Good afternoon! The race for the next Fed chair has been narrowed to one very specific qualification. Your name might need to be Kevin. President Trump told the Wall Street Journal he is deciding between Kevin Hassett and former Fed Governor Kevin Warsh, turning the hunt for America’s top interest rate wizard into a two-Kevin coin flip.

Markets are already placing bets. Hassett’s odds on Kalshi have slid from 78% last week to 41%, while Warsh has jumped into the lead at 50%. Both Kevins favor lower rates, but investors seem more comfortable with Warsh, whose Fed background gives the impression of independence. Notably absent from the lead pack is Fed Governor Christopher Waller, whose biggest disadvantage appears to be not being named Kevin.

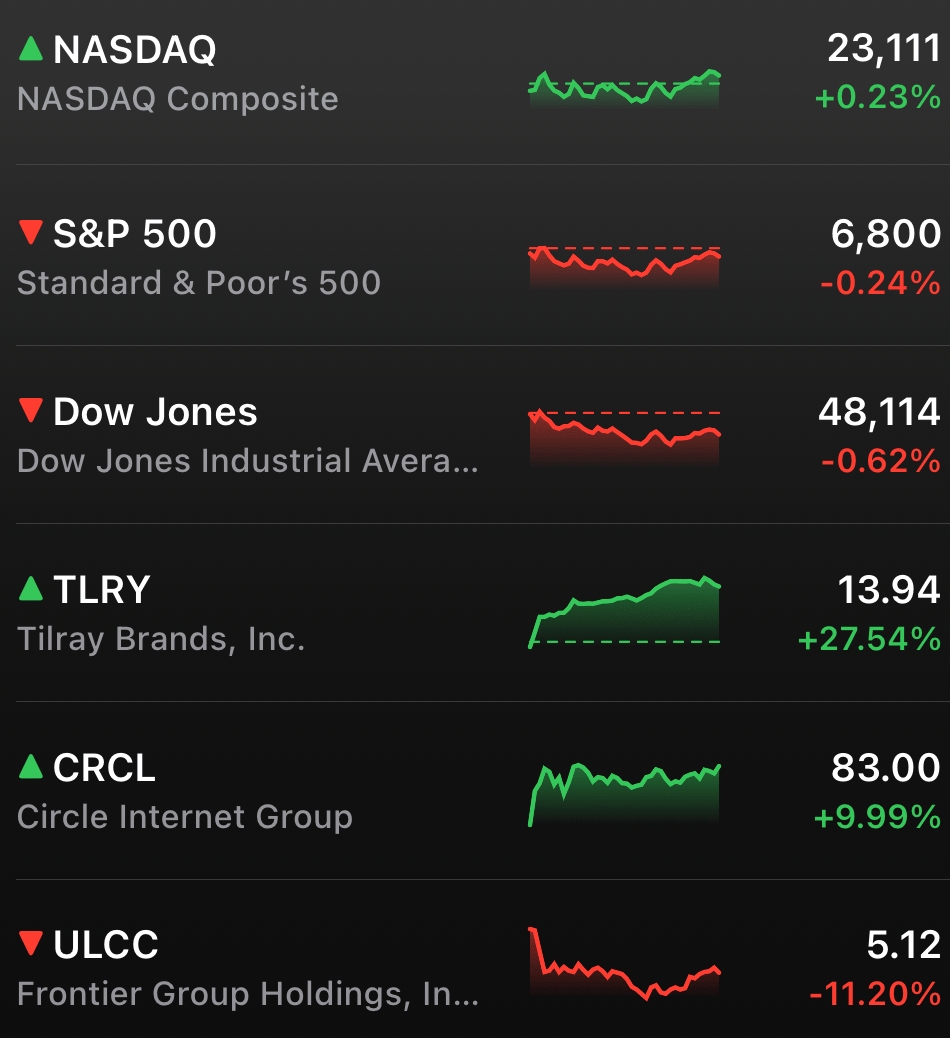

MARKETS

Jobs data dropped like a wet blanket on markets Tuesday. October and November payrolls showed unemployment rising to 4.6%, its fourth straight increase, but it didn’t meaningfully shift expectations for Fed rate cuts in 2026.

Stocks mostly lagged on the news. The S&P 500 and Russell 2000 closed lower, while the Nasdaq 100 staged a late rally to sneak into the green as investors shook off earlier AI trade jitters.

STOCKS

Winners & Losers

What’s up 📈

Rezolve AI surged 27.80% after management boosted 2025 annual recurring revenue guidance by 33%. $RZLV

Tilray Brands jumped 27.54% as cannabis stocks rallied on renewed hopes of U.S. marijuana rescheduling. $TLRY

Curaleaf climbed 22.57% after President Trump said he’s “very strongly” considering an executive order to reschedule marijuana. $CURLF

Canopy Growth rose 10.24% in sympathy with the broader cannabis rally. $CGC

Circle Internet Group gained 9.99% after Visa said U.S. partners can now settle transactions in USDC. $CRCL

IonQ advanced 7.81% after Jefferies initiated coverage with a Buy rating and a $100 price target. $IONQ

D-Wave Quantum rose 7.48% on the same Jefferies Buy initiation. $QBTS

What’s down 📉

Duluth Holdings cratered 29.39% after missing revenue expectations despite a narrower loss. $DLTH

Navan sank 11.86% after posting a quarterly loss and announcing its CFO will step down. $NAVN

Frontier Airlines dropped 11.20% after its longtime CEO abruptly departed. $ULCC

Humana slid 6.03% following the retirement announcement of its president. $HUM

APA fell 5.18% and Halliburton slipped 4.24% as crude prices declined. $APA $HAL

Pfizer dipped 3.41% after forecasting weaker-than-expected 2026 profits amid fading COVID sales. $PFE

AI

CoreWeave Stock Crashes as AI Infrastructure Hype Meets Reality

When CoreWeave $CRWV ( ▼ 3.03% ) went public in late March, it was supposed to be the cleanest way to play the AI infrastructure boom. The first major tech IPO since 2021, a self-described pure-play AI company, and a stock that surged nearly 300% in its first three months. The market was hungry for picks-and-shovels exposure. CoreWeave looked like the answer.

Fast forward to now, and the mood has flipped. Shares are down about 56% over the past six months, including a sharp 23% drop in just the last week, as optimism around AI spending runs into balance sheet concerns and execution issues.

Debt Is Doing the Heavy Lifting

CoreWeave’s model is straightforward but risky. It borrows heavily at high interest rates to buy Nvidia chips, installs them in data centers, and rents the compute to customers like Microsoft, Meta, and OpenAI. That works great when AI demand is roaring. It looks a lot shakier when investors start worrying about leverage and customer concentration.

Analysts have not been subtle. D.A. Davidson called CoreWeave’s balance sheet the ugliest in tech, and short seller Jim Chanos has openly questioned whether data center economics can justify this level of capital intensity.

When Weather Becomes a Headwind

The selloff accelerated after construction delays at a major Texas data center, reportedly caused by summer storms. The site was expected to house a large OpenAI deployment, and mixed messaging from management around the delays only added fuel to the fire. A failed acquisition of Core Scientific and a recent convertible bond offering piled on more uncertainty.

Why Investors Are Nervous: CoreWeave’s stumble is hitting at a sensitive moment for the AI trade. If a high-profile, high-growth infrastructure name cannot maintain momentum, it raises uncomfortable questions about how durable AI spending really is. For now, CoreWeave has become a case study in how quickly AI hype can turn into AI scrutiny.

NEWS

Market Movements

🧠 Needham Turns More Bullish on Micron Ahead of Earnings: Needham raised its Micron price target to $300 from $200, citing a tightening memory market and sold-out HBM capacity through 2026. The firm sees AI-driven demand colliding with limited supply, boosting pricing power and margins. $MU

🚕 Tesla Robotaxi Safety Data Raises Red Flags: New data shows Tesla’s Robotaxis in Austin have been involved in eight crashes since June, implying a much higher accident rate than human drivers. The findings clash with Tesla’s safety claims, even as the company begins testing vehicles without safety monitors. $TSLA

🎬 Disney Licenses IP to OpenAI Using Stock Instead of Cash: Disney agreed to license its intellectual property to OpenAI in exchange for stock warrants rather than cash, an unusual move for the media giant. The structure signals Disney is betting on OpenAI’s long-term upside instead of treating the deal as a traditional licensing agreement. $DIS

☢️ Oklo Clears Key DOE Approval for Nuclear Fuel Plant: Oklo received approval from the Department of Energy to begin assembling a nuclear fuel production facility under a new fast-track program. The regulatory green light strengthens Oklo’s credibility as investors continue to price in future nuclear demand. $OKLO

🏛️ Elon Musk’s Political Donations Stir Investor Anxiety: Elon Musk is backing Republican candidates ahead of the 2026 midterms, reviving concerns about political distractions at Tesla. Investors have historically reacted negatively when Musk’s political involvement ramps up. $TSLA

✈️ Frontier Airlines Stock Slides After CEO Exit: Frontier shares dropped after longtime CEO Barry Biffle announced he is stepping down, with the company naming an interim replacement. The shakeup adds uncertainty as the ultra budget airline model faces mounting pressure. $ULCC

📊 Semiconductor Stocks Flagged in New AI Bubble Screen: Ned Davis Research found that several AI and chip stocks meet academic criteria associated with market bubbles. The firm stressed this does not signal an imminent crash, but noted excess optimism is concentrated in semiconductors. $NVDA $AVGO $PLTR

📺 Meta Launches Instagram Reels App for TVs: Meta rolled out a dedicated Instagram TV app starting with Amazon Fire TV, bringing short-form Reels to the living room. The move puts Meta in more direct competition with YouTube for TV screen time. $META

⚛️ Quantum Stocks Jump on Jefferies Buy Ratings: IonQ and D-Wave Quantum rallied after Jefferies initiated coverage with buy ratings and aggressive price targets. The firm is betting the recent selloff in quantum names went too far. $IONQ $QBTS

⚡ Senators Probe Whether AI Data Centers Are Raising Power Bills: Lawmakers opened an investigation into whether the rapid buildout of AI data centers is driving higher electricity costs for consumers. Major tech and data center operators have been asked to explain how infrastructure upgrades are being funded. $META $MSFT $AMZN $GOOGL

🎥 Warner Bros. Discovery Signals Preference for Netflix Deal: Warner Bros. Discovery plans to urge shareholders to reject Paramount’s takeover bid in favor of its existing Netflix agreement. The move sets up a potential bidding battle ahead of Paramount’s January deadline. $WBD $NFLX $PSKY

ECONOMY

Jobs Report Misses the Vibe as Unemployment Climbs to 4.6%

The November jobs report finally showed up, and it was not worth the wait. Payrolls rose by 64,000, slightly above expectations, but the unemployment rate jumped to 4.6%, the highest since 2021 and higher than forecast. Good headline. Bad footnote.

Heather Long of Navy Federal Credit Union called it a “jobs recession,” pointing out that nearly 70% of new jobs came from healthcare. Translation. If America were not aging, this report would look a lot worse.

Blame the Shutdown Math

Markets did not freak out, mostly because this report was always going to be messy. The government shutdown forced the Bureau of Labor Statistics to mash October and November together, distorting the data and hiding a one-time drop in government jobs. Goldman Sachs said the Fed is unlikely to put much weight on the report, which explains the collective shrug from investors.

Zoom Out, It’s Not Pretty: Step back and the trend looks softer. Hiring in prior months was revised lower, and the US is now averaging roughly 55,000 jobs added per month this year. That puts 2025 on pace for the weakest labor market since 2020. Inflation is still running above the Fed’s 2% target, leaving policymakers boxed in. Cut rates and risk inflation. Hold tight and risk the labor market cracking further.

Stagflation Whispers Get Louder: Costs are rising from tariffs, consumers are pulling back, and policy uncertainty around the Fed is growing. After the report, markets priced in just a 24% chance of a January rate cut. The Fed is stuck, and the jobs report did not offer an exit ramp.

CALENDAR

On The Horizon

Tomorrow

The data calendar takes a breather tomorrow after a packed week of economic reports, but the Fed is not going quiet.

Investors will still hear plenty from central bankers, with scheduled remarks from Fed Governor Chris Waller, New York Fed President John Williams, and Atlanta Fed President Raphael Bostic, all of whom could influence rate expectations.

Earnings are lighter as well. The main names to watch are Micron Technology and General Mills, offering just enough activity to keep markets engaged while the data flow slows.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com