Good afternoon! VCs didn’t just flirt with AI in 2025. They went all in. From January through September, a massive share of the $366.8B in global venture funding flowed into AI startups, with megachecks landing at names like Anthropic and xAI while more than 1,300 AI companies crossed $100M valuations and roughly 500 hit unicorn status.

So… bubble or buildout? That’s the debate. Some investors see froth, others see an ecosystem play where the real money isn’t just in models, but in the chips, power grids, data centers, and infrastructure AI needs to survive.

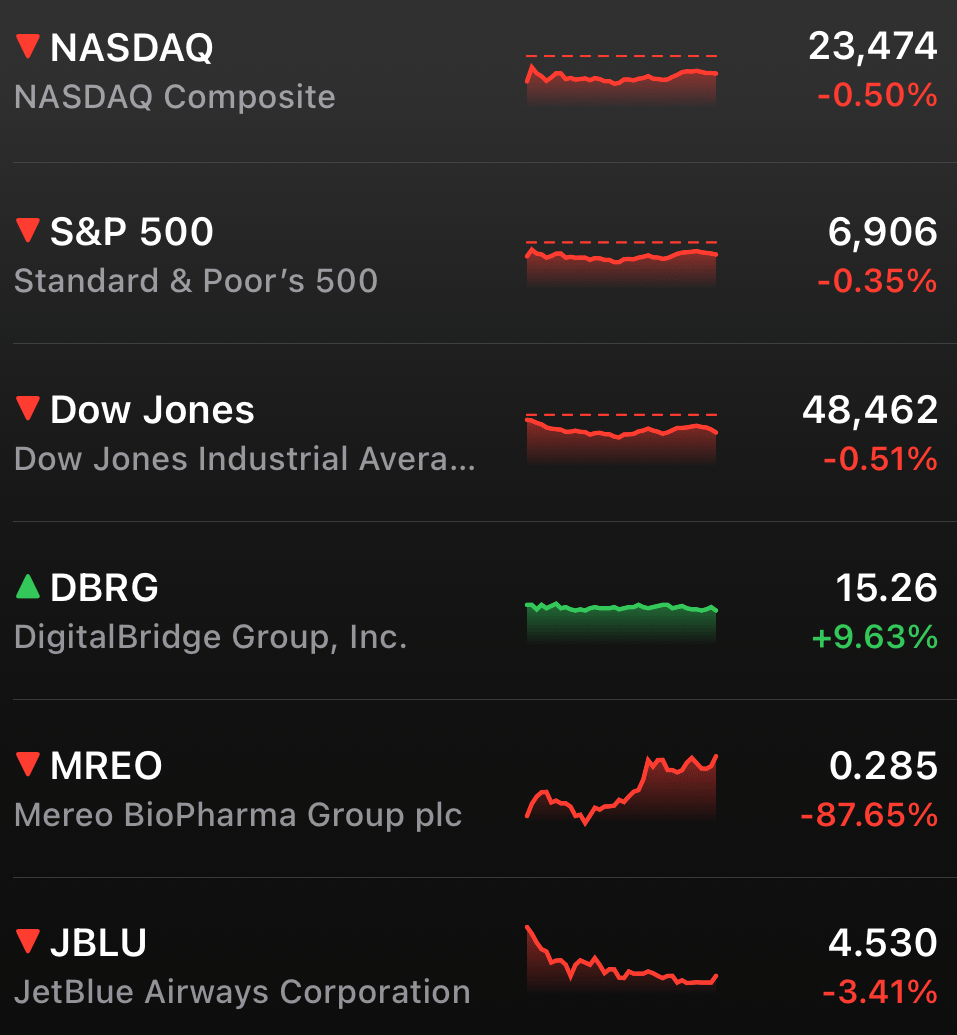

MARKETS

Big Tech slid, pulling the major indexes lower and cutting short any late-year rally hopes. Energy was the lone bright spot as oil prices climbed on rising geopolitical tensions that could squeeze supply.

Precious metals cooled off after a strong run. Gold slipped from recent highs, while silver briefly surged above $80 an ounce before a sharp pullback as traders locked in profits.

STOCKS

Winners & Losers

What’s up 📈

Nio jumped 5.10% after CEO William Li said Q4 vehicle sales are expected to top $4.27 billion, implying more than 56% growth from Q3 as deliveries rebound. $NIO

Energy Fuels rose 3.01% after announcing it exceeded 2025 guidance for uranium production and sales, reinforcing optimism around nuclear fuel demand. $UUUU

DigitalBridge Group surged 9.70% on reports it’s in advanced talks to be acquired by SoftBank, sparking takeover speculation in digital infrastructure. $DBRG

What’s down 📉

JetBlue slid 3.62% as airline stocks broadly dipped with oil prices moving higher, pressuring fuel cost outlooks. $JBLU

United Airlines fell 2.24%, American Airlines dropped 1.98%, and Delta Air Lines declined 1.86% on the same energy-driven headwinds. $UAL $AAL $DAL

Mereo BioPharma Group collapsed 87.57% after its bone disease drug failed a late-stage trial, dealing a major blow to its pipeline. $MREO

COMMODITIES

Silver’s Vertical Run Just Hit Gravity

Silver spent the past few weeks acting like the star of the market. Then it reminded everyone how fast gravity works in commodities. After ripping to a fresh record near $84 an ounce late Sunday, prices snapped back hard, erasing gains in a hurry and rattling traders who chased the breakout late.

The speed of the move mattered more than the move itself. Silver had become one of the most crowded trades in the market, with retail attention spiking and positioning stretched well above recent averages. When trades get that popular that fast, the exit door usually feels a lot smaller on the way out.

Retail Turned the Volume Knob to Max

Silver was everywhere across trading forums, with retail flows flooding into metal-linked ETFs like iShares Silver Trust $SLV ( ▼ 6.35% ) as momentum took over. That kind of attention helped push prices higher, but it also made the reversal sharper once sentiment flipped.

Even after the drop, silver is still sitting far above longer-term trend lines, which helps explain the violence of the pullback. This was not a collapse of the story, just a reset after a move that got too vertical too quickly.

The Same Forces Are Still There

What makes this pullback interesting is what did not change. Physical silver markets remain tight, premiums are elevated, and futures curves still signal demand for immediate delivery. Industrial demand tied to solar, electrification, and data infrastructure has not gone anywhere, and China continues to loom large on the supply side.

That matters because silver’s run this year was not just speculation. It was part of a broader hard-asset surge that also sent gold and copper to record highs, driven by geopolitics, central bank buying, infrastructure spending, and the physical buildout behind AI and energy systems.

A Pause, Not a Funeral

Exchanges raising margin requirements and thin year-end liquidity added fuel to the pullback, forcing some traders to unwind. That kind of mechanical pressure tends to hit hardest after parabolic moves and often says more about positioning than fundamentals.

Silver may not be finished this cycle. But like the rest of the hard-asset rally, it is learning the same lesson markets always teach. Even the strongest trends need time to cool before the next leg higher can begin.

NEWS

Market Movements

🚗 Tesla’s Robotaxi Clock Is Ticking: Tesla has just days left to meet Elon Musk’s promise to remove safety drivers from its Austin Robotaxi service by year end, and there’s still no sign of public driverless rides. So far, unsupervised trips appear limited to employees and insiders, raising doubts about whether autonomy is scaling as fast as promised. $TSLA

₿ Citi Sees Big Bitcoin Upside: Citi says bitcoin could reach $143,000 in its base case next year, with a bull case near $189,000 if ETF flows rebound. Near term, the bank expects choppy trading as macro risks and regulatory uncertainty keep investors cautious. $BTC

📈 Stocks Need Earnings Now: Wall Street expects stocks to grind higher in 2026, but the driver has shifted from hype to profits. Forecasts call for earnings growth to broaden beyond mega cap tech, even as the biggest names continue to lead, just with less margin for disappointment. $META $AAPL $AMZN $GOOGL $MSFT $NVDA $TSLA

🚘 Tesla Delivery Estimates Slip: Wall Street is trimming expectations for Tesla’s fourth quarter deliveries as EV tax credit demand fades. Prediction markets are even more skeptical than analysts, suggesting investors are bracing for a softer print in early January. $TSLA

✈️ Airlines Hit by Rising Oil: Airline stocks slid as oil prices jumped on renewed geopolitical tensions tied to Venezuela. Higher fuel costs are back in focus, putting pressure on margins just as carriers head into 2026 planning season. $DAL $UAL $AAL $JBLU

🚚 Cybertruck Supplier Deal Collapses: A key Tesla battery supplier slashed a Cybertruck contract once valued near $3 billion down to almost nothing, signaling demand has badly missed expectations. The write down adds to mounting evidence that Cybertruck volumes have fallen short of early hype. $TSLA

CRYPTO

Crypto Had the Green Light, Then Hit the Brakes

Crypto sprinted into 2025 like it finally got invited to the grown-up table. A Trump win, memecoins from the First Family, a strategic bitcoin reserve, real legislation, dropped lawsuits, and Wall Street piling in all made it feel like this was the year digital assets went legit. For a while, that confidence looked justified.

Then the macro showed up.

When Policy Met Reality

Tariffs and trade uncertainty flipped the script fast. As investors de-risked, bitcoin slid hard and spent most of the year seesawing instead of trending. Rate cuts sparked rallies. Growth fears killed them. And wherever bitcoin went, the rest of crypto followed like a shadow.

The bigger surprise was gold. Bitcoin’s long-running “digital gold” pitch ran into an actual gold boom, and a lot of capital chose the shiny original over the digital remix.

A Cold Finish Doesn’t Mean a Bad Year

Even with the volatility, 2025 was still a milestone year for crypto. Prices cooled, but legitimacy advanced. Regulation became clearer, institutions leaned in, and crypto-linked equities turned into mainstream trades rather than fringe bets.

That sets the stage for 2026, but patience will be required.

Citi’s Take, Higher, But Not Smooth: Citi sees meaningful upside ahead for bitcoin $BTC, but not in a straight line. Their outlook points to consolidation first as ETF outflows, cautious positioning, and macro uncertainty keep pressure on prices. Regulation could be the unlock later in the year, but until then, expect chop, frustration, and fakeouts.

The message is clear. The destination might be higher, but the path is still bumpy.

Meanwhile, ETFs Went Fully Off the Rails

While crypto cooled, the ETF world did the opposite. Assets blew past $19 trillion, and product creativity crossed into full degeneracy. Crypto ETFs expanded beyond bitcoin and ethereum, memecoin exposure went mainstream, and tokenized funds moved from theory to roadmap.

Even longtime skeptics softened. Wall Street isn’t backing away from digital assets, it’s just getting more selective. The easy hype trade is gone. What’s left is a market that demands structure, patience, and proof.

Bottom line: Crypto didn’t collapse in 2025. It grew up. And growing up is rarely a straight line.

RESOURCES

The Federal Reserve Resource

Join our options subreddit ⚡️: https://www.reddit.com/r/optionstrading/

Join our discord community 💠: https://discord.gg/optionality

Wall Street Reads 💎 (Best Books):

Check out our latest issues 🎯: 0ptionality.com