Good afternoon! Lululemon’s founder just re-entered the chat. Chip Wilson is launching a proxy fight, nominating three directors weeks after the board announced CEO Calvin McDonald’s exit without a successor, a move he says highlights weak leadership planning.

The timing is awkward. Lululemon’s stock is down sharply from its peak as tariffs, softer spending, and competition bite, and Wilson, now the company’s second-largest shareholder, is clearly done waiting. His nominees include execs from ESPN, Activision, and rival On Running, turning a messy transition into a full-blown boardroom showdown.

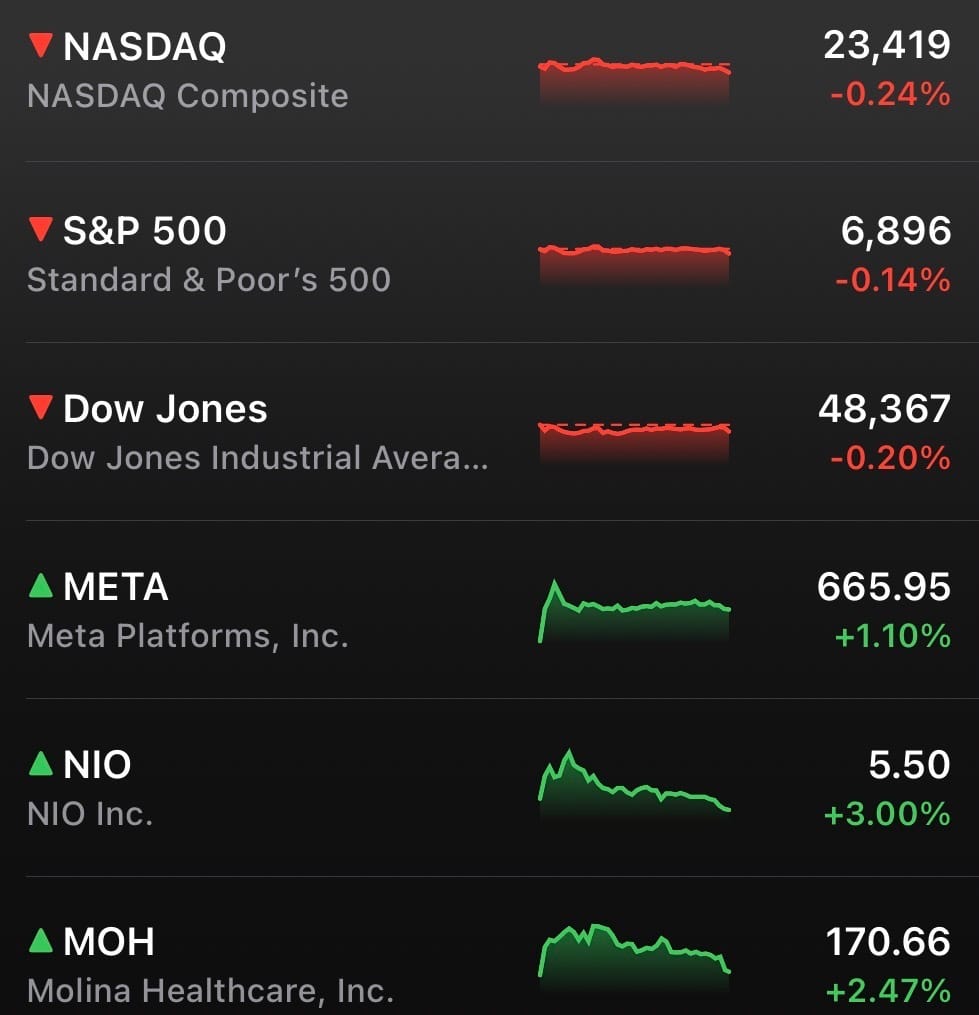

MARKETS

The Santa Claus rally is starting to feel like it missed its flight. Stocks slipped for a third straight session, with the S&P 500 and Nasdaq edging lower while smaller caps lagged, even as energy stocks quietly carried the market’s backpack.

Traders spent the day parsing the Fed’s December meeting minutes, which hinted at more internal debate and a longer road to rate cuts in 2026. Commodities refused to cooperate with the gloom, though, as gold and silver bounced back sharply after Monday’s surprise selloff.

STOCKS

Winners & Losers

What’s up 📈

Meta jumped 1.10% after reports it will acquire AI startup Manus for more than $2 billion, adding another piece to its aggressive AI buildout. $META

Nio climbed 3.28% after China announced an extension of its EV trade-in subsidy, giving demand a fresh tailwind heading into 2026. $NIO

Molina Healthcare rose 2.48% after “The Big Short” investor Michael Burry called the stock a “generational buy,” putting it back on value investors’ radar. $MOH

MARKETS

The Magnificent Seven Didn’t All Pull Their Weight

The Magnificent Seven spent 2025 doing what they do best: dragging the entire market higher. Together, they accounted for the majority of the S&P 500’s gains, but the performance gap inside the group was wider than most investors realized. This was not a year where everyone pulled equal weight.

Some names ran like it was an Olympic event. Others jogged, tripped, or quietly let momentum pass them by.

The Heavy Lifters

Alphabet set the pace as AI fears faded and Gemini finally convinced investors it could compete. Nvidia kept printing wins as data center demand stayed relentless, proving once again that being the arms dealer in an AI boom has its perks. Microsoft delivered steady gains on cloud growth, though its massive AI spending bill kept enthusiasm in check.

These were the names doing the actual carrying, turning AI optimism into real earnings momentum.

The Middle of the Pack

Meta kept ad revenue strong but faced growing investor skepticism around its AI spending spree. Tesla’s headline numbers hid a messy year underneath, as margins tightened and competition intensified. Apple moved higher too, quietly betting that slow and steady AI integration beats burning cash chasing hype.

None collapsed. None dominated. They simply… existed.

The One That Lagged

Amazon brought up the rear. AWS remained profitable, but heavy capex and regulatory pressure weighed on the stock compared to its peers. In a year that rewarded clarity and cash flow, Amazon’s long-term bets asked investors for patience they weren’t eager to give.

Bottom Line: 2025 proved that the Magnificent Seven are not a monolith. The market rewarded execution, punished excess, and stopped handing out free passes just for saying “AI.”

The group still runs the market but next year, investors may be far pickier about who gets to wear the crown.

NEWS

Market Movements

🚗 Tesla delivery expectations keep slipping: Tesla $TSLA may head into year-end with one of its weakest delivery prints in years as analyst estimates continue to slide. Tesla’s own compilation now points to a sharp year-over-year drop, underscoring how quickly sentiment has cooled heading into the official delivery report.

🍎 Apple’s quiet AI strategy is winning fans: Apple $AAPL is emerging as a surprise AI favorite by doing almost the opposite of Big Tech peers. Instead of flooding the market with capex and hype, Apple is embedding AI quietly across its massive device ecosystem while keeping margins, cash flow, and buybacks front and center.

🇨🇳 China throws EVs a lifeline: Shares of Nio $NIO jumped after Beijing confirmed it will extend its vehicle trade-in subsidies through 2026. The move removes a major policy overhang for Chinese EV makers and provides demand support just as the market was bracing for a pullback in government incentives.

🏠 Opendoor’s leadership rally fades: Opendoor $OPEN has given back nearly all the gains sparked by its September management shakeup as excitement around the new leadership team cools. With no full-quarter results yet under the new regime, the stock is drifting back toward fundamentals instead of hope.

🤖 SoftBank overtakes Microsoft in OpenAI bet: SoftBank $SFTBY has fully funded its massive OpenAI investment, officially becoming the startup’s largest financial backer ahead of Microsoft $MSFT. The move signals SoftBank’s shift from public AI winners toward owning the physical and financial backbone of the AI economy.

ECONOMY

Fed Hits the Brakes on Rate Cuts

The Fed just dropped its December meeting minutes, and the takeaway is pretty clear: rate cuts are no longer on autopilot. While officials did go ahead with another cut to close out 2025, a growing chunk of the committee wasn’t exactly comfortable doing it. Some thought the decision was a coin flip. Others would’ve been fine not cutting at all.

That hesitation matters because it signals a shift in tone. Inflation has cooled, but not cleanly, and policymakers are increasingly worried about cutting too fast while price pressures linger. Translation: the Fed still sees a path to lower rates, just not in a hurry.

Less Urgency, More Debate

The minutes revealed a more divided Fed than markets had assumed. Several officials argued rates may need to stay where they are for a while, especially with economic growth holding up better than expected. Consumer spending remains strong, GDP surprised to the upside, and while the labor market has softened, it hasn’t cracked.

That backdrop makes easing a tougher sell. After three straight cuts to end the year, some officials now want to step back and see how the data settles before doing anything else.

January Is No Layup

Markets are increasingly aligned with that caution. Futures pricing suggests traders largely expect the Fed to hold rates steady at the January meeting unless the next jobs report delivers a real shock. With inflation still above target and policy already less restrictive than earlier this year, the bar for another near-term cut has gone up.

The Fed’s own projections tell the same story. The latest dot plot points to just one cut in 2026, with wide disagreement across officials about timing and pace. This is no longer about stimulus. It’s about fine-tuning.

Bottom Line: The Fed isn’t done cutting. But it’s also done rushing. After a year of aggressive pivots, policymakers are signaling that patience is back in fashion. For markets hoping for a smooth, steady glide path to lower rates, the message is simple: expect more waiting, more debate, and fewer freebies.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com