Buying a stock is basically buying a slice of a business and like test-driving a car, you want to know whether the engine actually holds up. Some companies break down the minute the economic weather turns. Others? They quietly compound, year after year, because their competitive edge is impossible to shake.

Heading into 2026, a fresh batch of companies checks all the long-term boxes. These aren’t the hype trains. These are the “sleep-well-at-night” names built to keep delivering.

What Makes a Company Worth Owning Long Term

The best long-term performers all share the same DNA: They stay one step ahead of the competition.

Warren Buffett called this an “economic moat”, the protective barrier that keeps rivals from invading your castle. Morningstar builds on that moat concept, measuring how durable a company’s advantage really is: strong brands, cost advantages, regulations, switching costs, network effects, and more.

Only the companies with the widest, most durable moats make the cut.

These businesses also have predictable cash flows, which makes it far easier to estimate their true value. They invest intelligently, avoid reckless risks, and can navigate fast-changing issues without scrambling to plug holes later.

Not every company on this list is a buy right now, some trade above what analysts believe they’re actually worth. But they’re all worth watching, because they consistently turn time into upward-trending shareholder value.

Consumer Cyclical: Where Brand Power Rules

The consumer cyclical world lives and dies by economic sentiment. When wallets open up, companies with strong brand equity get first dibs from travel to dining to entertainment. These companies shine because people choose them on purpose, not by accident.

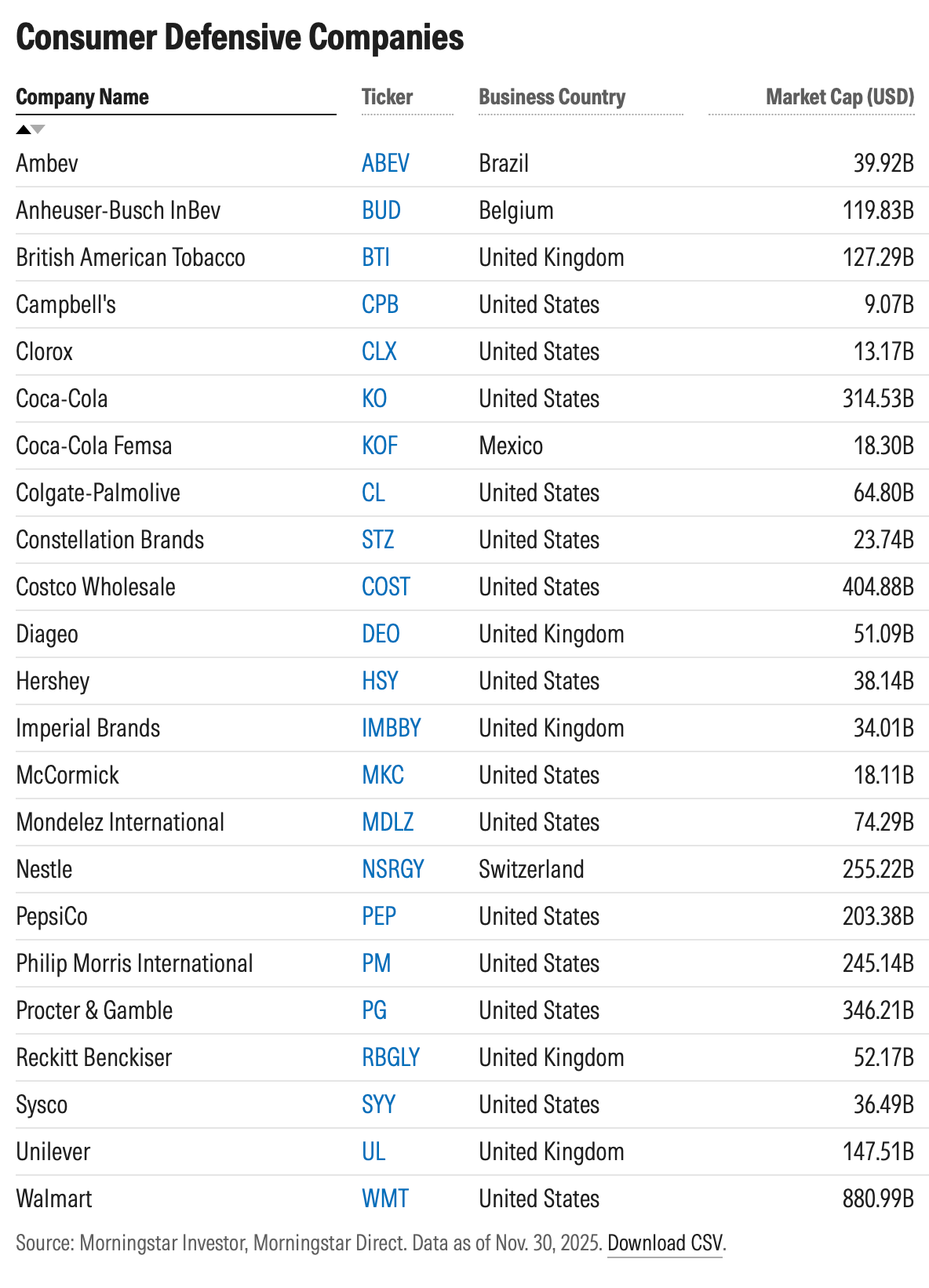

Consumer Defensive: The Stuff You Buy No Matter What

Toilet paper, toothpaste, cereal, detergent. The “always in the cart” stuff. Consumer defensive companies win because the economy can’t bully them. They sell essentials, maintain strong pricing power, and build loyalty that competitors struggle to crack.

Financial Services: High Switching Costs, High Staying Power

Banks, brokerages, insurance firms, exchanges. They all benefit from one advantage: customers don’t leave easily. The hurdles to switching are high, the relationships are sticky, and the economics tend to improve with scale.

Interest rates, credit cycles, and market levels still matter, but moats matter more.

Healthcare: Stability Meets Innovation

Healthcare doesn’t care much about recessions, and the best companies in the sector lean on patents, research depth, and long-term demand. Drugmakers with intellectual property protection and diagnostics companies with deep data moats dominate the list.

Industrials: The Old-School Moat Builders

Planes, trains, factories, machinery. the industrials sector is full of companies that win because they already own the infrastructure, the contracts, or the regulatory hurdle.

This group has the most entries this year, thanks to century-old brands and cost advantages that new entrants simply can’t replicate.

Tech: Stability in a Disruptive World

Tech is where moats are hardest to maintain but when a company builds one, it’s massive. The winners here tend to be software platforms with high switching costs or hardware companies with deep R&D pipelines.

Once a business relies on these tools, dropping them becomes expensive, risky, or impossible.

Other Sectors: The Specialists

From materials to energy to real estate, these companies face more volatility and tougher competition. But the ones on this list have carved out durable competitive advantages that keep them relevant through economic cycles.