Good afternoon! It was a rough week inside the AI labs themselves. At Anthropic, the head of Safeguards Research resigned, warning in his departure letter that the world could be “in peril” and that the company was struggling to live up to its stated values. Over at OpenAI, one researcher quit over fears that ChatGPT’s new ad strategy could manipulate users, a senior safety leader was fired after opposing the release of AI erotica, and an engineer publicly warned about AI’s “existential threat” to jobs.

The policy fight is heating up just as fast as the tech. Anthropic pledged $20 million to back political candidates focused on AI safety, while OpenAI has supported a pro-AI super PAC pushing for fewer restrictions. Meanwhile, turnover continues across the industry, including multiple founder departures at Elon Musk’s xAI, adding to the sense that even insiders can’t agree on how cautious the world should be about what they’re building.

MARKETS

Stocks caught a brief tailwind after January’s CPI report came in cooler than feared, giving traders a rare Friday-the-13th win. The rally didn’t last long though, fading into the close as major indexes finished barely higher, while small caps quietly stole the show with a stronger bounce. Bitcoin joined the relief move, rebounding after recent volatility.

Outside equities, policy chatter added fuel to the mix as President Trump said he plans to roll back tariffs on steel and aluminum. Gold edged higher on the softer inflation data, but tech remained under pressure, with nearly all Magnificent 7 names slipping even as the broader market tried to stabilize.

STOCKS

Winners & Losers

What’s up 📈

Rivian surged 26.64% after delivering a strong Q4 report, marking its best trading day ever as investors cheered plans to launch its $45,000 R2 SUV. $RIVN

Coinbase jumped 16.57% as record stablecoin revenue and a rebound in free cash flow outweighed a revenue miss and surprise loss. $COIN

Instacart climbed 9.27% after topping revenue estimates and issuing upbeat guidance, reporting its strongest transaction volume in three years. $CART

Roku rose 8.63% following a strong quarter and bullish outlook that prompted analyst upgrades. $ROKU

Applied Materials gained 8.05% after beating earnings and guidance, with management forecasting more than 20% semiconductor growth. $AMAT

Moderna advanced 5.29% on an earnings beat and upbeat outlook helped by stronger vaccine sales. $MRNA

Arista Networks moved higher by 4.77% after posting earnings and revenue beats driven by networking demand. $ANET

Airbnb added 4.66% after beating Q4 sales expectations and issuing strong guidance for the current quarter. $ABNB

Plug Power ticked up 3.85% after shareholders approved an increase in authorized shares, avoiding a reverse split. $PLUG

Advance Auto Parts edged higher 1.01% as cost cuts and store closures helped deliver an earnings beat. $AAP

What’s down 📉

Pinterest plunged 16.84% after issuing weak sales guidance amid softer advertising demand from retailers. $PINS

DraftKings sank 13.51% on disappointing forecasts for 2026 revenue and profit. $DKNG

Constellation Brands fell 8.04% after announcing a CEO transition. $STZ

Norwegian Cruise Line dropped 7.57% following a downgrade tied to weaker booking trends and heavier promotions. $NCLH

Expedia declined 6.41% despite beating earnings, warning that emerging AI travel platforms could pressure growth. $EXPE

Amazon slipped 0.42%, extending its losing streak to nine straight sessions, its longest since 2006. $AMZN

EARNINGS

Coinbase Reports $667 Million Q4 Loss as Crypto Market Slump Cuts Revenue

Coinbase delivered a rough fourth quarter, posting a $667 million loss as the broader crypto market cooled sharply from its late-2025 highs. Revenue dropped about 22% from a year earlier, reflecting a steep slowdown in trading activity that hit the exchange’s core business where it hurts most. The results underscore a familiar truth: when crypto sneezes, Coinbase $COIN catches pneumonia.

Trading Frenzy Turns Into Trading Freeze

Transaction revenue, historically Coinbase’s bread and butter, plunged as investors pulled back from speculative bets during the digital asset downturn. The company’s own holdings of bitcoin and other tokens also weighed on results, amplifying losses as prices fell across the market. Since the October peak, crypto has shed roughly $2 trillion in value, taking trading volumes down with it.

Shares of Coinbase and other crypto-linked firms have followed the same downward trajectory, reinforcing how tightly the company’s performance remains tied to market sentiment.

Stablecoins Steal the Spotlight

Not everything in the report was bleak. Subscription and services revenue surged, driven largely by stablecoin income and custody fees, providing a steadier stream of cash flow even as trading slowed. Stablecoins have quietly become one of Coinbase’s most reliable businesses, generating interest income and facilitating payments rather than speculation.

The company says it now has multiple business lines generating over $100 million annually, part of a broader push to diversify away from pure trading dependence.

Waiting for the Next Thaw

Management sounded cautiously optimistic about long-term adoption and potential regulatory clarity, which could bring more institutional money into the space. But in the short term, Coinbase $COIN’s outlook hinges on whether crypto markets recover or remain stuck in another prolonged downturn.

For now, the exchange is once again navigating a familiar cycle: boom times bring explosive growth, and busts test how well the business can stand on legs other than trading fees.

NEWS

Market Movements

🚙 Rivian Tops Expectations as R2 Launch Approaches: Rivian $RIVN rose after beating Q4 estimates despite revenue falling year over year, with losses narrower than feared. The company is betting heavily on its upcoming $45K R2 SUV, set to begin deliveries in Q2, to drive mass-market growth. Full-year deliveries are projected at 62K–67K vehicles. $RIVN

🔋 Plug Power Cleared to Issue More Shares: Plug Power $PLUG won shareholder approval to increase its share count, allowing the company to raise new capital without a reverse split. The move removes immediate financing risk but opens the door to further dilution. The hydrogen firm has relied heavily on equity raises since its IPO. $PLUG

💉 Moderna Beats but Faces Regulatory Headwinds: Moderna $MRNA topped Q4 expectations and projected about 10% revenue growth in 2026 despite ongoing challenges. The company still depends heavily on its COVID vaccine and recently saw the FDA refuse to review its mRNA flu shot application. Roughly half of future sales are expected to come from international markets. $MRNA

🧊 SharkNinja Hits All-Time High on Viral Growth: SharkNinja $SN reached a record high after reporting an “outstanding” holiday season and $6.4B in annual sales. Revenue has more than quadrupled since 2018, fueled by viral products and constant new launches. The company plans to introduce about 25 new products per year to sustain momentum. $SN

🧠 Applied Materials Surges on AI Chip Boom: Applied Materials $AMAT soared after beating expectations and issuing strong guidance, prompting a wave of price-target hikes. Analysts see accelerating demand for advanced chip manufacturing equipment tied to AI infrastructure. The quarter was described as “narrative-changing” for the company. $AMAT

🍎 Apple Falls as AI Execution Concerns Mount: Apple $AAPL dropped sharply despite limited AI spending, as investors worry the company is falling behind due to delays in key AI features. The firm recently partnered with Google’s Gemini but has yet to deliver meaningful AI products. Retail investors have been heavy sellers this year. $AAPL

👓 Meta Revives Facial Recognition for Smart Glasses: Meta $META plans to reintroduce facial recognition through smart glasses, allowing users to identify people in real time using AI. The company previously scrapped similar tech in 2021 amid privacy backlash. The move could reignite debates over surveillance and public anonymity. $META

💊 Regulators Probe Pharmacy Linked to Hims GLP-1 Drugs: State regulators are investigating Strive Pharmacy, a key supplier for Hims & Hers $HIMS, over alleged ketamine misuse and improper drug distribution. The scrutiny adds pressure to the booming telehealth weight-loss market and follows concerns about compounded versions of drugs from Eli Lilly $LLY and Novo Nordisk $NVO. The outcome could impact availability of cheaper GLP-1 alternatives. $HIMS

🌐 Arista Networks Beats and Raises as AI Data Center Demand Surges: Arista Networks $ANET jumped after posting stronger-than-expected Q4 profit, revenue, margins, and Q1 guidance, signaling robust demand for cloud and AI networking gear. Sales hit $2.49B and outlook topped estimates, reinforcing that data center buildouts remain strong. Shares climbed about 9% after hours. $ANET

🎰 DraftKings Drops on Weak 2026 Outlook: DraftKings $DKNG plunged after forecasting 2026 revenue and EBITDA below Wall Street expectations, overshadowing a solid Q4 that met or beat estimates. The guidance suggests slowing growth in the competitive online betting market. Shares fell roughly 15% after hours. $DKNG

📌 Pinterest Sinks on Soft Q1 Sales Forecast: Pinterest $PINS tumbled after projecting Q1 revenue below expectations, even as Q4 results were roughly in line. Management blamed retailers pulling back on ad spending amid tariffs and economic uncertainty. The stock fell about 20% premarket. $PINS

ECONOMY

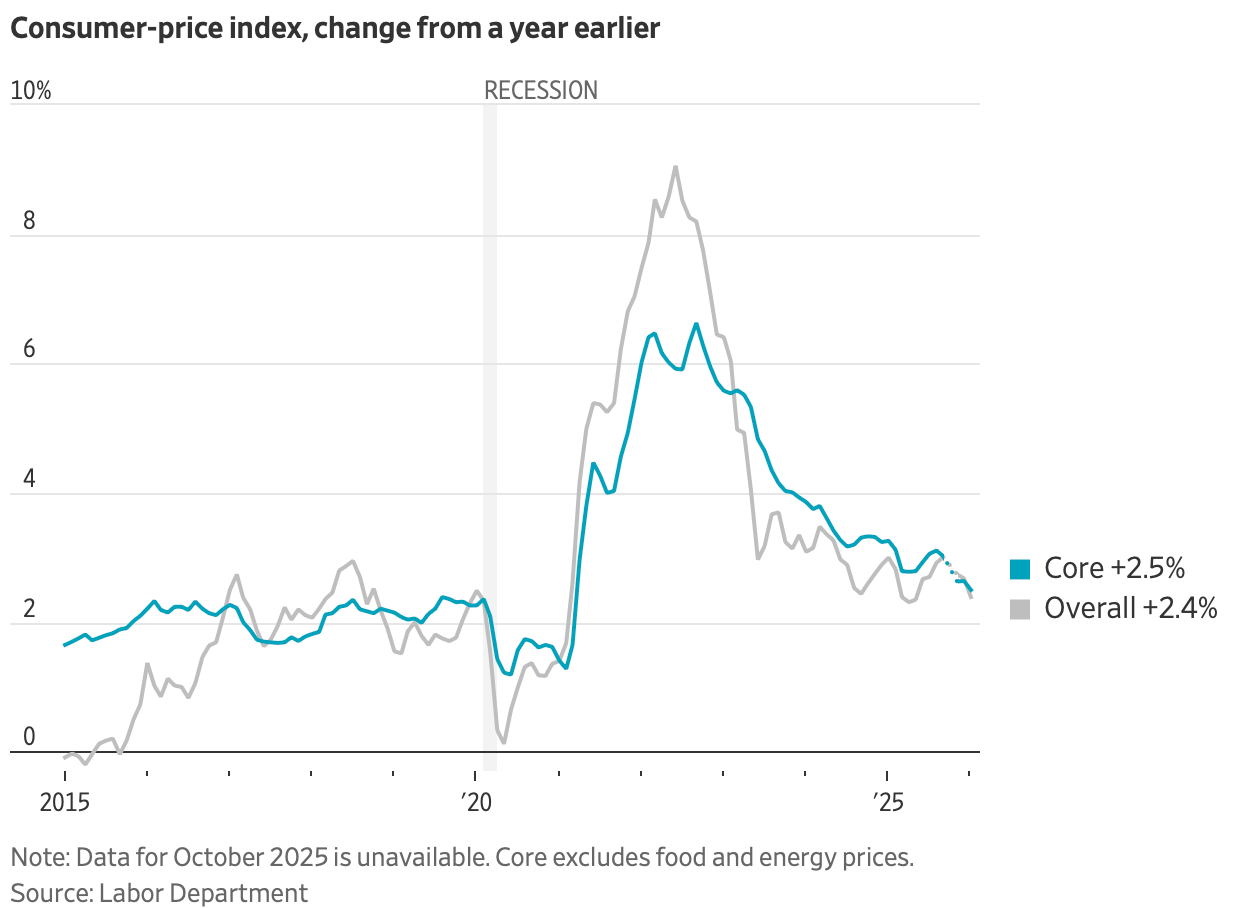

US Inflation Cools to 2.4% in January as Gas Prices Fall but Core Costs Stay Sticky

Inflation slowed more than expected to 2.4% in January, helped largely by cheaper gasoline and used vehicles, offering a welcome break after years of relentless price hikes. Core inflation, which strips out food and energy, came in at 2.5%, suggesting underlying price pressures are easing but not disappearing. For households hoping for a full reset on costs, the message was clear: relief is arriving, just not everywhere.

Gas Down, Groceries and Gadgets Up

Lower fuel costs did much of the heavy lifting, but plenty of everyday items still got more expensive. Prices climbed for computers, appliances, furniture, hospital care, airline tickets, and new cars, many of which economists say are being pushed higher by tariffs filtering through supply chains. Services inflation, in particular, accelerated at its fastest monthly pace in a year, reinforcing fears that the hardest-to-tame part of inflation is still hanging around.

Housing costs rose modestly, while electricity prices dipped slightly, though natural gas costs increased. The mixed picture shows why consumers continue to feel squeezed even as headline inflation trends in the right direction.

Fed Relief Isn’t Guaranteed Yet

Stronger-than-expected job growth alongside cooler inflation paints a surprisingly healthy economic backdrop, but it may not be enough to trigger immediate rate cuts. Policymakers are likely to wait for several more months of consistent progress before declaring victory, especially with tariff-driven price increases still working their way through the system. Traders nudged Treasury yields lower after the report, signaling expectations for somewhat easier policy down the road.

For now, inflation is no longer the five-alarm fire it was in 2022, but it’s also not back to normal. Prices may be rising more slowly, yet after years of increases, the level itself remains painfully high for many Americans.

CALENDAR

On The Horizon

Tomorrow

President’s Day gives markets a three-day weekend, but once traders are back at their desks, the calendar quietly fills up.

Monday is a full stop for US markets, while Tuesday eases things in with the Empire State Manufacturing Survey and earnings from names like Medtronic, Palo Alto Networks, Cadence Design Systems, Devon Energy, and InterContinental Hotels.

Wednesday brings a delayed housing update with fresh data on starts and permits, plus minutes from the Federal Reserve’s last policy meeting. Corporate results roll in from Analog Devices, Booking.com, DoorDash, eBay, Garmin, Carvana, Moody’s, Wingstop, and Cheesecake Factory, among others.

Thursday pairs the weekly jobless claims report with new trade deficit figures, alongside a heavyweight earnings lineup including Walmart, Deere, Rio Tinto, Newmont, Etsy, Wayfair, Live Nation, and Airbus.

Friday closes the week with a dense macro dump featuring PCE inflation, an early read on fourth-quarter GDP, consumer sentiment, and business activity surveys, while a smaller group of companies such as Western Union, Anglo American, and Danone report results.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com