Good afternoon! Davos is basically turning into the annual “AI Group Chat,” and this year the vibe is: everyone’s equal parts excited and terrified. While the bundled-up elite pretend they’re not doomscrolling, panels have been packed with big names debating whether AI is about to turbocharge inequality, replace entry-level workers, and decide which countries run the world.

The quotes were spicy: BlackRock’s Larry Fink warned capitalism already widened the gap and AI could pour gasoline on it, while AI legend Yoshua Bengio said the tech is getting uncomfortably human-like. Meanwhile, Anthropic’s Dario Amodei and DeepMind’s Demis Hassabis both hinted junior jobs are in the danger zone, Satya Nadella said power costs will decide the AI winner, and everyone’s still arguing over China, with Hassabis saying they’re ~6 months behind, while Amodei compared shipping Nvidia’s best chips to Beijing to “selling nukes to North Korea.”

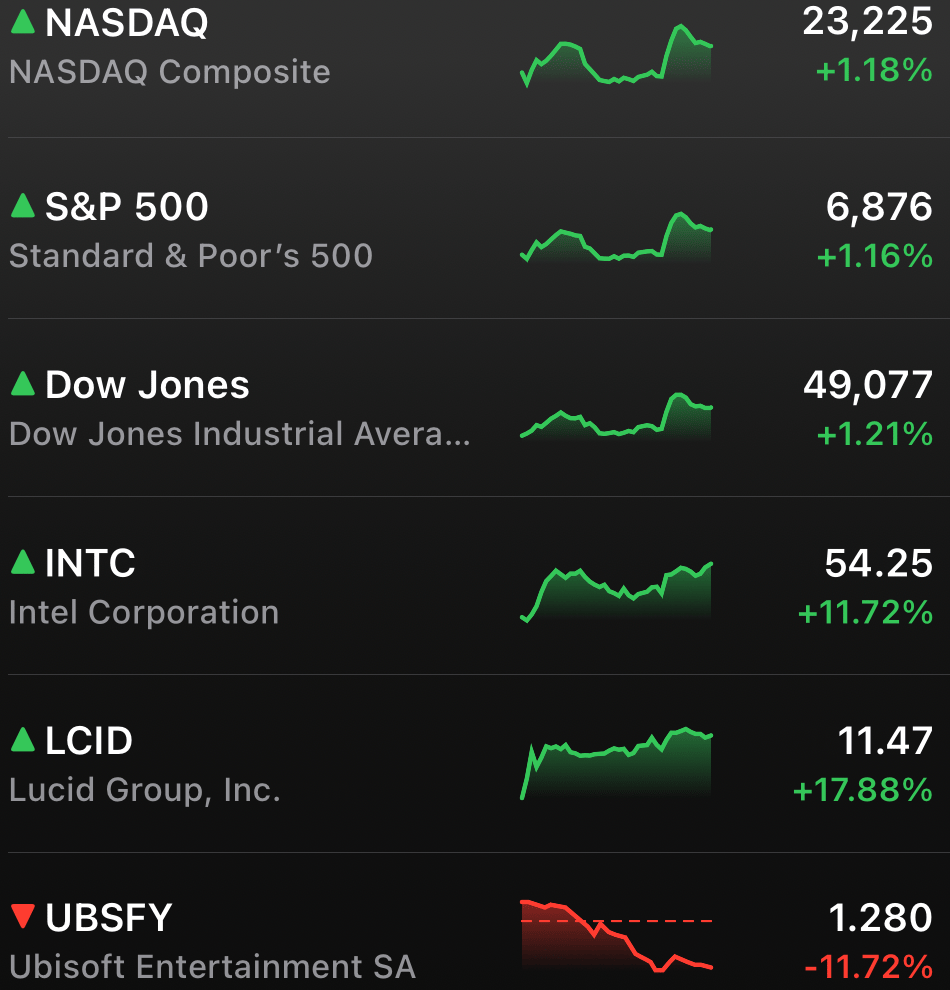

MARKETS

Yesterday nuked the S&P 500’s YTD gains. Today erased all of it and put the index back in the green, aka pure investor whiplash. Trump walking back European tariff threats sparked the broad bounce.

But the stress hedges stayed on. Gold still ripped above $4,800 for the first time ever, while the Supreme Court sounded unimpressed with the case against Fed Governor Lisa Cook and Trump teased his next Fed chair pick is down to one name.

STOCKS

Winners & Losers

What’s up 📈

Intel $INTC ripped 11.72% as traders piled in ahead of its earnings report tomorrow, helped by heavy options activity + upbeat analyst chatter.

Lucid $LCID surged 17.88% after expanding its Rockwell Automation partnership to support manufacturing growth in Saudi Arabia.

Interactive Brokers $IBKR climbed 6% after a strong Q4 beat driven by high trading volumes.

United Airlines $UAL gained 2.2% after strong results and a forecast for record earnings this year on resilient travel demand.

Progress Software $PRGS jumped 10.62% on a strong fourth-quarter earnings report.

GameStop $GME rose 2.8% after CEO Ryan Cohen bought 500,000 shares.

Charles Schwab $SCHW ticked up 0.8% despite an earnings miss, as client assets kept expanding.

Seagate $STX rose 5.60% after BNP Paribas upgraded the stock and lifted its price target.

What’s down 📉

Ubisoft $UBSFY sank 11.35% after canceling six games, shutting two studios, and confirming more layoffs in a restructuring push.

Xerox $XRX slid 10.36% after announcing plans for a $250M securities offering.

MakeMyTrip $MMYT dropped 12.13% after mixed quarterly results and profits that fell 73% YoY due to higher taxes and financing costs.

Netflix $NFLX fell 2.15% after issuing a weaker-than-expected earnings forecast.

Kraft Heinz $KHC dropped 5.74% amid reports Berkshire may consider selling its stake post-Buffett transition.

MACRO

Trump Walks Back Greenland Tariffs at Davos

Trump brought The Art of the Deal to the Swiss Alps today and, for markets at least, it landed like a temporary ceasefire.

Speaking at the World Economic Forum in Davos, the President called for “immediate negotiations” over Greenland and publicly ruled out military force, telling the room he “won’t use force.” That alone was enough to calm investors who have been watching this Greenland situation turn from meme to market risk in real time.

Markets Take the Hint

Stocks bounced as soon as Trump signaled diplomacy was still on the table, especially after the last few days of escalating rhetoric and tariff threats that had fueled the “Sell America” mood across global markets. The relief was not just about Greenland, it was about the tone. Investors basically heard: this is still negotiation theater, not a true geopolitical cliff.

But the bigger jolt came later in the day, when Trump said he reached a “framework of a future deal” with NATO Secretary-General Mark Rutte covering Greenland and the broader Arctic region. Even better for risk assets: Trump said that because of that framework, he will not impose the tariffs that were set to begin February 1.

The TACO Trade Strikes Again

If you’re a trader, today was another reminder that “buy the dip when Trump threatens chaos” has been one of the most reliable playbooks of the last two years. This cycle keeps repeating: a headline shocks markets, investors panic, then Trump signals a walkback and stocks rip.

Still, the details of the “framework” are murky, and the political damage in Europe may already be underway. The EU parliament reportedly moved to freeze ratification of the prior US trade deal anyway, which is a reminder that even if the market calms down, relationships do not reset that quickly.

Bottom line: Trump used Davos to hit reverse on the Greenland tariff threat and markets immediately rewarded him for it. But the story is not over. It just moved from “tariff timer” to “negotiation timeline,” and Wall Street will be trading every headline like it’s earnings season.

NEWS

Market Movements

✈️ United Airlines Stock Jumps After Earnings Beat and Strong 2026 Profit Outlook: United Airlines $UAL popped after hours after beating Q4 EPS and guiding Q1 profit above Street expectations. Full-year 2026 EPS guidance came in at $12 to $14, basically telling investors demand is still alive. Management also said early 2026 momentum is strong, with early January setting record weeks for flown revenue, ticketing, and business sales.

🔞 OpenAI Launches Age Prediction System Before Allowing Adult Content: OpenAI is rolling out an age prediction system that tries to infer if a user is under 18 using behavioral and account signals. If flagged as a minor, ChatGPT will restrict content like sexual role-play, self-harm content, and harmful challenges. If the system gets it wrong, adults may need to submit a selfie for verification to remove restrictions.

🛋️ IKEA Invests $2.2B to Expand Stores and Manufacturing in India: IKEA plans to more than double its India investment to about $2.2B over five years and grow from 6 stores to 30. The push comes after two straight years of declining global revenue, so India is being positioned as a growth engine. IKEA is also leaning into India as a manufacturing base as more global companies shift production there.

🎮 GameStop Stock Rises After CEO Ryan Cohen Buys $10.6M in Shares: GameStop $GME moved higher after CEO Ryan Cohen bought 500,000 shares worth about $10.6M. Cohen now owns roughly 8.45% of the company, and his compensation package is tied to aggressive EBITDA and market cap milestones. A board member also bought shares, adding to the “insiders are buying” signal.

🏬 Amazon Approved for Massive Hybrid Store and Fulfillment Center Near Chicago: Amazon $AMZN got approval to build a hybrid big-box store plus fulfillment center near Chicago, reportedly about twice the size of a typical Target $TGT. The logic is simple: most retail spending still happens offline, and Amazon customers still shop heavily at Walmart $WMT. The real battleground is groceries, where even Amazon’s customers still buy elsewhere.

🤖 Meta Says New Internal AI Models Are “Very Good” After Llama 4 Issues: Meta $META said its Superintelligence Labs delivered new internal models in January and they are “very good,” according to CTO Andrew Bosworth. He did not name them, but prior reporting has pointed to projects like Avocado and Mango. Meta is trying to reset credibility after Llama 4 faced delays and benchmark controversy.

💊 Johnson & Johnson Stock Falls Despite Strong 2026 Guidance: Johnson & Johnson $JNJ beat Q4 sales expectations and guided 2026 revenue to $100B to $101B, above consensus. It also guided adjusted EPS to $11.43 to $11.63, roughly in line to slightly above estimates. The stock still slipped, which suggests the market wanted a cleaner upside surprise.

💾 Seagate Stock Up After BNP Upgrades on Durable Data Center Storage Cycle: Seagate $STX rose after BNP Paribas upgraded it to outperform and raised its target to $380. BNP’s thesis is that HDD storage has structurally shifted into a more profitable setup driven by a duopoly and heavier data center demand. They also kept an outperform view on Western Digital $WDC.

🚕 Morgan Stanley Cuts Tesla Robotaxi Expectations vs Musk Timeline: Morgan Stanley expects Tesla $TSLA to have about 1,000 Robotaxis in service by the end of 2026. That is far below Musk’s earlier claim of 1,500 by the end of 2025. The bank says the real milestone is removing safety monitors, because that is the step that unlocks unsupervised FSD at scale.

EARNINGS

Netflix Stock Drops After Weak Q1 Guidance

Netflix $NFLX ( ▼ 0.15% ) reminded Wall Street that “good results” don’t matter if the forward outlook doesn’t sparkle. The stock slipped more than 4% after hours Tuesday after the company posted a basically fine quarter, then followed it up with Q1 guidance that came in just light enough to ruin the party.

This was the classic mega-cap trap: the quarter didn’t disappoint, but investors were expecting Netflix to overdeliver, especially with the stock priced like a perfectly-run machine.

A Solid Quarter, A Soft Landing

Netflix’s Q4 numbers were steady. Revenue came in at $12.05B, beating both analyst estimates and Netflix’s own forecast, while adjusted EPS landed at $0.56 vs $0.57 expected. Nothing broke, but nothing screamed “blowout” either.

Then came the issue: Q1. Netflix guided earnings to $0.76 per share vs $0.80 expected and projected a 32.1% operating margin, slightly higher than last year, but not enough to calm the market’s “we need upside” addiction.

Ads Are Real, But Still Small

One of the most important updates was the ad business. Netflix said advertising revenue topped $1.5B in 2025, growing more than 2.5x year over year. That’s not a side hustle anymore, it’s becoming an actual revenue engine.

But zoom out and it’s still small relative to Netflix’s overall scale. With total 2025 revenue at $45.2B, ads are still only about ~3% of the business, meaning subscriptions are still doing almost all the heavy lifting.

The $82.7B Plot Twist

Adding to the chaos: Netflix is simultaneously trying to pull off the biggest entertainment acquisition in years. On the same day as earnings, Netflix amended its Warner Bros. Discovery $WBD bid into an all-cash offer, keeping the headline value the same $82.7B but making the deal materially more credible.

Translation: Netflix is trying to execute perfectly, while carrying an $80B-sized stress test on its back. Wall Street clearly sees that as a lot to juggle, especially when guidance is already slightly below expectations.

CALENDAR

On The Horizon

Tomorrow

The data dump is stacked: we’ll finally get the delayed October and November PCE inflation prints, plus the first revision of Q3 GDP, which will shape the “rates cut soon vs not a chance” debate all over again.

Earnings season stays busy too, with reports from Procter & Gamble $PG, General Electric $GE, Intel $INTC, Abbott $ABT, Intuitive Surgical $ISRG, Capital One $COF, Freeport-McMoRan $FCX, CSX $CSX, Alcoa $AA, and McCormick & Co. $MKC. Also on the culture calendar: Oscar nominations drop, and Sundance officially kicks off.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com