Wall Street is looking ahead to 2026 with optimism, and the case for higher stocks is shifting away from hype and toward profits. Forecasts point to the S&P 500 rising to around 7,750 next year, implying roughly 14% upside from current levels, driven primarily by earnings growth rather than expanding valuations.

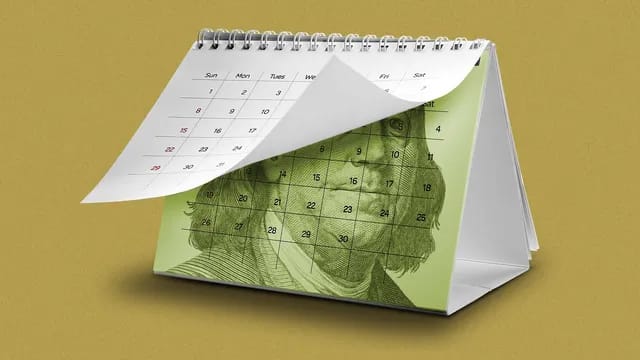

From vibes to profits

The big shift is what is powering gains. Over the past few years, stocks benefited heavily from valuation expansion, with investors willing to pay more for future growth, especially after the AI boom kicked off in late 2022. That dynamic appears to be cooling. Markets are reacting more skeptically to splashy AI announcements, and rallies now need to be backed by real financial results.

This change is already visible in how investors respond to news. Large AI-related deals that once sent stocks soaring are now met with a more muted reaction, signaling that expectations have risen and patience is thinner.

The rest of the market tries to catch up

Earnings growth is expected to broaden beyond the largest tech names. Companies outside the so-called Magnificent 7 are projected to see profit growth accelerate meaningfully in 2026, narrowing the gap that has dominated market leadership for years.

That said, the biggest tech companies are still expected to grow earnings faster than the broader market, just not by as wide a margin as before. Meta $META ( ▲ 1.1% ) , Apple $AAPL ( ▲ 0.53% ) , Amazon $AMZN ( ▼ 0.6% ) , Alphabet $GOOGL ( ▼ 1.65% ) , Tesla $TSLA ( ▼ 0.29% ) , Microsoft $MSFT ( ▲ 1.78% ) , and Nvidia $NVDA ( ▲ 2.91% ) are all forecast to continue delivering strong profit growth, even as others begin to close the distance.

Rotation may not be smooth

Investors are increasingly debating whether it is time to rotate out of mega-cap tech and into the rest of the market. The logic is clear, but execution may be messy. Earnings growth outside the largest names has improved, but not consistently enough to support a clean handoff in leadership.

The result could be a choppy transition rather than a sharp pivot. Stocks may still grind higher overall, but with leadership rotating unevenly as investors test where real earnings power is showing up.

Bottom line: If 2026 delivers on earnings expectations, stocks could keep climbing. The difference this time is that the market wants receipts, not just big promises.