Good afternoon! Elon Musk just duct-taped his two most ambitious projects together. SpaceX is acquiring xAI in an all-stock deal that values the combined company at a casual $1.25 trillion, creating a mashup of rockets, satellites, AI models, and Musk’s broader tech empire. The pitch: build a vertically integrated machine that runs AI from orbit while beaming internet and data back down to Earth.

Musk says the future of cheap AI computing is literally in space, where satellite-powered data centers could train models faster and at lower cost. SpaceX’s booming Starlink business gives the new entity steady cash flow, while xAI brings the compute hunger and big-brain ambitions. Translation: Musk is turning space into both the cloud and the power plant for his AI dreams.

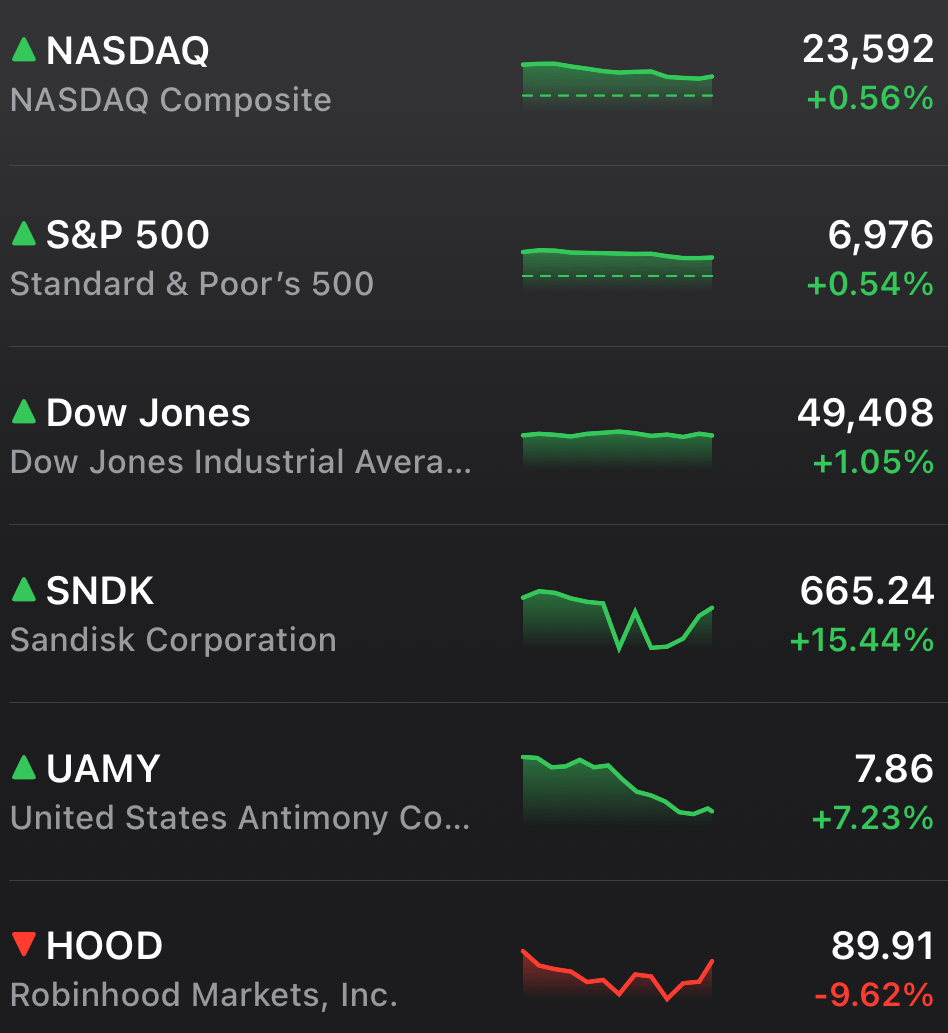

MARKETS

Stocks got a boost after fresh data showed US manufacturing expanded for the first time in a year. The Dow jumped while the S&P 500 closed just shy of a new all-time high, as investors took the report as a sign the economy still has legs.

Commodities and crypto didn’t share the party mood. Gold and silver kept sliding, oil dipped on easing US–Iran tensions, and bitcoin briefly fell below $80K over the weekend before bouncing. Adding to the uncertainty, key jobs data is delayed because of the partial government shutdown.

STOCKS

Winners & Losers

What’s up 📈

SanDisk soared 15.44% after Bernstein raised its price target on the memory storage company to $1,000

Frontier Airlines surged 9.59% as oil prices eased and US–Iran tensions cooled $ULCC

JetBlue jumped 8.42% on the same drop in fuel prices and improving geopolitical tone $JBLU

GameStop rallied 8.21% after CEO Ryan Cohen said the retailer is aiming to acquire a company larger than itself $GME

United States Antimony gained 6.82% on reports of a $12B US critical minerals stockpile $UAMY

United Airlines climbed 4.93% as airline stocks lifted alongside falling oil $UAL

Delta Air Lines rose 4.83% on the pullback in energy prices $DAL

Southwest Airlines added 4.42% as lower fuel costs boosted the group $LUV

Walmart advanced 4.13% on leadership optimism around its new CEO

Alaska Airlines gained 3.60% as airlines broadly moved higher $ALK

American Airlines rose 3.05% with the rest of the sector $AAL

What’s down 📉

Robinhood tumbled 9.62% as investors worried the end of the NFL season could slow activity in its prediction markets business $HOOD

BitMine Immersion Technologies fell 8.94% after buying more ethereum while the token remains well below prior highs $BMNR

Disney dropped 7.32% despite strong earnings, as investors focused on CEO succession uncertainty $DIS

BYD sank 6.87% on reports of falling auto sales for a fifth straight month $BYD

Lucid slid 6.87% after China moved to restrict flush door handle designs $LCID

Strategy fell 6.67% as bitcoin briefly traded below the company’s average purchase cost $MSTR

Coinbase lost 3.53% as crypto-linked stocks reacted to bitcoin’s weekend selloff $COIN

Coterra Energy declined 3.60% following news of Devon Energy’s acquisition of the shale producer $CTRA

MARA Holdings dropped 4.00% alongside weakness in crypto miners $MARA

RARE EARTHS

$12B US Mineral Stockpile Ignites Rare Earth Rally

Rare earth and critical mineral stocks jumped after reports the White House is preparing a $12 billion initiative to build a national stockpile of key industrial materials. The program, reportedly called Project Vault, would function like a Strategic Petroleum Reserve but for metals essential to EVs, semiconductors, aerospace parts, and defense systems.

Investors quickly piled into domestic producers and processors. Shares of MP Materials $MP, NioCorp Developments$NB, and United States Antimony Corp. $UAMY all moved higher on expectations that a government-backed buyer could stabilize long-term demand.

From Oil Barrels to Metal Vaults

Unlike traditional government purchasing programs, Project Vault would blend public financing with private commitments. Manufacturers would agree in advance to buy minerals later at set prices, while the stockpile acquires and stores the materials today. That structure helps companies hedge against supply shocks without needing to warehouse raw materials themselves.

The effort is designed to reduce America’s reliance on China, which controls the majority of global processing capacity for many of these elements. When export restrictions or geopolitical tensions flare, prices spike and supply chains wobble. A domestic reserve acts like a buffer, smoothing volatility for US manufacturers.

Mining Meets National Security

This marks a shift from piecemeal subsidies toward a coordinated industrial strategy. The US already maintains a defense-only mineral reserve, but Project Vault would protect civilian industries like automakers, tech firms, and energy producers.

That broader scope explains why stocks such as USA Rare Earth $USAR and Critical Metals Corp. $CRML also caught a bid. The message from Washington is clear: critical minerals are no longer a niche commodity story. They are now a core pillar of economic and national security policy.

NEWS

Market Movements

💾 Oracle Spells Out $50B AI Fundraise Plan: Oracle said it plans to raise $45B to $50B this year, split roughly evenly between debt and equity, to fund its data-center expansion while protecting its investment-grade rating. About $20B of the equity will come via an at-the-market program, and the debt piece will be issued early, starting with an eight-part USD bond deal. Investors liked the clarity, with the stock up in premarket and long-term bonds rallying too. $ORCL

₿ Strategy Briefly Goes Underwater As Bitcoin Slips: Bitcoin dipped near its 2025 low, and for the first time in more than two years, the value of Strategy’s BTC holdings briefly fell below the company’s cost basis. Strategy disclosed it holds 713,502 bitcoin bought at an average price of $76,052, and BTC traded as low as about $74,540 before rebounding. The firm also set aside $1.44B in cash reserves to cover interest and dividends without being forced to sell bitcoin into a drawdown. $MSTR $BTC

🧩 GameStop Pops As Ryan Cohen Teases Big M&A: GameStop climbed again as Ryan Cohen continued a media blitz hinting the retailer wants to buy a company bigger than itself. Reports said Cohen believes a deal could eventually make GameStop worth hundreds of billions, and he framed the hunt as either genius or totally foolish. His Fox Business appearance was reportedly canceled, adding more mystery to the whole setup. $GME

🎬 Disney Beats On Earnings But Investors Stay Focused On Succession: Disney topped expectations on adjusted EPS and revenue, driven by strength in its entertainment segment and improving streaming profitability. Management reaffirmed guidance and said it’s on track for a $7B buyback, but warned about international visitation headwinds at US parks. Shares still slid as CEO succession chatter intensified, with the board reportedly weighing parks chief Josh D’Amaro while Bob Iger has signaled he plans to step down before the end of 2026. $DIS

🥇 Gold And Silver Extend The Selloff After A Historic Reversal: Gold and silver resumed their slide after last week’s wipeout, when silver plunged more than 30% intraday and gold fell more than 10% at the lows. The rally had gotten overheated on central bank buying, ETF inflows, and retail speculation, but snapped when Trump said he plans to nominate Kevin Warsh for Fed chair, pushing the dollar higher and crushing non-yield assets. Even after a brief bounce, both metals were down again early Monday. $GLD $SLV

🚘 Tesla Europe Headlines Look Loud, But The Region Is Smaller Than It Feels: Tesla’s Europe sales keep making news because registration data is more transparent there than in the US, but Europe is still a minority slice of the business. In 2025, Tesla sold 238,656 vehicles across Europe, down 27% year over year, which was under 15% of global deliveries. The US remains the key market by volume and revenue, and weakness there matters far more for the stock. $TSLA

🚪 China Moves To Ban Hidden EV Door Handles By 2027: China issued new safety rules requiring mechanical inside and outside door releases that work even without power, effectively outlawing the hidden, motorized handles popularized by Tesla. The regulation kicks in January 1, 2027, with some models getting until 2029 to comply, following multiple high-profile incidents where power failures were suspected to trap passengers. Because China sets norms for global auto design, this could ripple beyond its borders over time. $TSLA $XIACY $LCID $RIVN

₿ Bitcoin Steadies After A Brutal Weekend Flush: Bitcoin dipped below $75K over the weekend before bouncing back above $78K, extending a rough stretch that included a 10%+ drop in January. Analysts flagged heavy liquidations and big ETF outflows, with some warning that $73K is the key support line that matters most. If that level breaks, a deeper move lower is on the table, but for now, markets are watching flows and liquidity more than narratives. $BTC $IBIT

💊 Novo’s Wegovy Pill Is Already Shifting The GLP-1 Market: Novo Nordisk’s oral Wegovy launched January 5 and is already pulling in new patients and switchers, with early prescription data showing fast uptake. Telehealth platforms are increasingly the distribution lane, and cash-pay demand is rising as employers drop coverage and pricing comes down. Competition is coming soon, with Eli Lilly’s pill expected around April and more oral GLP-1s in the pipeline. $NVO $LLY

🪙 BitMine Doubles Down On ETH Even While Underwater: BitMine bought another 41,788 ETH as part of its ethereum treasury strategy even though the position is currently underwater versus its earlier funding levels. Management argued ETH is being mispriced relative to its utility and role in finance, while other observers framed the pullback as a reset rather than a structural breakdown. Either way, it’s a big bet that on-chain usage wins over short-term price pain. $BMNR $ETH

EARNINGS

Palantir Posts Record $1.41B Quarter as AI and Defense Demand Surge

Palantir $PLTR just delivered its biggest quarter ever, reporting $1.41 billion in revenue, up 70 percent from a year ago and well ahead of Wall Street expectations. Net income hit a record $609 million as both government and commercial customers ramped spending on AI-powered data tools.

The growth engine is clearly humming in the US. Government revenue climbed to $570 million, up 66 percent year over year, while US commercial sales more than doubled to $507 million. Translation: Palantir is no longer just a defense contractor with software, it is becoming a mainstream enterprise AI platform.

AI Gold Rush, Government Edition

A big chunk of that momentum is coming from Washington. Palantir continues to win large defense and intelligence contracts, including hundreds of millions of dollars tied to military data systems and logistics. Management says demand from US agencies remains intense as AI moves from buzzword to battlefield infrastructure.

At the same time, private-sector adoption is accelerating. Companies are using Palantir’s platforms to organize and operationalize their AI models, turning messy data into systems that actually drive decisions. That shift is pushing deal sizes higher and expanding Palantir’s footprint beyond its traditional government base.

Controversy in the Background

Not all of the attention has been positive. Palantir’s work with immigration enforcement agencies has drawn criticism from activists, employees, and some lawmakers, especially amid heightened political tensions around deportation policy. CEO Alex Karp acknowledged internal debates but reiterated that the company stands by its government partnerships.

Even with the political overhang, investors focused on the numbers. Shares jumped in after-hours trading as Palantir also issued strong forward guidance, projecting 2026 revenue of roughly $7.2 billion. For a company once seen as niche and opaque, Palantir is increasingly looking like one of the central software beneficiaries of the AI spending boom.

CALENDAR

On The Horizon

Tomorrow

Markets have a busy calendar lined up, with investors getting a fresh read on the services side of the economy via the ISM Services report, plus a labor market pulse check from JOLTS. If either one surprises, expect rates and the “soft landing” narrative to do their usual dance.

On the corporate side, earnings season is in full chaos mode. Big names on deck include AMD $AMD, Merck $MRK, PepsiCo $PEP, Amgen $AMGN, Pfizer $PFE, Eaton $ETN, Nintendo $NTDOY, Emerson Electric $EMR, TransDigm $TDG, Mondelez $MDLZ, Chipotle $CMG, Electronic Arts $EA, PayPal $PYPL, Corteva $CTVA, Take-Two $TTWO, Super Micro Computer $SMCI, and Foot Locker $FL.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com