Good afternoon! Usually, a long retirement means balloons and a goodbye email. When the person stepping aside is Warren Buffett, it feels more like a regime change. Greg Abel officially took the wheel this week, inheriting not just a title, but one of the most closely watched balance sheets on the planet.

Abel’s first challenge is deciding what to do with Berkshire’s mountain of cash after years of sitting on the sidelines while markets ran hot. Buffett trusted him enough to hand over the keys, but investors are still watching closely. The legend isn’t gone entirely though. Buffett stays on as chair, which means the shadow is still there, even if someone else is driving.

MARKETS

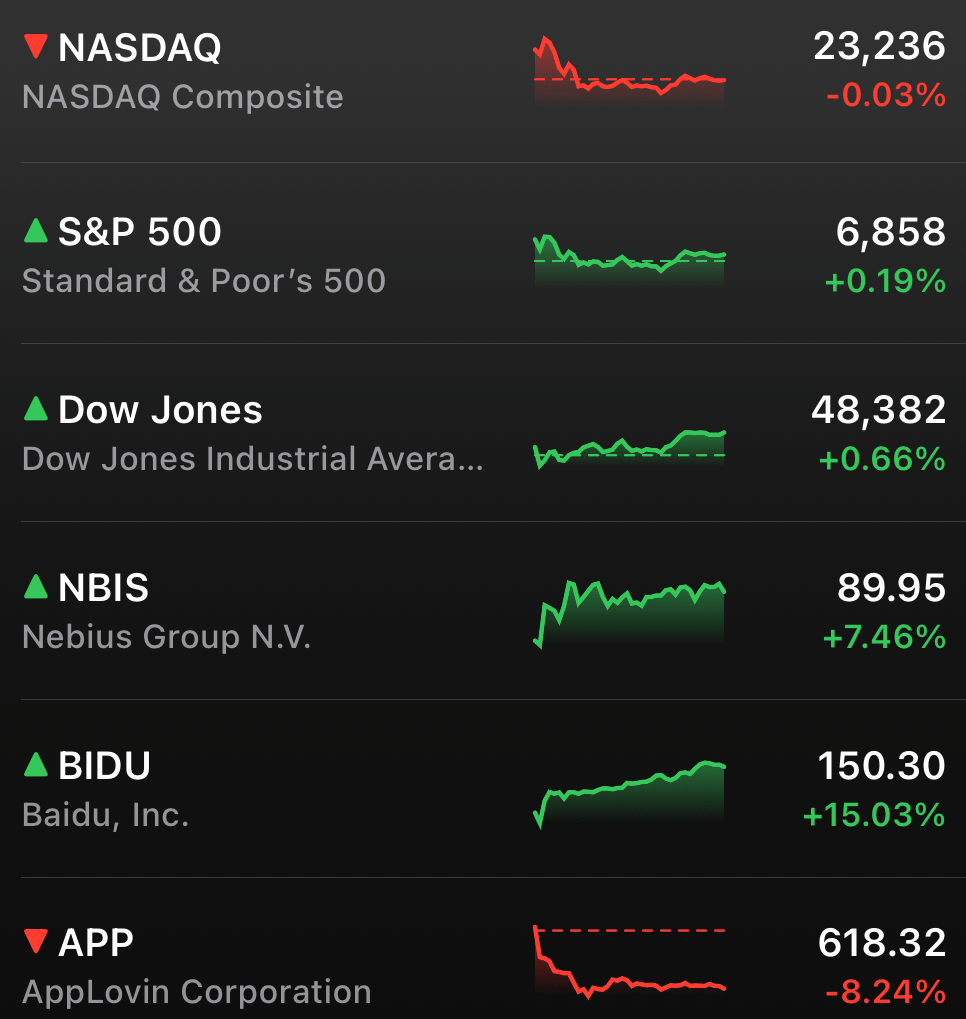

Markets started the year in a fog, with traders easing back in after the holidays and volumes staying light. The S&P 500 managed to stop its slide, but the Nasdaq kept drifting as investors looked for a fresh catalyst.

Elsewhere, Tesla lost its EV crown after another year of declining deliveries, while tariff headlines offered some relief. President Trump delayed new levies on home goods and trimmed duties on Italian pasta, giving retailers a boost and letting carbs breathe easy for now.

STOCKS

Winners & Losers

What’s up 📈

AI hardware and infrastructure stocks rallied as traders leaned back into the “new year, same AI” trade, pushing up chipmakers, foundries, memory names, and AI infrastructure plays across the board $NVDA $AMD $TSM $MU $WDC $STX $SNDK $CRWV $NBIS $IREN $CIFR $BE $OKLO $PLUG $ASML $SMCI

Baidu surged after reports it is preparing a Hong Kong IPO for its AI chip unit, reviving optimism around its long-term AI strategy $BIDU

What’s down 📉

AI software and hyperscalers sold off as investors rotated away from downstream AI names and questioned near-term monetization, dragging software, cybersecurity, and cloud giants lower $APP $CRWD $PANW $PLTR $ADBE $NOW $CRM $META $AMZN $MSFT

Tesla slid for a seventh straight session after Q4 deliveries fell well short of expectations, marking its steepest multi-day losing streak since early 2024 $TSLA

MARKETS

Wall Street Is Lining Up for Another Big Year in 2026

Between a sharp April selloff, a powerful rebound, and nonstop chaos in crypto, 2025 reminded investors that certainty is a luxury. Still, Wall Street is doing what it always does. Making bold calls anyway. A growing number of strategists think stocks have more room to run in 2026, powered by rate cuts, resilient consumers, and an AI-driven earnings tailwind.

Not everyone agrees on how strong that year will be. The most bullish forecasts see the S&P 500 pushing toward 8,000 or higher, while the cautious camp expects far more modest gains. Even the bears are not calling for a collapse. Just a market that cools instead of melts up.

Why Recession Fears Keep Missing

One reason bulls remain confident is simple. The recession that was supposed to arrive never really showed up. After tariff scares briefly rattled markets earlier this year, growth held steady, spending stayed intact, and layoffs failed to snowball. Historically, long bear markets tend to come with recessions. Right now, that risk is not dominating investor psychology.

That backdrop keeps a floor under equities. As long as the economy avoids a hard slowdown, dips look more like buying opportunities than warning signs.

A few paragraphs later, another shift is quietly strengthening the bull case.

Earnings Are Finally Broadening Out

For most of the past two years, a small group of mega-cap tech companies carried earnings growth for the entire market. At one point, they accounted for nearly all of it. That imbalance is starting to fade. Recent earnings seasons have delivered more upside surprises from outside Big Tech, expanding the profit pool and reducing reliance on a handful of names.

That matters because broader earnings growth tends to support more durable rallies. Markets do not need extreme valuation expansion when profits are coming from more places.

What It Means for 2026

Put it together and the picture becomes clearer. The economy is bending but not breaking. Earnings growth is spreading. AI remains a powerful force, even as expectations become more grounded. That combination helps explain why some of Wall Street’s boldest forecasts are not being dismissed outright.

Nothing is guaranteed, especially in a market shaped by geopolitics, technology shifts, and sentiment swings. But if the past year proved anything, it is this. Betting against the market’s ability to absorb shocks has been a tough trade. And heading into 2026, plenty of strategists are not ready to fade it yet.

NEWS

Market Movements

🚗 Tesla Q4 Deliveries Miss as Annual Sales Fall Again: Tesla $TSLA reported weaker-than-expected Q4 deliveries, extending its annual sales decline for a second straight year. Demand was pulled forward into Q3 by the now-expired $7,500 EV tax credit, leaving vehicles effectively more expensive into year-end as competition from Chinese EV makers intensifies.

📊 Markets Quietly Reset Over the Holidays: While inboxes filled with out-of-office replies, markets ended 2025 on a softer note as stocks pulled back from record highs and speculative trades cooled. AI dealmaking stayed hot, silver’s momentum snapped sharply, and economic data showed early labor market cracks without derailing bullish 2026 expectations.

🤖 AI Trade Roars Back to Start 2026: Investors wasted no time piling back into AI leaders, with chips, memory, and infrastructure names leading early gains. The buying spans semiconductors, neoclouds, and energy plays, signaling conviction rather than headline-driven positioning.

🐸 Meme Coins Rip Higher to Start 2026: Meme coins snapped back into focus as Pepe surged, triggering short liquidations and pulling speculative capital back into crypto. Dogecoin and Shiba Inu followed, making early-year risk appetite hard to ignore.

🤖 AI Trade Splits Into Two Lanes: Early 2026 is drawing a clear line between AI infrastructure winners and software laggards. Investors are favoring chips, memory, and power with visible demand while trimming application-layer names still selling future monetization. $NVDA $TSM $MU $APP $PLTR $META

🧠 Retail Investors Keep Beating Wall Street: Retail traders just logged a third straight year of market outperformance by leaning aggressively into AI, tech, and metals. High-beta exposure cuts both ways, but for now, buying volatility while institutions de-risked continues to pay off.

EV

BYD overtakes Tesla as the world’s top EV seller for the first time

China’s EV champion just passed a milestone Tesla once made look untouchable.

After years of rapid growth, BYD has officially overtaken Tesla as the world’s largest seller of battery electric vehicles on a calendar-year basis, according to company filings released this week.

BYD’s rise goes from punchline to powerhouse

BYD said its global battery electric vehicle sales climbed nearly 28% in 2025 to 2.26 million units. That puts it ahead of Tesla for the first time ever, a remarkable reversal for a company Elon Musk famously laughed off in a 2011 Bloomberg interview, saying he didn’t view BYD as a real competitor.

Fast forward to today, and BYD’s scale, pricing power, and dominance in China have turned it into the global volume leader. Its growth has been driven by aggressive expansion across Asia, Europe, and emerging markets, alongside a broad lineup that spans budget EVs to higher-end models.

Tesla’s delivery slide tells a different story

Tesla $TSLA delivered 1.64 million vehicles in 2025, down roughly 8% year over year and marking its second consecutive annual decline. Fourth-quarter deliveries fell about 16% compared to the same period in 2024, coming in well below last year’s tax-credit-fueled surge.

The softer numbers reflect a tougher environment for Tesla’s core EV business. Competition has intensified, prices have effectively risen as incentives rolled off, and demand has not kept pace with production ambitions. Tesla’s reported deliveries remain the closest proxy for sales, but the downward trend is hard to ignore.

Two very different strategies heading into 2026

While BYD has leaned into volume, affordability, and global expansion, Tesla has increasingly shifted its narrative away from car sales and toward autonomy, AI, and robotics. That strategy has helped Tesla’s stock rebound sharply, even as EV deliveries continue to slide.

For now, BYD holds the crown in pure EV sales, a symbolic and strategic win that would have sounded implausible a decade ago. The bigger question heading into 2026 is whether Tesla’s bet on autonomy can offset a shrinking lead in the business that built the company in the first place.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com