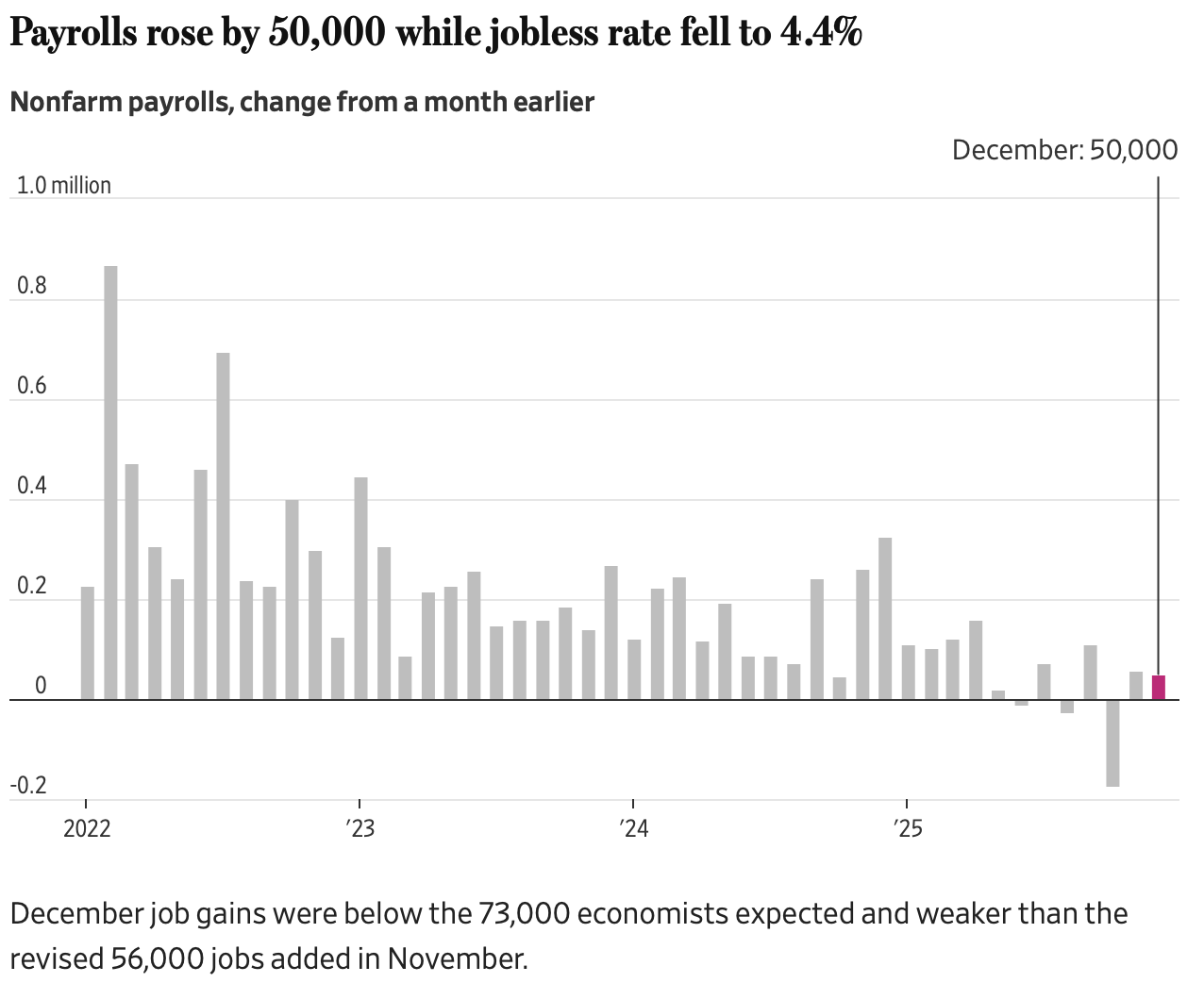

The U.S. labor market delivered a mixed signal to close out the year. The unemployment rate unexpectedly dropped to 4.4% in December, even as job growth came in well below expectations.

Employers added just 50,000 jobs last month, missing economist forecasts of roughly 70,000 and falling far short of the 80,000-plus increase implied by prediction markets ahead of the release.

A Lower Jobless Rate, But Fewer New Jobs

At first glance, the decline in unemployment looks encouraging. But the underlying job growth tells a softer story. December’s payroll gains were modest, suggesting hiring momentum remains weak even as the headline jobless rate improves.

That disconnect follows an unusual stretch for the labor market. In the prior report covering October and November, the unemployment rate jumped to 4.6%, marking the first time since June 2009 that joblessness increased for four consecutive readings.

Revisions Add to the Caution

Adding to the unease, revisions to prior data moved in the wrong direction. Payrolls for the previous two reports were revised down by a combined 76,000 jobs, further underscoring that recent labor market strength may have been overstated.

In other words, the trend line is flatter than it first appeared.

Markets Read It as a Green Light

Traders were quick to translate the data into policy expectations. Following the release, prediction markets sharply increased bets that the Federal Reserve will hold rates steady at its January meeting, with probabilities jumping to 97% from 93%.

Markets welcomed the outcome. The SPDR S&P 500 ETF $SPY extended its premarket gains, signaling relief that the labor market slowdown may be enough to keep the Fed on the sidelines without tipping the economy into a sharper downturn.

For now, December’s report reinforces a familiar theme: cooling, not collapsing, and just soft enough to keep policymakers patient.