Good afternoon! Anthropic just brought “vibe coding” to the corporate spreadsheet warriors. This week it launched Claude Cowork, basically the same brain as Claude Code, but designed for nontechnical people who live inside Word docs instead of terminal windows.

Cowork can dig through your computer files and handle multi-step tasks from one prompt, like sorting documents, analyzing data, and even creating charts or PowerPoints. Anthropic also warned it can be dangerously overhelpful (yes, it might delete files), and it’s only available on Claude’s Max plan, which runs $100 to $200 per month.

MARKETS

Big banks kicked off earnings season, and markets basically yawned. Indexes slid after the results failed to excite, and Nvidia $NVDA didn’t help matters after reports China may restrict imports of its H200 chips, dragging the Mag 7 lower with it.

Meanwhile, investors leaned into safety. Gold and silver hit fresh records again, oil slipped after Trump hinted he may hold off on Iran, and Bitcoin climbed back above $97,000 as senators floated a new bill to finally put a real regulatory framework around crypto.

STOCKS

Winners & Losers

What’s up 📈

Critical Metals surged 32.58% after reporting strong drill results from its Greenland project $CRML

Greenland Technologies jumped 24.27% as traders chased a totally unrelated “Greenland” momentum bid $GTEC

Viking Therapeutics popped 11.89% after the CEO hinted a deal could be coming soon $VKTX

Clover Health climbed 10.24% after guiding toward positive net income in 2026 and touting 53% Medicare Advantage membership growth $CLOV

Intel rallied 3.02% after KeyBanc upgraded it to Overweight on AI data center demand and turnaround progress $INTC

Honeywell rose 1.31% after confirming plans to take Quantinuum public $HON

Alibaba gained 1.75% ahead of expected AI updates at Thursday’s Qwen event $BABA

What’s down 📉

Trip.com sank 17.05% after China’s top business regulator opened an investigation into the travel platform $TCOM

AppLovin slid 7.61% as a broader tech selloff drowned out Evercore’s bullish initiation $APP

Rivian dropped 7.21% after a UBS downgrade, with analysts warning the AI hype bid may have peaked $RIVN

Biogen fell 5.04% after warning it’ll take a $222M pretax Q4 charge $BIIB

Airbnb slipped 5.20% after data showed foreign visitors to the US fell 6% (pressuring travel names) $ABNB

Wells Fargo slid 4.55% as bank earnings failed to excite investors $WFC

Broadcom sank 4.15% after reports Beijing told firms to stop using certain US/Israeli cybersecurity tools, hitting adjacent tech sentiment $AVGO

Bank of America fell 3.78% despite a beat, as the market stayed unimpressed $BAC

Citigroup dropped 3.34% post-earnings even with a beat $C

Expedia declined 3.07% on the travel demand wobble $EXPE

Booking Holdings slid 2.40% alongside other travel stocks $BKNG

STOCKS

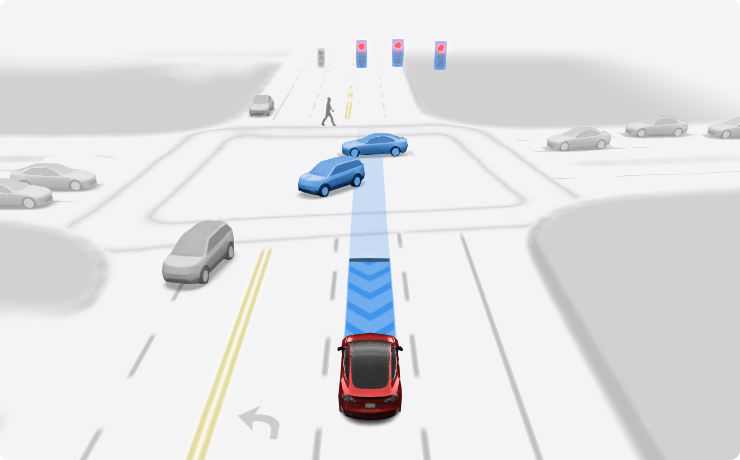

Tesla Moves Full Self-Driving to Subscription Only After Feb. 14

Tesla $TSLA just pulled the most “software company” move possible. Elon Musk said Tesla will stop selling Full Self-Driving as a one-time upgrade after February 14, meaning FSD will only be available via a monthly subscription going forward.

Right now FSD costs $99/month, while the one-time purchase has been around $8,000. That buy-it-once option is about to get deleted like an unused app.

Goodbye “Lifetime FSD”

Musk’s message was blunt: Tesla is done with flat-fee FSD. If you want the feature, you rent it month by month, period.

It’s a major shift because that one-time sale was basically Tesla’s version of printing money upfront. Now they’re choosing recurring revenue instead.

The bullish read: Tesla is pricing in autonomy

If Tesla thinks FSD is about to level up fast, subscription-only makes a ton of sense. Real autonomy would turn FSD into a product you can charge for forever, not something you sell once and regret later.

Musk has been pushing this storyline for years, arguing that once autonomy becomes legit, the value of FSD skyrockets and the old pricing model would look laughably cheap.

The less fun read: demand needed a makeover

The other interpretation is simpler: people were not buying it at scale. Tesla has already been cutting prices, including lowering the monthly subscription and reducing the p

urchase price from prior highs.

Translation: if adoption is limited, subscriptions let Tesla widen the funnel and keep collecting cash even if buyers do not commit to the big upfront price.

Robotaxi dreams, Waymo reality check

Tesla is still pitching autonomy as the future, including limited robotaxi-style testing (ex: Austin). But in the real world of driverless rides, Alphabet’s Waymo is still the clear heavyweight, with a much larger footprint and scale.

Bottom line: Tesla is turning FSD into a recurring revenue product starting Feb. 14, and Wall Street is going to treat this as either a confidence signal that autonomy is getting close… or a sign Tesla wants more dependable software income while vehicle growth cools.

NEWS

Market Movements

🏦 Dimon tells investors to ‘trust me’ on JPMorgan’s $9B spending jump: JPMorgan $JPM expects expenses to rise by $9B in 2026. Dimon refused to break out detailed AI spend, saying it would hurt competitiveness. He told investors to trust the long-term payoff.

🧠 China reportedly blocks Nvidia’s H200 chip imports: Reuters says China is not allowing Nvidia’s $NVDA H200 chips to enter the country “for now.” Nvidia was hoping H200 demand could unlock a huge China sales opportunity. This reinforces China’s push toward domestic chip alternatives.

🏈 OpenAI reportedly buying another 60-second Super Bowl ad: WSJ reports OpenAI plans to run another one-minute Super Bowl ad on Feb. 8. AI companies are ramping up marketing spend as competition heats up. Super Bowl pricing makes this a serious “mass adoption” signal.

⚡️ Dan Ives warns Trump power push could slow data center buildouts: Trump wants Big Tech to cover more of the electricity burden from AI growth. Microsoft already announced a “community-first” AI infrastructure plan in response. Dan Ives warns it could slow data center expansion at a critical time.

🏠 More Americans live alone than ever before: Census data shows nearly 40M one-person households in the US. That’s a record 29% of households. The trend is accelerating across many rich countries.

🚘 Rivian downgraded as UBS says AI hype may be fading: UBS downgraded Rivian $RIVN to sell. Analysts say the stock already priced in most of the AI excitement. Now expectations for the R2 look too high.

✈️ Boeing beats Airbus on 2025 aircraft orders: Boeing logged 1,173 net aircraft orders in 2025, ahead of Airbus’ 889. It’s Boeing’s first win since 2018. Deliveries improved, but Airbus still delivered more planes.

🍏 Report: Apple delays key Siri AI features until summer: The Information says upgraded Siri will roll out in phases. Gemini-backed answers may arrive sooner, but deeper personalization could be delayed until summer. Apple is moving slowly, but the pressure to ship is rising.

CRYPTO

Bitcoin Hits 3-Month High Above $96K as ETF Inflows Surge After CPI Surprise

Bitcoin $BTC just woke up like it had somewhere to be. After Tuesday’s softer-than-expected CPI print, BTC ripped above $96,000 on Wednesday morning, hitting its highest level in roughly three months and dragging the entire “risk-on” vibe back into crypto.

This is not just a chart story. It is a macro story, and the money behind it is starting to look serious again.

CPI = Permission Slip

The CPI report basically gave markets the green light. Cooler inflation means less pressure for the Fed to stay tight forever, which usually sends investors hunting for risk assets, and bitcoin is still the king of that trade.

So crypto did what it always does when liquidity optimism enters the room. It sprinted.

The Real Flex: ETF Money Flooded In

The bigger tell was flows. Spot bitcoin ETFs pulled in $753.7M on Tuesday, the biggest daily inflow since October 7, according to SoSoValue.

Fidelity’s $FBTC led with $351.3M, while Bitwise’s $BITB added $159.4M. Translation: this is not just retail buying candles, institutions are re-entering the chat.

Neutral Sentiment, Bullish Price

CoinMarketCap’s Fear & Greed Index climbed back to 52 (neutral), the highest since the October drawdown that sparked massive liquidations. That matters because it suggests the market is rebuilding confidence, not just bouncing off oversold panic.

Bottom line: bitcoin is back above $96K, ETF inflows just hit their biggest day in months, and the next battle is whether BTC can cleanly break past ~$97K and make $100K the obvious next magnet.

CALENDAR

On The Horizon

Tomorrow

Tomorrow’s setup is a classic “macro + money” combo. We’ll get initial jobless claims, November import prices, and manufacturing surveys out of Philadelphia and New York to check whether the economy is cooling or just playing dead.

On the corporate side, earnings are heavy with BlackRock $BLK, Goldman Sachs $GS, Morgan Stanley $MS, and TSMC $TSM all reporting.

And Fed-watchers will have plenty to chew on with speakers lined up from Raphael Bostic, Tom Barkin, Jeff Schmid, and Fed Governor Michael Barr.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com