Good afternoon! Chipotle just launched a menu item that skips the tortilla altogether. The chain rolled out a snack-sized cup of adobo chicken or steak as part of a new high-protein push, selling about four ounces of meat for roughly $3.82. It’s inspired by customers already ordering sides of protein and is aimed at driving traffic outside normal meal hours, especially among macro-counters and GLP-1 users.

The move comes as Chipotle works to reignite momentum after softer traffic and declining same-store sales this year. Protein is the hook: most Americans say they prioritize it, competitors are leaning in, and Chipotle is betting a simple meat cup can help bring customers back between burritos.

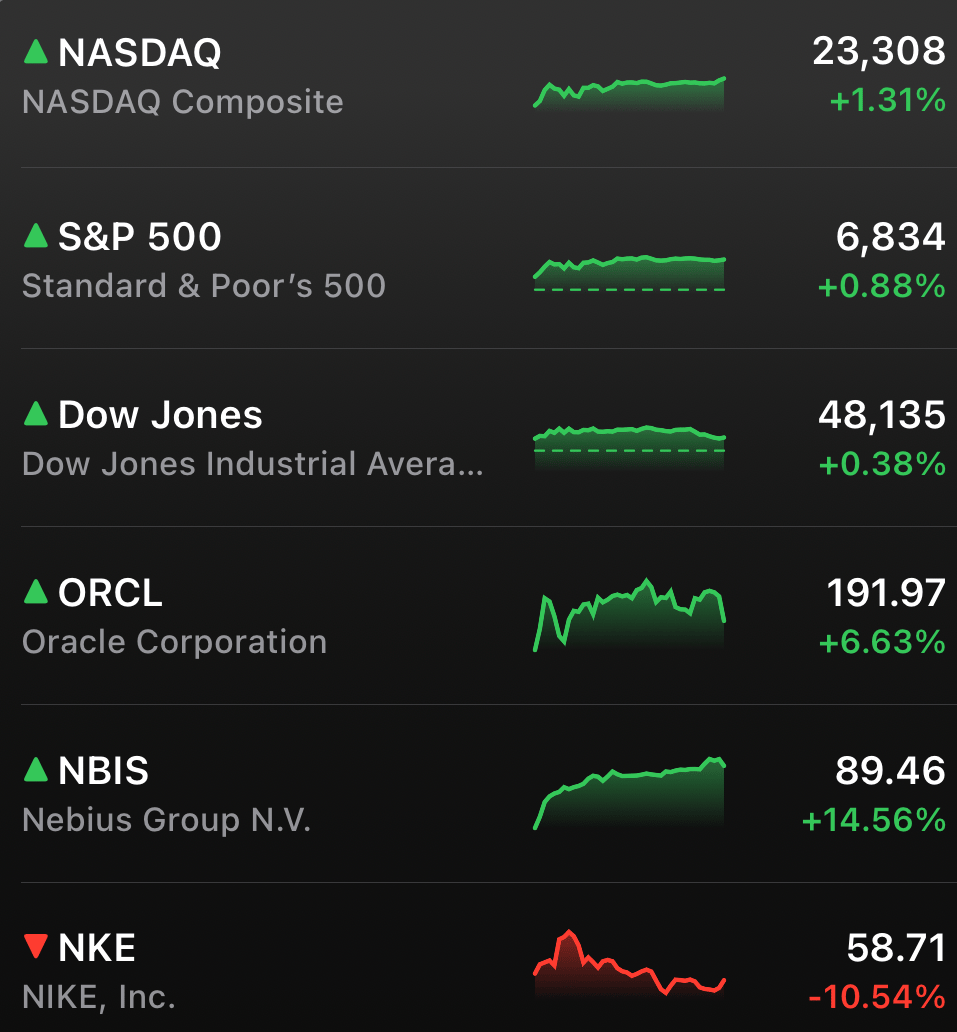

MARKETS

Stocks wrapped up the final full week of the year on a brighter note, with the AI trade helping the Nasdaq and S&P 500 recover enough ground to turn the week positive. It marked a second straight day of gains and revived hopes for a late-year rally.

Elsewhere, the picture was more muted. Consumer sentiment edged up to 52.9 in December but remains nearly 30% lower than a year ago, underscoring lingering caution. And despite new federal holidays on December 24 and 26, markets will operate as normal, with Treasury auctions and trading hours unchanged.

STOCKS

Winners & Losers

What’s up 📈

Oracle surged 6.83% after TikTok signed an agreement to sell its US operations to a consortium that includes the cloud computing giant, boosting confidence in Oracle’s cloud and data center strategy $ORCL

AI Neoclouds Rally: CoreWeave jumped 22.56%, Nebius climbed 14.53%, IREN rose 11.59%, and Cipher Mining gained 7.19% as improving sentiment around AI infrastructure, Big Tech spending, and Wall Street upgrades reignited demand for high-beta data center and compute plays $CRWV $NBIS $IREN $CIFR

Cannabis Trade Rebounds: The AdvisorShares Pure US Cannabis ETF rose 0.92% as investors bet institutional capital could begin flowing into US cannabis operators following rescheduling headlines $MSOS

Rivian jumped 10.55% for a second straight session, hitting its highest level since December 2023 as analyst upgrades and optimism around the upcoming R2 platform continued to build $RIVN

Carnival climbed 9.77% after beating earnings expectations and issuing strong full-year guidance for 2026, signaling resilient demand for cruises $CCL

Micron rose 6.99% as its post-earnings rally continued, driven by strong AI-related memory demand and tightening supply conditions $MU

Amicus Therapeutics surged 30.21% after BioMarin agreed to acquire the company in a $4.8 billion deal. BioMarinshares also climbed 17.71% on the acquisition news $FOLD $BMRN

Winnebago Industries gained 8.43% after reporting a strong fiscal Q1, with revenue growth far exceeding expectations $WGO

Trump Media rose another 8.28% as momentum continued following news of its merger with fusion-energy firm TAE Technologies $DJT

What’s down 📉

Lyft fell 2.22% after Wedbush downgraded the stock, warning that autonomous vehicles and robotaxis pose a greater threat to Lyft than investors currently appreciate. Uber also slipped as part of the same concern $LYFT $UBER

Nike plunged 10.55% after issuing weak guidance, with China sales declining, tariffs pressuring margins, and direct-to-consumer sales continuing to struggle $NKE

Lamb Weston sank 25.94% despite solid quarterly results, after management warned that heavy discounting and rising international manufacturing costs will pressure profits $LW

Health Insurers Slide: Humana, UnitedHealth, Cigna, and Elevance Health all moved lower after President Trump said he plans to pressure insurers to cut prices in upcoming meetings, reviving concerns about political risk to margins $HUM $UNH $CI $ELV

Target dipped 1.05% after a major outage disrupted its app and website during the peak holiday shopping period, impacting online orders and gift card processing $TGT

DEALMAKING

Oracle Gets a Surprise Win in TikTok’s US Sale

Oracle $ORCL ( ▼ 5.17% ) has spent the last few months as the AI trade’s favorite punching bag, weighed down by debt worries and an expensive data-center buildout. Then TikTok showed up with a plot twist no one had on their bingo card.

The social media giant agreed to sell its US operations to a new joint venture that includes Oracle, Silver Lake, and Abu Dhabi–backed MGX, with each taking a 15% stake. That was enough to send Oracle shares sharply higher and give the company something it’s been missing lately: good news.

From Cloud Provider to Gatekeeper

Oracle’s role isn’t just financial. Under the deal, it becomes TikTok’s “trusted security partner,” responsible for hosting US user data, overseeing compliance with national security rules, and retraining TikTok’s recommendation algorithm using only US data. In other words, Oracle gets a marquee customer and a real-world use case for the data centers investors have been side-eyeing.

TikTok is already one of Oracle’s biggest cloud clients, but bringing US operations fully under Oracle’s roof could deepen that relationship and drive incremental non-AI cloud revenue a welcome offset as the company pours cash into AI infrastructure.

A Lifeline, Not a Cure: The deal values TikTok’s US business around $14 billion, and analysts estimate Oracle could see $1–$2 billion in annual revenue upside. Helpful, but not transformational. China still has to approve the transaction, and the final economics remain fuzzy.

Still, for a stock battered by AI fatigue and leverage fears, this is a badly needed narrative shift. Oracle didn’t fix its balance sheet overnight but it just reminded investors it can still land consequential deals.

NEWS

Market Movements

📊 Investors See AI Bubble as Top Risk for 2026: A new Deutsche Bank survey of 440 global asset managers shows more than half see an AI and tech bubble as the biggest threat to markets next year, the widest margin any single risk has ever had in the survey. Strikingly, investors showed little concern about geopolitics, pandemics, or credit stress, despite high yield spreads sitting near multi decade lows. $SPX

📚 Five Books That Defined the Financial Conversation in 2025: From Ray Dalio’s warning on debt spirals to Morgan Housel’s rethink of how people actually spend money, this year’s standout titles focused less on hype and more on structural flaws in markets and data. The common theme was simple: the system looks stable until you zoom in.

💬 A Hedge Fund Born on Discord Is Now Managing Millions: What started as casual trade chats between two retail investors turned into Enders Capital, a quant driven fund now managing roughly $5 million. Built using automation and online talent, the fund is a glimpse at how money management is quietly shifting away from Wall Street pedigree toward distributed communities.

👟 Nike Sells Off After Weak Outlook Overshadows Earnings Beat: Nike beat Q2 earnings and revenue expectations, but shares fell sharply after management warned of slowing sales, margin pressure from tariffs, and continued weakness in China. Ongoing declines in direct to consumer and Converse sales are raising questions about the company’s turnaround timeline. $NKE

🚕 Lyft Downgraded as Robotaxi Threat Gets Real: Wedbush cut Lyft to underperform, warning that autonomous vehicles could disrupt ride hailing faster than investors expect. The firm sees Lyft as especially exposed due to its US focused business and lack of diversification compared with Uber. $LYFT $UBER $GOOGL $TSLA

🌿 Cannabis Stocks Swing After Trump Reschedules Marijuana: President Trump signed an order moving cannabis from Schedule I to Schedule III, easing tax burdens for US operators and opening the door to more institutional interest. The main ETF used for exposure surged in assets but saw sharp volatility as investors debated how fast capital can truly flow into the space. $MSOS

🤖 OpenAI Valuation Whiplash Highlights AI Spending Frenzy: Reports on OpenAI’s next funding round have swung wildly in days, with valuations ranging from $500 billion to as high as $830 billion. The rapid shifts underscore how aggressively investors are chasing exposure to AI infrastructure, even as cash burn continues to climb. $AMZN

🚙 Rivian Rallies as Analysts Bet on the R2 Launch: Rivian shares jumped again after multiple analysts raised price targets, calling 2026 a key year as the company prepares to launch its lower cost R2 model. Optimism has been building since Rivian’s AI Day, signaling a sharp shift in sentiment after a long slump. $RIVN

🏥 Health Insurers Slip After Trump Signals Price Pressure: Shares of major managed care companies fell after President Trump said he plans to push insurers to cut prices in upcoming meetings. While no policy details were announced, even the hint of political pressure was enough to rattle investor confidence. $UNH $HUM $CI $CVS $ELV

AI

AI Trade Roars Back as Neocloud Stocks Rip Higher

After weeks of panic over whether the AI boom had peaked, investors are suddenly buying first and asking questions later. Speculative data center and compute names are ripping higher again as confidence returns in Big Tech spending, easier financial conditions, and OpenAI’s seemingly endless fundraising runway.

Over the past two sessions, the so-called neoclouds have surged sharply. CoreWeave $CRWV ( ▼ 8.44% ) is up 22.64%, Nebius $NBIS ( ▼ 8.41% ) has jumped 14.56%, IREN $IREN ( ▼ 17.38% ) is higher by 11.51%, and Cipher Mining $CIFR ( ▼ 12.36% ) has climbed 7.0%.

What flipped the switch

The last 48 hours delivered a rapid-fire reset for the AI narrative. Citi resumed coverage of CoreWeave with a buy rating and a $135 price target, offering a clear signal that Wall Street still sees upside in outsourced AI infrastructure. Oracle $ORCL ( ▼ 5.17% ) rebounded sharply as it moves closer to acquiring TikTok’s US operations, easing fears around AI-related debt and capex.

At the same time, OpenAI chatter has turned euphoric again, with reports suggesting its valuation has climbed on consecutive days as new fundraising talks accelerate. That matters directly for neoclouds, since more capital for OpenAI means more spending on compute, data centers, and long-term infrastructure commitments.

Why the macro helps too

Fundamentals did not disappear either. Micron’s earnings reinforced that demand for AI compute and memory remains red hot and continues to outstrip supply. On the macro side, softer-than-expected CPI data has revived hopes for lower interest rates, which disproportionately benefits highly leveraged, long-duration AI infrastructure plays.

Put it all together and investors are once again betting that the AI arms race is far from over. For now, faith in tech CEOs chasing digital godhood is back on the balance sheet.

CALENDAR

On The Horizon

Next Week

Next week’s calendar is basically running on holiday mode. There are no earnings on deck, and the only real data worth circling are the delayed Q3 GDP print on Wednesday and the usual jobless claims report on Thursday. That’s about as light as it gets.

A quick scheduling note: US markets close early at 1 pm on Wednesday for Christmas Eve and stay closed all day Thursday for Christmas, before reopening Friday (technically). And while trading may be open, productivity is very much optional.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com