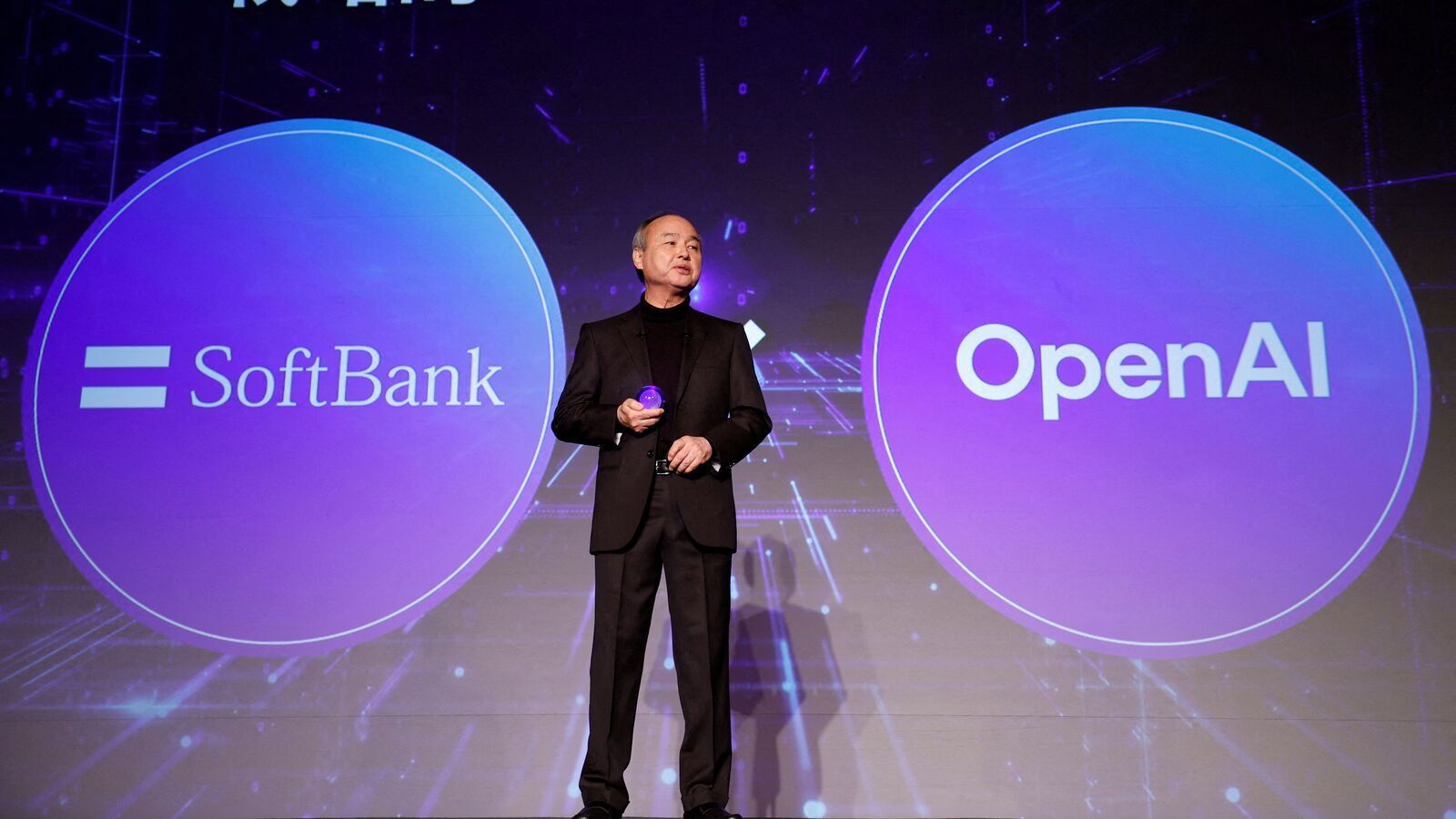

SoftBank $SFTBY ( ▼ 6.65% ) posted its fourth consecutive profitable quarter, fueled largely by a sharp rise in the value of its OpenAI stake. The Japanese conglomerate reported net profit of 248.6 billion yen, about $1.6 billion, reversing a sizable loss from the same period a year ago.

The key driver was a $4.2 billion valuation gain tied to its investment in OpenAI.

OpenAI Becomes a Core Asset

SoftBank has invested roughly $34.6 billion in OpenAI so far, giving it about an 11% stake in the company. According to analysts, OpenAI now accounts for roughly 30% of SoftBank’s net asset value.

Since the initial investment, SoftBank says it has recorded nearly $19.8 billion in cumulative gains from OpenAI alone. The company is reportedly considering investing up to $30 billion more in a funding round that could value OpenAI at as much as $830 billion.

Raising Cash to Double Down on AI

To build additional firepower, SoftBank $SFTBY has been selling assets and borrowing aggressively. The company sold about $12.7 billion worth of T-Mobile shares in the second half of 2025 and an additional $2.3 billion early this year.

It also took on significant leverage, borrowing through a margin loan backed by SoftBank Corp. shares. Management is clearly positioning the firm to continue backing OpenAI and other AI focused ventures.

Vision Fund Mixed, AI Leads the Way

While OpenAI and other second Vision Fund investments drove a $6.5 billion fair value increase during the quarter, the first Vision Fund posted a $4.1 billion loss, largely due to declines in holdings like Coupang $CPNG ( ▼ 0.88% ) and DiDi.

Even so, SoftBank’s growing exposure to OpenAI has become the dominant narrative for investors. The stock has nearly doubled over the past year as traders seek indirect exposure to the privately held AI leader.