighter. The exchange asked regulators to allow 23-hour weekday trading starting in late 2026, adding an overnight session from 9pm to 4am ET so investors can trade on late-breaking news instead of waiting for the opening bell.

Wall Street is not thrilled. Critics warn nonstop trading could thin liquidity, boost volatility, and leave less time to digest earnings, with Wells Fargo calling the idea “the worst thing in the world.” Still, with the NYSE exploring longer hours and apps like Robinhood already offering night trading, markets may be heading toward a sleepless future anyway.

MARKETS

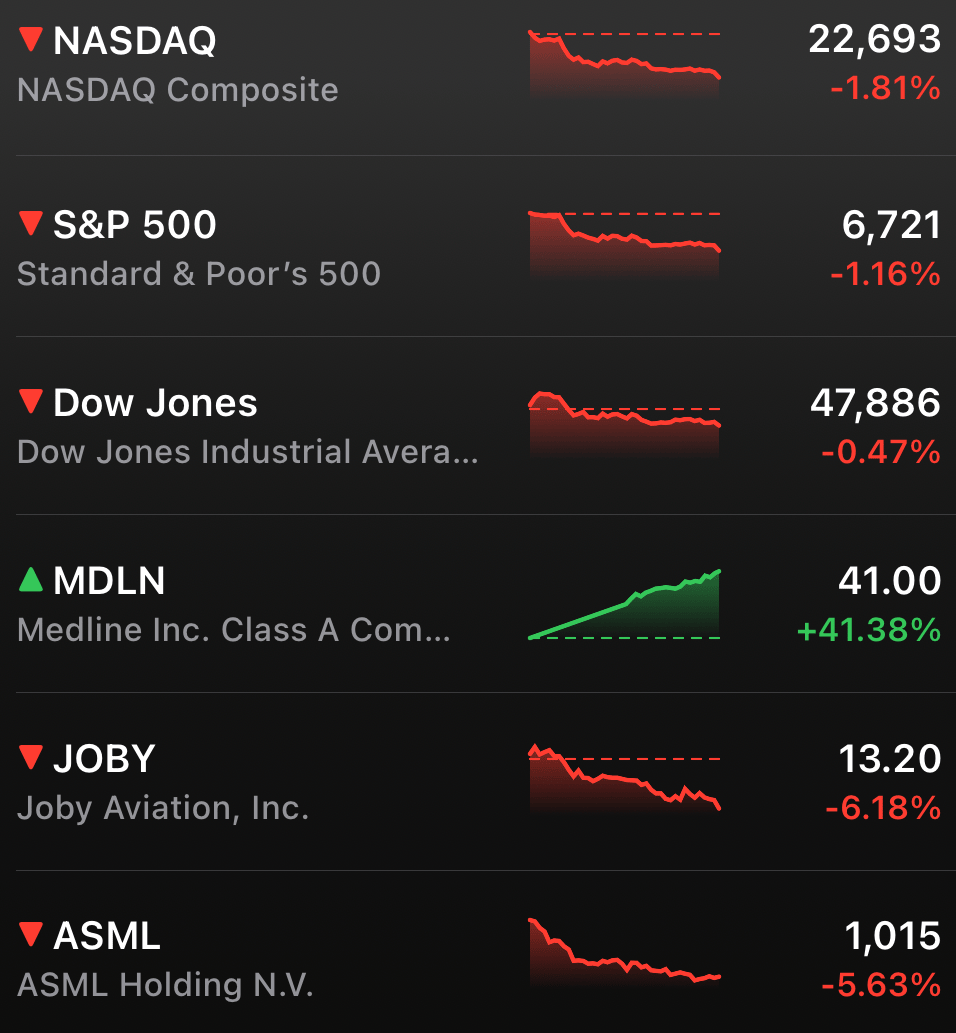

Stocks slid again Wednesday as the AI trade continued to cool, pulling all three major indexes lower. The S&P 500 fell more than 1%, the Nasdaq 100 dropped nearly 2%, and both are now on track for their worst month since March.

Tech led the selloff after reports that Blue Owl would not fund Oracle’s $10 billion Michigan data center reignited AI credit concerns. Oracle pushed back, but the damage was done, with the Magnificent Seven and AI-linked names like Broadcom, AMD, and CoreWeave sliding.

STOCKS

Winners & Losers

What’s up 📈

Medline skyrocketed 41.38% after its IPO, marking one of the biggest market debuts in years. $MDLN

DBV Technologies jumped 25.42% on positive Phase 3 trial results for its peanut allergy treatment in children. $DBVT

Spirit Airlines popped 15.00% after reviving merger talks with Frontier, which would create the fifth-largest U.S. airline by passenger miles. $SAVE

Udemy soared 12.66% after agreeing to a $2.5 billion merger with Coursera, combining two major online education platforms. $UDMY

Hut 8 surged 8.98% after signing a $7 billion deal to lease a Louisiana data center, accelerating its shift from crypto mining to AI infrastructure. $HUT

Texas Pacific Land climbed 7.59% after announcing an AI data center partnership backed by a $50 million investment on its West Texas land. $TPL

What’s down 📉

Joby Aviation sank 6.11% after announcing plans to double air taxi production to four aircraft per month by 2027. $JOBY

ASML slid 5.63% after reports China completed a prototype EUV chip fab, raising concerns about future competition. $ASML

Paramount Skydance fell 5.42% after Warner Bros. Discovery urged shareholders to reject its takeover bid in favor of a Netflix deal. $PSKY

Oracle dropped 5.39% after Blue Owl Capital pulled out of a planned $10 billion OpenAI data center project amid debt concerns. $ORCL

Brown-Forman dipped 5.16% after Citi downgraded the stock to Sell and cut its price target. $BF.B

Lennar slid 4.53% following a Q4 earnings miss and weaker-than-expected guidance. $LEN

AI

OpenAI in Talks With Amazon for $10B Investment and AI Chip Partnership

OpenAI may be adding another giant to its already crowded cap table. According to Bloomberg, the company is in early talks to raise at least $10 billion from Amazon $AMZN ( ▼ 5.56% ) , a deal that could value OpenAI north of $500 billion and deepen its relationship with Amazon Web Services.

The discussions are still preliminary, but the structure is what stands out. Alongside fresh capital, OpenAI would begin using Amazon’s in-house Trainium AI chips, marking a potential shift in how it sources the massive compute power needed to train and run its models.

Amazon’s Chip Moment

For Amazon, this would be a long-awaited breakthrough for its semiconductor ambitions. Nvidia $NVDA ( ▲ 7.87% ) still dominates AI hardware, but hyperscalers are increasingly pushing their own chips to loosen that grip. Trainium is Amazon’s bet that cheaper, tightly integrated silicon can win over developers at scale.

Landing OpenAI would instantly elevate Trainium’s credibility and help Amazon close the AI perception gap with Microsoft $MSFT ( ▲ 1.9% ) , which has benefited from its deep ties to the ChatGPT maker.

OpenAI Spreads Its Bets

For OpenAI, the talks signal something just as strategic: diversification. Microsoft still owns a significant stake following OpenAI’s recent restructuring, but the company has been clear it does not want to rely on a single backer or compute provider.

Last month, OpenAI agreed to buy $38 billion of cloud capacity from AWS over seven years, largely powered by Nvidia chips. Adding Trainium into the mix would give OpenAI more leverage on pricing, flexibility, and supply as its compute needs continue to explode.

The AI Arms Race, Up Close

This is less about one funding round and more about the next phase of the AI arms race. Capital, chips, and cloud infrastructure are converging, and the biggest players are racing to lock in strategic partners. If the deal comes together, it would further cement OpenAI’s role as the gravitational center of the AI ecosystem.

NEWS

Market Movements

💾 Micron Blows the Roof Off Estimates: Micron crushed earnings and issued guidance that topped even the most bullish forecasts as memory demand outpaces supply. The report reignited optimism across the entire storage space. $MU $STX $WDC

🪙 Bitcoin Trades Like a Risk Asset: Bitcoin’s correlation with unprofitable tech stocks just hit record levels, undermining its “digital gold” narrative. For now, crypto is moving with sentiment, not fundamentals. $BTC $IBIT

🏗 Oracle’s AI Buildout Hits a Funding Snag: Blue Owl reportedly walked away from financing a $10B Michigan data center tied to OpenAI workloads, spooking investors. Oracle pushed back, saying the project is on track with a different equity partner. $ORCL $OWL

🗳 Musk’s Politics Test Tesla Investors’ Patience: A new survey shows most Tesla shareholders want Elon Musk focused on the company, not politics. History suggests markets agree when distractions pile up. $TSLA

🇨🇳 China Takes Aim at EUV Monopoly: Reuters reports China has built a prototype EUV chip fab, a potential long-term threat to ASML’s dominance in advanced lithography. Even partial success could reshape the global semiconductor balance. $ASML $NVDA

✈️ Joby Shifts From Flying to Scaling: Joby Aviation plans to double air taxi production to four aircraft per month by 2027 as it moves from prototypes toward real manufacturing. A deeper partnership with Toyota signals a focus on execution, not demos. $JOBY $TM

🤖 Waymo Nears $100B Valuation: Alphabet’s self-driving unit is in talks to raise over $15B, cementing its lead in commercial robotaxis with real revenue and fully driverless operations. The funding helps Alphabet reduce the burden of its costly “Other Bets.” $GOOGL

🚗 California Clips Tesla’s Autonomy Language: Regulators ruled Tesla misled consumers with terms like “Autopilot” and “Full Self-Driving,” giving the company 60 days to revise its marketing. Failure to comply could temporarily block Tesla from selling cars in its largest U.S. market. $TSLA

🎮 Roblox Tries to Win Back Russia: Roblox says it’s willing to limit features and revise content moderation to lift a ban in one of its top five markets. The move highlights how valuable the region is despite rising regulatory risk. $RBLX

☢️ Oklo Bets on Plutonium Power: The nuclear startup is pushing to use leftover weapons-grade plutonium as fuel for small reactors, reframing waste as an energy solution. Investors are buying the vision despite zero revenue and major regulatory hurdles. $OKLO

🛒 Discount Stores Go Mainstream: Walmart, Dollar General, Dollar Tree, and Aldi are pulling in shoppers from both ends of the income ladder as high prices push even wealthy consumers toward bargains. Nearly 28% of high-income households now shop discount, turning a recession trade into a structural shift. $WMT $DG $DLTR

MARKETS

Robinhood Pushes Deeper Into Prediction Markets as Investing Starts to Look Like Betting

The line between investing and gambling is getting thinner, and Robinhood $HOOD ( ▲ 13.95% ) is leaning into it. The trading app is expanding its prediction markets business with new features that let users place parlay-style bets on NFL games, player performances, and eventually custom combos spanning multiple outcomes, all inside a brokerage app.

The timing is not random. As younger investors struggle to build wealth the traditional way, markets are filling up with meme assets, leveraged products, and now sports-style betting wrapped in financial language. Stocktwits cofounder Howard Lindzon calls this the “degenerate economy,” where it has never been easier to trade, and never harder to stay invested.

From Stock Picks to Parlays

Robinhood says prediction markets are already its fastest-growing revenue line, with more than 1 million users trading 11 billion contracts since launch. The company is now doubling down by adding preset NFL combos, live player props, and eventually custom bets that look a lot like parlays by another name.

Robinhood executives argue they are simply meeting users where demand already exists. Critics counter that investing is drifting further away from balance sheets and fundamentals and closer to entertainment and impulse.

AI Joins the Party

Alongside betting tools, Robinhood is also rolling out Cortex, an AI-powered assistant that helps users generate trade ideas, analyze markets, and execute orders. The company frames it as an information tool, not an advisor, but the combination of AI guidance and always-on betting is hard to ignore.

Big picture, Robinhood is betting that the future of retail investing is interactive, real-time, and closer to sports betting than long-term portfolio building. Whether that is financial innovation or just a shinier slot machine depends on who you ask.

CALENDAR

On The Horizon

Tomorrow

It’s been a packed week for macro watchers, and tomorrow is not letting up.

Investors will get a two-for-one update on the Fed’s favorite stress points, November CPI and weekly jobless claims, offering a final read on inflation for the year alongside a fresh snapshot of the labor market.

The data lands just as the Fed gears up for its late January meeting, giving Jerome Powell more to chew on before rate decisions come back into focus.

On the corporate side, earnings stay busy too, with reports from Nike, FedEx, KB Home, BlackBerry, CarMax, Accenture, Cintas, and Birkenstock set to drop.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com